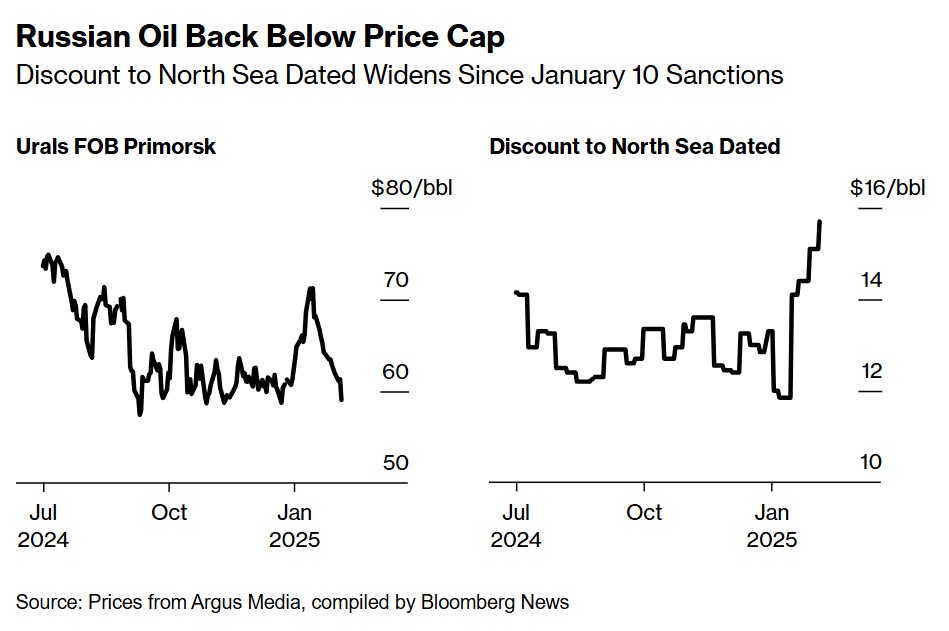

Russian Urals crude has fallen below the $60 price cap as new US sanctions strain Moscow's oil trade, Bloomberg reports. The flagship Russian oil grade now trades at a $16 discount to global benchmarks—the steepest since May 2024.

This price drop suggests that the Biden administration’s January sanctions targeting Russia’s oil shipping network are having the intended effect: limiting Moscow’s energy revenues.

"With buyers in India and China wary about dealing with the [sanctioned] ships, that's supported rates for the vessels still willing to move Moscow's oil," Bloomberg notes, citing Argus Media data.

The US Office of Foreign Assets Control (OFAC) imposed these sanctions on 10 January, blacklisting 161 tankers linked to Russia’s oil trade.

As a result, the gap between Russian export prices and global delivery prices has widened:

- At Russia’s Baltic port of Primorsk, Urals crude now trades $15.70 below the North Sea Dated benchmark.

- The Indian delivery discount has reached $13 per barrel.

The drop below $60 per barrel theoretically allows Russia to use Western shipping and insurance services under G7 price cap rules—but only if buyers can verify purchase prices. In late 2023, Urals crude exceeded $80 per barrel, forcing Russia to rely on a costly shadow fleet to evade restrictions.

Russia’s budget and war spending

Meanwhile, Russia’s 2025 federal budget is built around an assumed Urals crude price of $69.7 per barrel—far higher than current market prices. If oil remains below this level, Moscow could face serious revenue shortfalls, further straining its economy.

This comes as Russia dramatically increases war spending. The 2025 budget allocates a record 13.5 trillion rubles ($145 billion) to defense, a 25% rise from 2024. This spending, which accounts for 6.3% of Russia’s GDP, is primarily funding the ongoing war in Ukraine, including weapons production, soldier salaries, and occupation costs.

If oil prices stay low and sanctions continue to restrict Russia’s revenues, Moscow may be forced to dig deeper into its sovereign wealth fund, raise taxes, or push inflation higher—all of which could worsen its long-term economic stability.

Read more:

- Bloomberg: Europe seeks Australian gas to reduce Russian energy dependence

- Bloomberg: For the first time, Russia’s fuel output in doubt as Ukrainian drones hit three key refineries

- Bloomberg: Oil flows halt at Russia's Ust-Luga Baltic port following reported attack