The Stockholm arbitral awards

The much-awaited arbitral awards from the Arbitration Institute of the Stockholm Chamber of Commerce (hereafter, the Arbitration Institute) in the disputes between Naftogaz and Gazprom, which the latter had initiated in 2014, were finally issued in December 2017 and February 2018. Stakes were high as the disputes focused notably on yearly gas transit volumes, the gas price formula and take or pay levels in the January 2009 supply and transit contracts expiring on 31 December 2019.

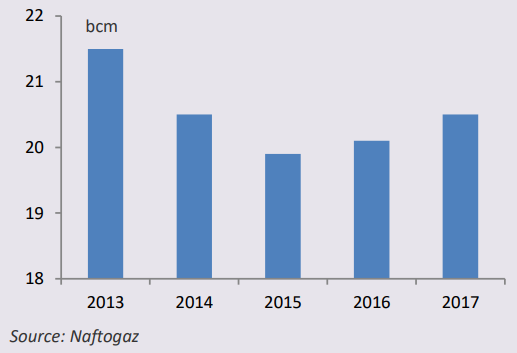

Naftogaz is a net winner of USD 2.6 bn. The Arbitration Institute stated that the take or pay level is reduced to a minimum of 4 bcm/year and that the gas price must be related to a German gas hub. The Arbitration Institute ruled that Gazprom has to pay damages for having transited less than 110 bcm/year. Yet Naftogaz could not impose its new entry-exit capacity payment mechanism, nor could it obtain the transfer of the transit contract to the newly created transmission system operator (TSO).

However, while the awards were long awaited, they did not bring the needed normalization of the companies’ relations. Quite the opposite.

Gazprom creates serious uncertainties

Instead of accepting the awards, Gazprom has refused to supply Naftogaz with a small volume of pre-paid gas on 1 March and returned the pre-payment made on the basis of an invoice, causing a local gas shortage in the midst of a cold wave. Gazprom has denounced the ruling as unbalanced (notably in denouncing the absence of a proper ship or pay provision for the transit), vowed to appeal the rulings and has initiated a procedure to terminate the sales and purchase as well as the transit contracts. Gazprom’s moves are legally possible and the current contracts remain operational until a court case and arbitration litigation awards, will be filled and completed, while Naftogaz is reportedly preparing legal actions to enforce the reintroduce a claim to change the transit tariff and collect its money with interests.

Read also: Russia’s March-2018 gas war attempt against Ukraine, explained

Gazprom’s reaction is pushing Ukraine to maintain its maximalist gas transit tariff demands for the post-2020 period, which Gazprom will refuse as it plans to put Nord Stream 2 and Turkish Stream into operation. This makes a partial interruption of Russian gas supplies to Europe in the middle of the winter in January 2020 possible.

Gazprom may have enough other supplies to avoid force majeure on its key long-term contracts while benefiting from higher prices. Yet a January 2020 supply crunch could destroy trust in natural gas and accelerate the move away from natural gas as conversely to past crises, the dust may not settle this time. Chancellor Merkel’s recent warning that future transit through Ukraine requires clarity is a clear reminder that politics can also seriously move in.

Reason must prevail

Russia and Ukraine at large are involved in many arbitration procedures: over Eurobonds, Crimean gas resources, the Crimea bridge and natural gas contracts, and the parties must comply with them. The European Union (EU), and others should support this.

In order to fulfill its commitment to be a reliable gas supplier to the EU, Gazprom should continue to use the Ukrainian gas transit system even beyond 2020, when alternatives become available, in order to accommodate seasonal variations and maintain reserve capacities.

Ukraine must accept the fact that Russian gas transit volumes are likely to be decreasing. A key priority is thus to ramp up domestic gas production; progress has been slow in this area so far.

Ukraine’s credibility as a transportation route will be tarnished if its transport tariff obviously discriminates supplies from Russia. The new entry-exit capacity booking system is the right way forward, in line with common EU practice. Yet Ukraine must not overplay its price-setting power and should work out an adjusted tariff proposal, which also allows for competitive and complex storage operations from abroad.

Naftogaz’s unbundling should be pursued while acknowledging that this is a complex undertaking which proved difficult enough in the EU. In a context of weak rule of law and hidden private interests, Ukraine’s internal divisions on such critical issues are harmful.

The EU has its role to play in proving support and ensuring that key remaining competition problems in Central Europe related to network access are addressed and that Ukraine remains a significant transit country. This commitment was made not least to encourage gas market reforms in Ukraine as part of its Energy Community membership.

The way ahead: Teaming up with European TSOs

Several European transmission system operators (TSOs) are reportedly considering participating in a tender currently prepared by the Ukrainian government and supported by the European Commission, for attracting a partner for the newly established TSO. Among them, two teams have come together, Eustream (Slovakia) and Snam (Italy) on the one hand and GRTGaz (France), Gasunie (Netherlands) and Transgaz (Romania) on the other hand.

The latter have laid out a management contract proposal covering the entire gas transmission system (GTS): their proposal is to train staff, nominate the management, control procurement and support key operations, such as balancing. It can be implemented quickly. The former are focusing on the management and operations related to the infrastructure that would be used only for the gas transit.

Ukraine should use this opportunity in order to improve the management, efficiency, and transparency of its GTS. It should also seek their support for working out an adjusted gas transportation tariff. It should open the possibility for European gas buyers to become shippers for Russian gas through Ukraine, which would further ease risks for Gazprom in the long term while enabling to keep gas selling points in existing contracts untouched.

European partners could also ensure that the new TSO is certified and foster efforts towards effectively unbundling regional gas companies and their proxies so that transparency covers the entire system.

Read also:

- How Ukraine can protect itself from Nord Stream 2

- Russia’s March-2018 gas war attempt against Ukraine, explained

- Stockholm court hands Ukraine victory over Gazprom’s “take or pay” claim: 5 things to know

- EU silent as Russia gears up for third gas war against Ukraine

- Legal war: Ukraine vs. Russia in international courts

- Nordstream2 opens road for Russian offensive in Ukraine, subjects EU to gas wars

- Siemens stops shipments to Ukraine’s Naftogaz, fearing lost contracts in Russia

- Gazprom is frightening Europeans with Ukraine again

- Ukraine decreases gas consumption by 27%

- Naftogaz Ukraine appeals to Stockholm court

- “Naftogaz” prepares for “big reversal”

- Ukraine and the EU: At the gas front of the hybrid war