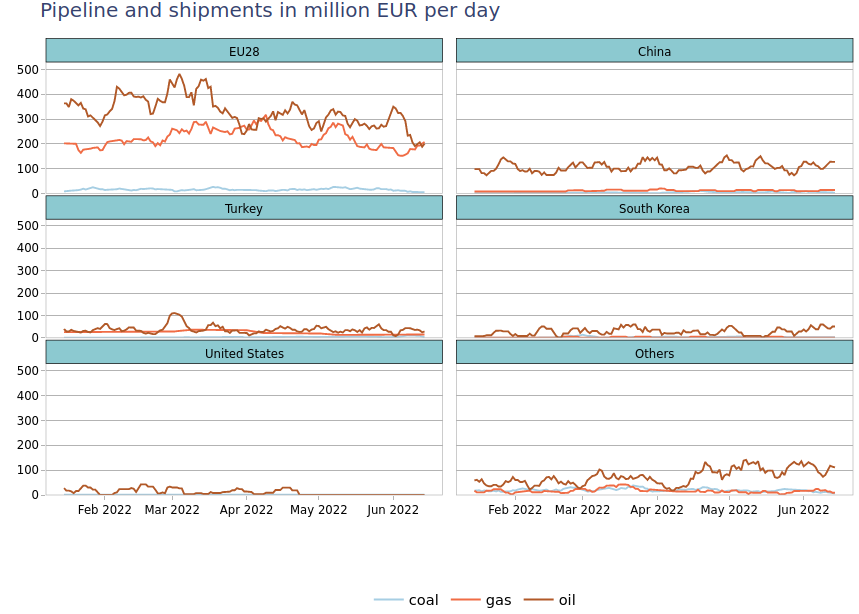

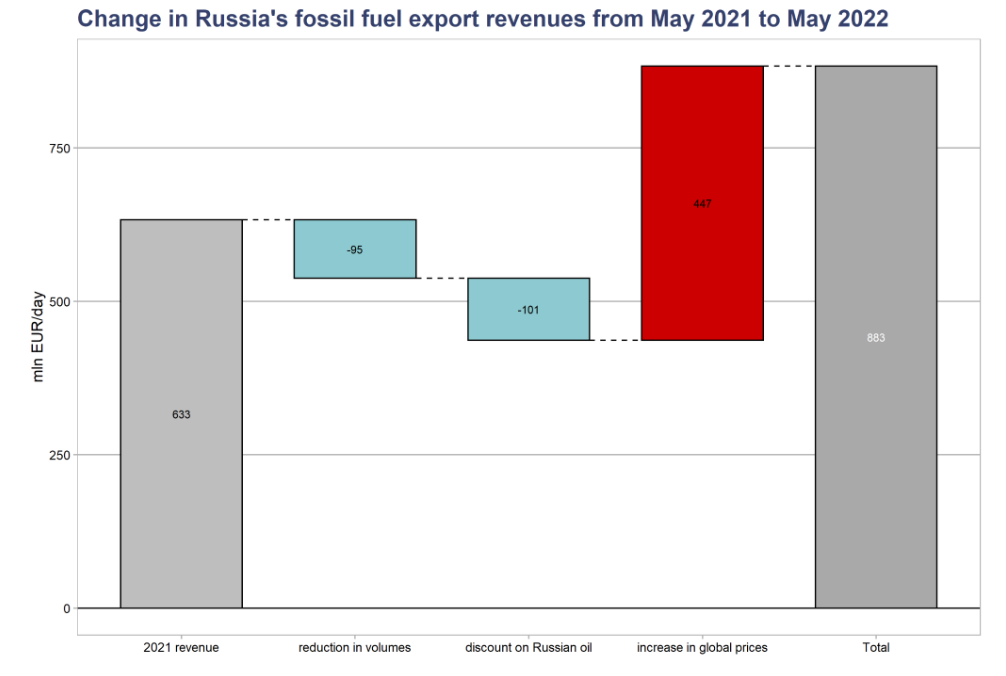

According to the study by the Center for Research on Energy and Clean Air, during the first four months of its full-scale war against Ukraine, Russia received EUR 62 bn from the EU countries for its fossil fuel exports — roughly 60% of Russia’s energy revenues.

Despite a 19% reduction in the total monthly import volumes of fossil fuels from Russia by the EU in May, in comparison to February-March 2022, the total Russian revenues did not suffer. This is due to the global increase in energy prices worldwide and especially on the European market, which allows Russia to sell less and receive the same amount of profits.

Current sanctions for Russia will have an effect, but only from 2023; Russia meets its financial goals for 2022 fossil fuel exports.

BB: How effective are the EU’s restrictions on Russian energy imports so far?

MH: Physically, the volume of Russian energy exported to the EU is declining. However, the financial revenues are not. On the contrary, compared to the same period last year, they have even increased. Russia sells less but gets more. The sanctions mechanisms applied by the EU so far, including the oil embargo, will show notable effects only next year.

Losing the European market, Russia can partially focus on other markets. China and India are its main saviors.

China already takes large volumes of oil from the Eastern Siberia-Pacific Ocean pipeline, so it can further increase imports only slightly. As for India, because of geographic logistics, this market was not important for Russia before.

However, even with the discount that Russians are giving India now, ($32 per barrel), the price of Russian oil for India is about $80 per barrel. This is approximately in line with the forecasts of the Ministry of Economic Development of Russia set for 2022. So they will get what they expected.

As for Russian gas, according to the five-month results, the supplies to Europe have decreased by almost a third. By projections, Europe may not reach the European Commission goal to reduce imports of Russian gas by two-thirds, but it is quite realistic that it might give up more than half of this gas.

By reducing exports, Russia needs to reduce production. That is inconvenient for Russia and, in the long run, will damage the Russian energy industry.

Russian counterattack: increasing energy prices in Europe by exacerbating the gas deficit

BB: How has Russia’s recent decision to limit gas supplies via Nord Stream 1 to Europe been affected by sanctions?

MH: Now the Kremlin is starting a “gas counterattack.” The recent reduction in supplies through Nord Stream 1 is an indicator of such preparation.

Russia will cut the Nord Stream 1 gas flow even more than initially announced, from 167m cubic metres a day to 67m. It also reduced gas supply to Italy by 15%. German minister said Russia's actions showed EU needed to end dependency on Russian fossil fuels https://t.co/2Y4Ssq0ytK

— Euromaidan Press (@EuromaidanPress) June 16, 2022

It’s all cleverly disguised as if “we just send turbines for maintenance to Canada and your sanctions don’t allow them to be returned.” But this is a serious manipulation. There are always spare turbines to replace those that are sent for repair. When they say most turbines get broken at the same time, it’s just another Russian fairy tale. No expert will believe that four Siemens turbines fail at the same time.

A turbine for Nordstream 1 is stuck in Canada over sanctions; gas flow through pipeline down by 40%

However, EU Commission trying to get exemption from Canada so Gazprom would get the turbine – Spiegel https://t.co/t0J1aqTAsW

— Euromaidan Press (@EuromaidanPress) June 14, 2022

Moreover, even if several turbines failed at the same time, there is Nord Stream 2 nearby, which is not yet functioning. The Russians can take a turbine from there. They are not doing so intentionally. Their plan is likely to shut down Nord Stream 1 altogether. There will be planned maintenance works in July when the pipeline will be closed for around 10 days. It will be very convenient for the Russians to say that there are problems, and “We cannot resume the work of the gas pipeline, we will need more time for some serious repairs… ”

But look, the Russians will say, the Nord Stream 2 is ready for operation. It has the same capacity of 55 billion cubic meters per year and delivers gas to the same point. They can propose to start it.

BB: But with this tactic, Russians are pushing the EU to abandon Russian gas in principle. Will they really be able to launch Nord Stream 2?

MH: They believe that Europeans will not be able to fully compensate for the lack of Russian gas. High gas prices remain in the European market since Russia launched this “special operation” to raise gas prices last year, by halting supplies. And now, with this situation with the Nord Stream 1, they are repeating the same scenario.

Obey the Kremlin or pay up: why the EU’s heating bills will skyrocket this winter

What the European Commission did not say or may not have said yet, is that there will be no catastrophe if North Stream 1 is shut down, because there is spare transit capacity equal to the amount of both Nord Streams through Ukraine’s gas transportation system. It is clear why Russia does not mention it, but the European Commission should clarify that there are no problems with gas delivery, Russians should use the route through Ukraine.

Alternatives to Russian gas: nuclear and coal power plants temporarily, lifting restrictions on shale gas in the US, saving gas by reducing heating, LNG from Qatar after 2025

BB: How much time does the EU really need to find a replacement for Russian gas? What are the alternatives?

MH: To begin with, it is necessary not to switch off coal power plants and nuclear power units as was planned this year.

The second option is to save as much as possible. There was already a proposal to reduce the heating temperature by 1 or 2 degrees, which will decrease the gas consumption by 28 billion cubic meters within the EU instantly. This is equal to half of the annual supplies through Nord Stream.

As for alternative supplies of gas to Europe, this is mainly liquefied natural gas (LNG) from the US and Qatar. However, the Biden administration has imposed severe restrictions on the development of new areas for shale oil and gas production, given the climate criteria.

Currently, Biden’s team does not dare to lift these restrictions. In my opinion, such a policy is irrational in current circumstances because it doesn’t decrease gas consumption, only allows Russia to maintain its influence in the European market, and together with Saudi Arabia to dictate oil prices in the OPEC+ format. This could be leveled by American oil and gas production. The US promised Europe to help reduce gas dependence on Russian supplies, and the US supplies LNG, but this is not enough without serious additional production.

Qatar has ambitious plans for LNG. The North Field East expansion project will expand Qatar’s LNG export capacity from the current 77 to 110 million tons per year in 2025.

Another producer of LNG is Australia, but it is quite far from Europe. However, agreements were reached to help Europe last year, that Australian LNG will enter the Asian market and American gas will come to Europe instead.

Theoretically, in the long run, there could be additional supplies of Turkmen or Iranian gas to Europe. But these are ideas from the 1970s and 1990s, which require huge investments and several years to construct pipelines to Europe that are unlikely to happen. Russia, on its part, has openly threatened that it will stop the construction of the Trans-Caspian pipeline project if it is launched. Iran is Number One in gas reserves, and Turkmenistan is Number Four. Qatar is Number Three, and Russia is in second place.

While only a limited increase of imports from Norway and Algeria is possible, the most realistic scenario remains LNG from the United States and Qatar, which also requires an increase in extraction.

Sanctioning tankers with Russian oil and gas, blocking Black and Baltic seas for them is the only effective way to ensure an oil embargo

BB: There were also extraordinary steps proposed. For example, to freeze any payments for energy to Russia until it withdraws troops from Ukraine, completely block the passage of tankers with Russian oil from the Baltic and Black Seas, and more. Could such tough measures have a real impact, or are they unrealistic for the EU?

MH: If you don’t do them, they will be unrealistic.

Blocking the passage of tankers with Russian oil is actually the only effective option that can physically have an effect and make an embargo that corresponds to the meaning of the word.

But in the first four months of the war, NATO as an alliance fled the Black Sea. If the alliance does not even dare to ensure the freedom of navigation to export Ukrainian grain, it is difficult to expect that they will take tough action, such as preventing oil tankers. Still, this is how it looks today.

But our experience has shown that Western partners first say that this is impossible, then begin to think about this, and then it turns out that it is possible.

Regarding the freezing of Russia’s payments for energy. Within the complex EU legal system, this is difficult to implement, but it is also quite real. This issue needs to be discussed because if things continue as they are now, the EU will simply become a laughing stock. The Kremlin is openly laughing at them when it says “yes, you have imposed sanctions, but we still get our money.”

Ironically, the EU – by permitting the massive rise in Greek tankers taking oil out of Russian ports (blue) – is the biggest enabler of this weaponization of gas exports, by giving Putin the shipping capacity to take his oil to places all around the world. With @JonathanPingle pic.twitter.com/XTaYwNDjZz

— Robin Brooks (@RobinBrooksIIF) June 21, 2022

Another thing that can effectively reduce Russia’s revenue by reducing global energy prices is the creation of a cartel of oil consumers.

There is a cartel of exporting countries, OPEC, which actually dominates the global oil market – having 80% of the oil reserves, more than 40% of the production, and more than 60% of the export. In contrast to this cartel, it is necessary to create a cartel of consumers that will set oil prices.

If now the oil price is $120, Russia offers its own for $80, the cartel of buyers may say that the price of oil should be $30, because it covers the costs of extraction. Producers themselves said the cost of production is $10 to $15. This is monopsony, the union of consumers as opposed to the dominance of suppliers. This discussion has started and this is the right direction.

The West is reluctant to sanction maritime insurance on oil tankers, for fear that the resulting spike in oil prices will cause recession. The cost of this is now becoming plain. Recession is coming anyway, while Russian oil flows in record amounts to China (lhs) & Brazil (rhs). pic.twitter.com/kMVJh6sNpZ

— Robin Brooks (@RobinBrooksIIF) June 22, 2022

BB: It is said that if the EU starts a complete financial blockade of Russia, the EU economy will collapse without Russian energy. But at the same time, Russia wouldn’t get almost half of its import earnings. Can the EU indeed not survive some time without Russian energy?

MH: The assumption is right but unfortunately neither NATO nor the EU is a monolith. The UK, Canada, or Central European countries are trying hard to prevent high-tech products from entering Russia. But Türkiye has not joined sanctions against Russia, while Hungary has formally joined, but it is unlikely to do anything to control it. I’m not even talking about Serbia, China, India, or South Korea.

Unfortunately, there is no collective West now, as business logic dominates over values. The world of values that Western “teachers” have been lecturing Ukraine about for decades has lost in their countries to the value of wallets.

But this does not mean the fall of the West, it is a test for all of us, and for Ukraine first of all because we are paying the highest price. And we have a moral right to demand stronger actions. We have the right to ask the question:

“Four months of full-scale invasion have passed. Russian aggression is in its ninth year. You promised that sanctions would stop this aggression, but they are far from complete. We are not asking you for direct military assistance, but we are asking for weapons and sanctions.”y to Hungary?

MH: Exceptions for them are formulated rather vaguely. It seems they are valid until they expand the capacity of the Adria oil pipeline to take non-Russian oil. We discussed this issue, it is a manipulation, because they have already expanded the Adria in 2015 and now the only question is to switch to non-Russian oil technologically. This would take less than a year.

Hungary can switch to non-Russian oil in less than a year, energy expert claims

The European Commission has agreed to this manipulation by Hungary to prevent the loss of face because if a small Hungary alone could block the consensus decision of all other EU members, it would look like a defeat of the EU. So, they decided to pretend that Hungary still had to work. However, at the end of this year, the EU must ask Hungary what had been done and how they had “worked” on giving up Russian oil.

Well, Orban, as the Ukrainian proverb says, “looks at Brussels, but his head is turned to Moscow.” The same is with Türkiye in NATO. With buying stolen Ukrainian grain from Russia and helping to transport it to the Middle East, Türkiye is actually playing on Russia’s side.

Poland for example has already cut Russian oil imports by a third, although it was the second or third largest Russian oil importer in the EU. They have already agreed with Saudi Arabia’s leading oil company on additional oil imports to completely get rid of Russian oil. They will complete this process by year-end.

BB: What about loopholes and the ways Russia tries to export its oil despite the embargo. Are there ways to limit this?

MH: Consider the embargo on Iran or Venezuela. India and China have been buying Iranian oil. For Venezuela, it was more complicated, but there were still “by-passing schemes.” Russia, along with India, shipped Venezuelan oil to India, where Russia’s Rosneft bought a refinery to refine Venezuelan oil. Even during the Cold War, the Soviet Union managed to circumvent the sanctions by purchasing high-tech equipment. An example is the scandal with the Japanese company Toshiba, which sold to the Soviet Union eight digitally-controlled machines for the production of controllable pitch propellers for warships and submarines.

There will always be options for circumventing sanctions, but if tough and radical measures are taken, there will be very few such options and sanctions will be effective. Current sanctions are obviously “not without loopholes,” when Russia blends its oil in the open sea and then manages to sell it. Sanctions after 2014 were also poorly monitored because currently, we are finding French and German equipment in Russian tanks produced at the time when sanctions were already prohibiting the export of military items to Russia.

The option that could be implemented now is what happened in 1990 to 1991 when Saddam Hussein’s Iraq invaded and occupied Kuwait and thus provoked the formation of a broad coalition under the leadership of the United States. In just six months they inflicted a devastating blow to Hussein’s regime and imposed appropriate sanctions against Iraq as an aggressor.

Or another example, after Slobodan Milosevic, former Serbian president, had been “roistering” in the Balkans for eight years, from 1991 to 1999, NATO finally decided to end his regime and completed this within two months. In our situation, Russian aggression has been going on for nine years, because the starting point is not 24 February 2022, but 20 February 2014. The waiting time has passed.

It is absurd to take sanctions by a teaspoon in the hope that after the next teaspoon the Russian regime will suddenly collapse. The Russians were preparing for war and sanctions, they created a price escalation in the EU market, and the West naively thought that dialogue would solve all issues. Dialogue is possible only when the other side also wants dialogue, but that side has clear goals of expanding influence.

All the logic of Russia is on the surface.

Related:

- 10 tricks Russia uses to evade sanctions

- How EU would benefit from reducing its reliance on Russian gas

- The scope of the EU energy dependence on Moscow and practical ways out

- The EU oil embargo is not enough. How to curb Russia’s petroeuros

- International sanctions slam Russia’s finance, economy, culture, sports: a list

- How Western sanctions cripple Russia’s war machine: no modern tanks, navigation systems or drones