Do Russian assets constitute a potential source of compensation for damages and losses incurred in Ukraine? In our comprehensive study, we examine the current situation and chart the path forward.

With each passing day of the full-scale invasion of Russia, Ukraine is suffering from increasing destruction and losses, which have already surpassed the $411 billion mark. It is more than challenging to assess the extent of the damage caused by the terrorist attack on the Kakhovka hydroelectric power plant.

The question arises: who should be responsible for compensating for these damages? The idea that the aggressor should bear the financial burden of the war is gaining momentum. In Ukraine, two dozen court decisions on confiscation have already been issued, and foreign partners are actively impeding Russian funds and developing legal mechanisms to facilitate asset recovery.

However, the international community has been slow to collectively seize Russian assets.

Nevertheless, there is a potential solution. Implementing a well-designed and transparent legal framework makes it possible to hold Russia accountable for the war and its devastating consequences. Different countries have adopted various approaches to the policy and legal regulation surrounding confiscating Russian assets.

The Institute of Legislative Ideas has created a confiscation tracker, which provides real-time updates on the compensation for losses and the seizure of Russian assets in Ukraine and worldwide.

How much Russian money has already been confiscated? How can we ensure that the aggressor bears the cost of the war? In our comprehensive review, we outline five effective steps for achieving proper compensation for the incurred damages and losses in Ukraine.

Current progress and challenges

To confiscate Russian assets, the first step is to identify and freeze them. This task is challenging due to the ability of Russian oligarchs to conceal their wealth since the imposition of sanctions in 2014 for the annexation of Crimea and the war in the Donbas.

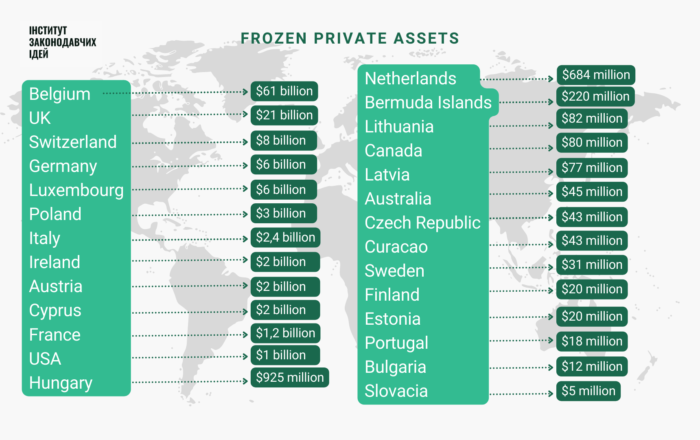

Nevertheless, Ukrainian partners’ resolute stance has led to the freezing of approximately $180 billion worldwide. These frozen assets belong not only to oligarchs but also to Russian politicians, propagandists, and other individuals involved in the war.

Presently, the countries with the highest levels of frozen private assets belonging to Russian entities are ranked as follows:

State assets, which comprise the funds of the Central Bank of the Russian Federation and its overseas properties, present a relatively easier task for identification. However, there is currently no consolidated information available regarding the extent of these frozen funds. Nevertheless, there have been public speculations suggesting a figure of $300 billion since the onset of the war.

It can be assumed that a significant portion of Russia’s European savings is held in Belgium, where the central office of the international depository Euroclear is situated. Notably, $180 billion of the assets of the Central Bank of the Russian Federation are frozen in Euroclear accounts.

Despite the substantial volume of frozen Russian assets worldwide, estimated to be around $400 billion, under 0.3% of them have been confiscated. Furthermore, the majority of these funds have been recovered in Ukraine.

Confiscation of Russian assets in Ukraine

Following the full-scale invasion, Ukraine implemented relevant legislative amendments that allow for the confiscation of both state assets of the Russian Federation and the judicial recovery of assets belonging to war collaborators.

As of June 2023, the High Anti-Corruption Court (HACC) has approved twenty decisions regarding confiscating assets of war collaborators. Some of these assets are already working for Ukraine, while others are in the process of being sold.

Among the assets subject to confiscation are those of:

- Vladimir Yevtushenkov, a weapons manufacturer;

- Mikhail Shelkov, the owner of a plant involved in titanium production for the Russian defense industry;

- Oleg Deripaska, whose Mykolaiv Alumina Plant was confiscated;

- Arkadiy Rotenberg, whose shares in the company that owns Ocean Plaza LLC in Kyiv were seized.

In addition, the HACC has also confiscated property from State Duma deputies and Russian propagandists. For more detailed information regarding the grounds, nuances of the process, and the seized property, please refer to the legal analysis of the HACC’s confiscation decisions.

This mechanism is exclusively applied during the period of martial law based on the specified grounds in the Law of Ukraine “On Sanctions.” It is a unique form of sanction that involves the seizure of assets belonging to individuals and legal entities who pose a significant threat to Ukraine’s national security, sovereignty, or territorial integrity, or who have significantly contributed to such actions. This seizure can occur when the assets have been blocked by a decision of the National Security and Defense Council.

The HACC (High Anti-Corruption Court) carries out the confiscation of these assets upon the claim made by the Ministry of Justice. This process is simpler compared to criminal proceedings. For more information on the essence of confiscating private assets from individuals responsible for aggression, the Ukrainian confiscation model, and the necessary guarantees to be observed during its implementation, please refer to our research study.

Ukraine has also implemented a special mechanism for confiscating property owned by the Russian Federation as a state. This mechanism has led to the seizure of assets belonging to two Russian banks, resulting in funds exceeding $0.5 billion. However, despite these seizures taking place during the second year of the war, Russian state assets remain in Ukraine.

The process of collecting 903 objects owned by the Russian Federation and its affiliated companies in Ukraine is still ongoing and has not yet been completed.

Therefore, it is logical to observe that Ukraine, as a victim of aggression, has become the first country to confiscate Russian assets, thereby setting an example for Western nations on recovering assets from war collaborators conducted lawfully and in compliance with required standards.

Current status of global confiscation of Russian assets

In May 2023, the United States approved the initiative to confiscate $5.4 million from Russian oligarch Konstantin Malofeev, who stands accused of violating the sanctions regime. It is important to note that this confiscation occurred within the framework of criminal proceedings, utilizing the general instrument of civil forfeiture for criminal assets. This represents the sole successful case thus far.

US approves first transfer of seized Russian oligarch funds to Ukraine

Additionally, Manhattan prosecutors filed a lawsuit to seize six properties, valued at approximately $75 million, located in New York and Florida and owned by Russian oligarch Viktor Vekselberg. Furthermore, the US District Court for the Eastern District of New York authorized confiscating a Boeing aircraft owned by Russian oil company Rosneft and valued at over $25 million.

Canada has become the first country to establish a dedicated mechanism for confiscating foreign assets, including both public and private Russian funds, at a legislative level. However, despite the law being in place for over a year, the implementation of this mechanism is still pending, although officials claim that the process of seizing assets belonging to Russian oligarch Roman Abramovich, valued at $26 million, has commenced.

Several partner countries are trying to introduce legislation to facilitate the legal and prompt confiscation of Russian assets.

The United Kingdom, having frozen unprecedented amounts of Russian funds, is currently attempting to introduce mechanisms for confiscating both public and private assets. However, their efforts have not been successful.

In February 2023, the British Parliament registered a bill on confiscating Russian state assets and providing support to Ukraine. This bill grants the UK government the authority to seize Russian state assets presently frozen in the country and transfer them to Ukraine and Ukrainian citizens. Unfortunately, this initiative lacks strong political support. The bill’s second reading is scheduled for the autumn.

Confiscating the assets of sanctioned individuals could be enhanced by adopting an amendment mandating all designated persons to declare any assets they control within the UK. Non-disclosure of these assets would be deemed a criminal offense – a form of sanctions evasion. Consequently, such assets could be confiscated through existing procedures. However, at present, this notion remains at a conceptual stage.

UK moves to use frozen Russian assets to help Ukraine rebuild – NYT

Estonia took the lead as the first EU country to initiate the development of specialized legislation for asset confiscation. In January 2023, the Estonian Ministry of Foreign Affairs officially announced its efforts to draft a law specifically focused on confiscating Russian assets. However, as of May, the presentation of such a draft has not yet taken place.

Poland also supports the idea and has proposed an amendment as part of its constitutional changes, granting the right to seize and confiscate assets if they can be utilized to support Russian aggression.

Consequently, most of Ukraine’s Western partners who consider property rights inviolable are actively seeking legal and legitimate avenues to restrict them within the context of recovering Russian assets and providing compensation for the inflicted damage.

However, specific states supporting Ukraine are unwilling to confiscate Russian assets.

A working group led by the Swiss Federal Office of Justice (FOJ) has concluded that the confiscation of private Russian assets would undermine the Federal Constitution of Switzerland and the existing rule of law.

Additionally, Montenegro has declined to seize and transfer frozen assets to Ukraine, citing the inconsistency of such actions with its Constitution and the strong bond between the people of Montenegro and Russia.

One potential interim solution between freezing and confiscating Russian assets involves transferring the profits from managing these frozen assets, including accrued interest on Russian funds, to Ukraine. Recently, European officials have discussed a proposal to allocate the interest earned by Russian assets in Euroclear, the world’s largest clearing house, to Ukraine, as previously mentioned.

In adherence to standard procedures, Euroclear lends its clients’ balances to mitigate credit risk and retains the interest yielded. The current circumstances of high interest rates and the extraordinary accumulation of payments due to sanctions have resulted in significant profits for the clearing house.

Specifically, during the first quarter of this year, Euroclear reported interest payments amounting to €734 million derived from the funds of sanctioned Russian assets.

On 13 June 2023, EU officials presented more specific proposals concerning the utilization of Russian assets at the meeting of EU leaders.

EU adopts 11th package of economic and individual sanctions against Russia

Belgium has taken tangible measures to transfer funds received from frozen Russian assets to Ukraine. As the Euroclear depository is situated in Belgium, taxes on the interest earned from the frozen Russian funds are paid to the Belgian budget. In total, this amounts to taxes worth €625 million annually. Out of this sum, Belgium allocates €92 million to Ukraine – half for military weaponry and half for humanitarian aid. In essence, Belgium is not providing Ukraine with Russian assets or the interest derived from managing such assets but rather utilizing its own budget revenue that would have otherwise been directed toward the Belgian budget.

Considering the substantial amount of Russian assets held abroad, it is apparent that this represents a significant financial resource that can be employed for damage compensation. Simultaneously, it is potent leverage to influence those who persist in financing the war with their resources.

The Institute of Legislative Ideas proposes that states focus on realistic measures to bring the aggressor closer to compensating Ukraine for the incurred damages and losses.

Five steps that will bring Russia and its accomplices closer to compensating Ukraine for the incurred damages and losses

1. Conduct a comprehensive audit of all Russian assets and synchronize the data.

Ukraine and partner states should identify and freeze not only the assets of the Central Bank of the Russian Federation but also the properties owned by the aggressor country, such as land plots, estates, apartments, and cultural centers. Additionally, companies in which Russia has a stake should also be targeted.

Determining the nominal owners of the sanctioned assets and subsequently freezing them is crucial. Coordinated and collaborative efforts should be made to ensure that the collected information is synchronized among the partners. The basic details, such as the value, type, and location of assets, must be made public. Consequently, access to a comprehensive database should be available in some form, enabling the tracking of asset movements.

2. Establish a unified fund to manage frozen assets effectively.

Firstly, a strategy should be developed to manage these frozen assets, aiming not only to preserve them physically but also to generate income. The generated income can then be utilized to rebuild the destroyed infrastructure and enhance Ukraine’s defense capabilities. Subsequently, an international frozen asset fund should be established, managed by the most efficient administrator with optimal administration costs.

3. Criminalize sanctions evasion and monitor compliance with sanctions regimes.

Firstly, implementing a mandatory self-reporting rule for assets owned directly or indirectly by sanctioned individuals should be introduced. Subsequently, the concealment of assets belonging to sanctioned individuals should be criminalized, with the possibility of further confiscation through civil proceedings. The effectiveness of these measures relies on providing adequate resources to the authorities responsible for monitoring sanctions compliance and investigating instances of sanctions evasion. This includes setting cost caps for such cases.

These steps aim to prevent asset shifting and facilitate the legal confiscation of assets involved in such crimes. To date, the current tools remain largely theoretical.

4. Improve existing procedures and introduce specific civilian mechanisms for confiscating assets of war collaborators.

Partner countries should incorporate mechanisms for civil asset forfeiture of sanctioned individuals into their legislation and actively employ existing civil forfeiture instruments within and beyond criminal proceedings. It is crucial to enshrine provisions that facilitate the transfer of confiscated assets to Ukraine.

5. Sign the International Multilateral Agreement under the Global Compensation Mechanism.

The current state of international law must effectively address emerging challenges, such as acts of aggression perpetrated by a superpower nuclear state and member of the UN Security Council against its sovereign neighboring country. It is imperative to reconsider the existing approach concerning the inviolability of property rights.

During the Summit of Heads of State and Governments of the Council of Europe held in Reykjavik on May 16-17, 2023, the establishment of the International Register of Damages caused by the aggression of the Russian Federation against Ukraine was announced. The Register of Damages represents the initial component of a comprehensive compensation mechanism.

Furthermore, a separate international agreement in collaboration with Ukraine will establish the International Compensation Mechanism. This mechanism will encompass the activities of the Claims Commission and the Compensation Fund.

The agreement should include provisions outlining the conditions for utilizing and recovering assets belonging to the aggressor and its accomplices as a means to contribute to the fund. Specifically, it should define rules for limiting sovereign immunity and establish grounds for the recovery of assets belonging to sanctioned individuals.

Tetiana Khutor, Chair of Institute of Legislative Ideas

Tetiana Khutor, Chair of Institute of Legislative Ideas

Andriy Klymosiuk, Candidate of Legal Sciences, lawyer/analyst at Institute of Legislative Ideas

Taras Ryabchenko, lawyer/analyst at Institute of Legislative Ideas

Related:

- Ukraine’s asset confiscation agency’s new head castigated by civil society, Transparency International

- The Council of Europe makes the first step to compensate Ukrainian war losses using Russian assets

- The $ 300 billion question: Why the West does not confiscate Russian frozen assets despite Ukraine war

- What EU should do to track Russian assets and seize them for reconstruction of Ukraine

- US Congress proposes to freeze Russia’s Central Bank assets to rebuild Ukraine: why it matters