In Ukraine, the initiative of elaboration of such of a Plan has been supported by both – the President and the Prime Minister, in addition to the parliamentary group mentioned above. It has been mentioned, notably, at the Ukraine-EU summit in mid-July 2017. The matter also attends further discussions during the Eastern Partnership’s summit in autumn.

This means that the idea is not a new one. It came up firstly in 2014-2015 on the crest of the wave of Western support of post-Maidan Ukraine. However, at the time the official authorities gave the highest priority to the agenda of liberal reforms, aimed at economic and financial stabilization and deregulation, reducing the role of the State, replacing its institutions and top-management. At the first stage of reforms, the issue of economic growth in the policy documents was considered as secondary and such that would solve itself in the future as a logical result of institutional changes. However, virtually absent growth for three years is more and more frustrating for Ukrainian citizens and international partners, moving the question of additional measures to the next level. This is what generates a wave of interest to the Marshall Plan for Ukraine. Is it possible to implement such an initiative today? Is it needed not only by us, but our partners as well?

Obviously, the theoretical possibility that someone from abroad would bring plans and money for “Ukrainian economic miracle” looks very attractive. However, the idea would become clearer after answering some direct questions.

Is there any specific idea or project for this Plan? Who is preparing or will prepare it and what is its aim?

The experience of discussing the idea shows that at the moment everyone has their own idea of the goals, sources of financing, performers and beneficiaries of this Plan. Someone thinks it should accelerate the reforms. But accelerating the already launched reforms does not require a separate plan or additional money. These plans are already drawn up and money is allocated, but they are not spent in full, either because of lack of projects, or because of the institutional failure of the State apparatus. Thus, the Marshall Plan, although it should be an integral part of the overall reform program, cannot have anything to do with the next financial assistance project, which is primarily a capital investment plan.

Some supporters of the plan's idea see it as a list of major infrastructure projects, such as an autobahn from the East to the border with the EU or new airports, or something else grand enough, which would demonstrate rapprochement with the European Union. There is also an idea of the plan as to the organization of foreign investment in the amount of 4-5 bn euros per year, which should accelerate real GDP growth from 1.6-1.8% forecasted for this year to 4-5%. The nature of these calculations is unknown. Such a volume will certainly not affect growth, as it is the usual level of foreign investment in recent years. In addition, it continues to be about loans from international financial institutions (IFIs), which would increase anew the already huge government debt and which should be returned mainly from the budget. If we want to see private investments in infrastructure, which Ukraine really needs urgently, then the projects should be financially remunerative, but the mechanisms of investment that would ensure the return on investment (such as, for example, public-private partnership) are currently not working.

In general, the impression is that there is no clear idea on the Plan among any of those who talk about it. There is only an idea of a plan, the implementation of which may either be a success or a disappointment for the country and its partners.

In 2015, the Institute for Social and Economic Research (ISER) proposes to work out a fundamentally new Plan aimed at the geostrategic victory of Ukraine and its Western partners in this region, as well as the establishment of a balance that should eventually be transformed into a world based on the "win-win" principle. The exclusively military victory, which a priori implies the opposition of the winner and the defeated, will never be able to satisfy all sides of the conflict, and, accordingly, cannot guarantee a sustainable peace. Attempts for a political settlement also periodically come to a standstill. The war lasts for the fourth year and its ending is not visible. This is a very long time for the region in the center of Europe. The conflict is depleting and gradually destroying all its participants. Instead, the economic victory has the highest potential for resolving the problem. Our victory will be indisputable when Ukraine becomes a dynamic, modernized State with a high level of technology development in industry and agriculture, a high level of well-being, high rates of economic growth and human capital development. According to all these indicators Ukraine should exceed the level of the CIS countries, including the Russian Federation, and become an example of success for the citizens of the post-Soviet States as a result of the correct geopolitical choice. Only for this purpose, the Marshall Plan is really needed as a joint project of the people of Ukraine and Western civilization.

Obviously, the "Marshall Plan" for Ukraine is exactly opposite to the current reform program, since the latter does not include real steps for accelerating economic growth. It should become the second stage of a rocket carrier, which comes into action when the first has fulfilled (or should have) fulfilled its function. To implement the Plan there is no need to create an entirely new program - it takes a lot of precious time and money. We already have everything, we need only, with the participation and leadership of the Government and the help of donors, to consolidate all the work in one plan, in order to unite society and start its realization around it.

Is there an understanding of who can provide the funds for the implementation of this Plan, and how much it is needed?

According to the model calculations of the Institute's experts conducted at the end of 2014 - early 2015, in order for GDP to grow 2 times over 10 years in real terms, it is necessary for these 10 years to invest in the economy the capital investments in an amount equivalent to $600 bn, that is on average $60 bn per year. The researches departed from the fact that even during the crisis period of 2015-2016, the Ukrainian economy generated $11-12 bn of investments in fixed assets. That is, there are still $50 bn annually.

According to official figures, foreign capital investments today (their share is about 3%) do not make a significant contribution to the development of the economy. Even those investments were, in essence, Ukrainian investments at the expense of funds previously moved to the offshore. The main share (60-70%) is made up of enterprises' own funds.

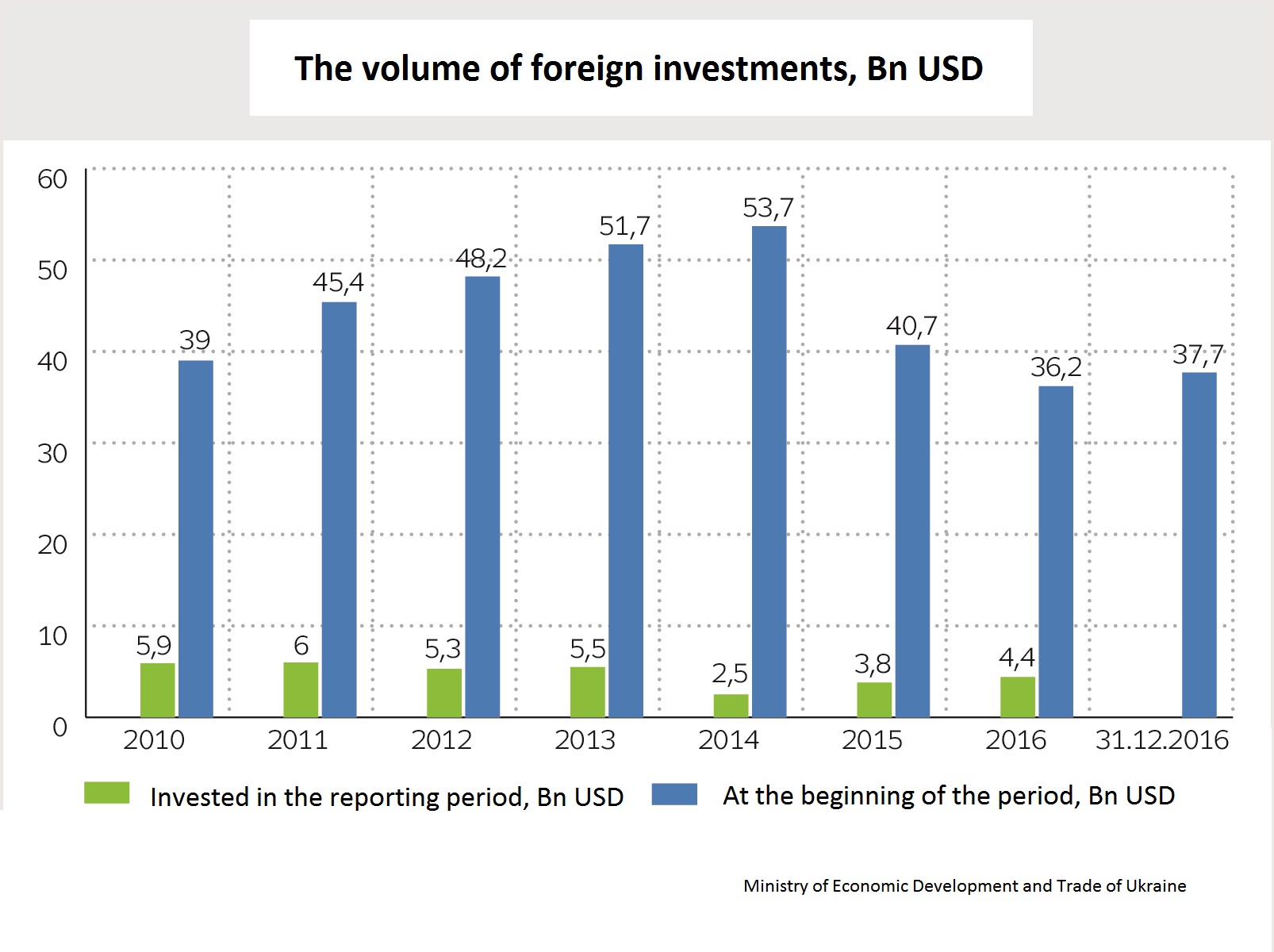

Foreign direct investments (FDIs, including both capital investments of foreign investors) are also negligible. According to official data of the Ministry of Economic Development, the amount attracted from the beginning of the investment of foreign direct investment (equity), as of December 31, 2014, amounted to 37.7 billion dollars. USA. It is almost $1.3 bn. Less than at the end of 2010, and by $16 bn less than by the end of 2014.

Such figures provide eloquent evidence that the current program of reforms, despite the intentions of deregulation and the improvement of the investment climate, did not bring results in the form of attracting foreign investment. Although FDIs in 2016 increased, compared to the previous 2 years, and reached $ 4.4 bn, their lion's share (64%) made from contributions to the capital of foreign financial and insurance companies, which led the Russian Federation to become last year the largest foreign investor (1.7 billion dollars), ahead of the traditional leader - Cyprus. Here is another proof that the $ 4-5 bn will not affect the rate of economic growth and that for this purpose not only the volumes, but also target segments of the economy, where it is necessary to direct the funds, are important.

Thus, for the entire period of investment, the volume of FDIs is less than we need to attract in investments (foreign and domestic) annually only in capital. Is not this pragmatism really the romanticism? Everything depends on the goal of reforms in the country and the position of the State. If we are to increase the volume of investment as a national priority, which will be subordinated to other areas of reforms, including the fight against corruption, then this is not easy, but realistically, with strong political support from both the inside and the outside. For example, according to the World Bank, the gross accumulation of fixed capital in the Republic of Korea during the period of active reforms from 1960 to 2016 amounted to an average of $130.35 bn per year. At the same time, since 2000 it has never been less than $168.23 bn, and in 2016 amounted to $412.22 bn. Other historical examples can be cited when, in a focused policy, even in the postwar period, countries found the possibility of attracting investment in structural modernization of the economy and high rates of economic growth. It should also be added that investment growth will have a certain multiplier effect. If, for example, under the Plan the funds will be invested in the construction of a new agricultural production plant or in the purchase of equipment for an existing plant, this will facilitate the company's receipt of profits that can be invested into new projects. With new equipment and modern competitive products, the company can apply to the bank for a loan to develop production and invest again. Employees of this company, having received high wages, will be able to save some of their money, which will also be a source of investment. And this multiplication will take place at an endless geometric progression, provided that the State develops and will adhere to the proper policy of stimulating and protecting investment and savings, and will carry out adequate regulation, preventing the economy from overheating and from the emergence of financial crisis.

The most important thing is where to invest. As part of the PEP study, ISER, for example, formed groups of economic activities based on the share of value added in the output and their share in total exports, cleared of the factors distorting the comparison with the addition of added value of innovative products. According to such estimates, the highest priority for attracting investment should be those activities that form a high-tech and export-oriented model of economic development. There are proposals on this issue of the Federation of Employers, are the results of the OECD project "Strategy of Sectorial Competitiveness of Ukraine". And there is more. That means, one can either choose one of the suggested approaches or try to combine them. The main point is to radically change the logic when money is attracted anywhere, as it is now, when investments are purposefully oriented towards the formation of a certain economic model with technological arrangements that will allow Ukraine to become part of the highly developed countries in the future either within the EU or within the framework of the current association. This model should be demonstrated by the government to potential investors and donors and to explain how it will work and what benefits it guarantees for them.

What are the incentives for the West to support Ukraine?

Indeed, why Western countries in the center of Europe, at the intersection of the powerful markets of the EU and Asia, led by China and the Customs Union led by Russia, at their expense create an industrial competitor, which in the future will compete with them in these markets? It seems more rational, with its under-loaded production capacities, to continue to provide Ukraine with some kind of lending support for the creation of State and market institutions and maintenance of infrastructure in an acceptable condition, and to direct investments to agriculture, mining and, possibly, processing of agricultural raw materials or waste. This course of actions means to support the agrarian-raw material model with the outflow of excessive labor force to the EU and the Russian Federation where there is a deficit, and also have a small market for the sale of low-quality goods and old machinery.

But this is a false rationalism and it could be justified only five years ago, prior to the signing of the Association Agreement with the EU by Ukraine, the annexation of the Crimea by Russia, the occupation of Donbas in the same time and the restructuring of Ukraine's State debt, which now again reached 80% of GDP.

Now it is expedient to transform Ukraine from an object that constantly needs help and protection, to a partner capable of helping with the settlement of the situation in the region. Otherwise, everyone will lose:

- Ukraine can turn into a poor agricultural country with a weak domestic market, an unstable socio-political situation, high unemployment and crime, a strong stratification of the population by income levels and a reduction in its size;

- The EU can get a constant source of instability and "gray zones" because of the smoldering conflict, uncertainty in protecting investment in Ukraine, and complicated by sanctions on investment in Russia. Consequently, European business will lose if it forfeits the markets in this part of the world;

- Russia loses as well. The existing regime sooner or later may shatter under the pressure of sanctions and fall. This fall is likely to plunge into the abyss not only Russia, but also Ukraine, part of Europe and Asia. It is impossible to predict the consequences;

- Failure for the US: if Ukraine loses its value as an energy bridge and a transit corridor between Europe and Asia, it will turn into a poor ally, which will require various help without any ability to find self-sustainable solutions to their problems;

- Losses for investors who, while maintaining the current economic scenario, may lose their money invested in Ukrainian securities or loans, because the country simply cannot return its debts and will require their restructuring or relief.

Thus, the Marshall Plan (although this name must be changed to a new own, without historical associations, incorrect in this case) under the conditions set forth in this article, is a rational step for the West. Today, Ukraine is a potentially "profitable asset", brought to a non-performance by poor governance. Someone tries to assign this asset by robbery, someone – tries to sell it more expensive, and someone - cheaper to buy. But this asset can become profitable for all parties and thus to advance the long-awaited victory through the new economy, the new status of a reliable partner and the outpost of Western values in the post-Soviet space. This will ensure stability and security in the region with the help of a "win-win" strategy.

An abridged text of this article was first published in Dzerkalo Tyzhnia

The translation of the full version was published at Institute for Social and Economic Research