Ukraine claims its campaign targeting Russian military assets far from front lines is disrupting logistics and artillery capabilities, likely shifting the attrition balance in Kyiv’s favor.

On July 22, Colonel Serhiy Baranov, chief of Ukraine’s missile and artillery forces, stated Ukrainian strikes are responsible for around 90% of Russian losses. He said Western long-range missiles allow “fire fist” strikes so powerful and accurate Russia struggles to counter them.

On July 22, Colonel Serhiy Baranov, chief of Ukraine’s missile and artillery forces, stated Ukrainian strikes are responsible for around 90% of Russian losses. He said Western long-range missiles allow “fire fist” strikes so powerful and accurate Russia struggles to counter them.

Oleksiy Danilov

Captain Nataliya Humenyuk, spokesperson for Ukraine’s Southern Operational Command, said July 22 attacks on Russian ammo depots deep in the rear are causing logistics issues. She noted decreased Russian shelling in Kherson indicates “shell hunger” there.

On July 22, Colonel Serhiy Baranov, chief of Ukraine’s missile and artillery forces, stated Ukrainian strikes are responsible for around 90% of Russian losses. He said Western long-range missiles allow “fire fist” strikes so powerful and accurate Russia struggles to counter them.

Oleksiy Danilov

- Brigadier General Oleksandr Tarnavskyi compared Ukraine’s counteroffensive to “boxing” on July 13, saying Ukraine intends to “hold the opponent at arm’s length,” likely referring to long-range strikes rather than close combat.

- On July 22, Colonel Serhiy Baranov, chief of Ukraine’s missile and artillery forces, stated Ukrainian strikes are responsible for around 90% of Russian losses. He said Western long-range missiles allow “fire fist” strikes so powerful and accurate Russia struggles to counter them.

- On July 22, Colonel Serhiy Baranov, chief of Ukraine’s missile and artillery forces, stated Ukrainian strikes are responsible for around 90% of Russian losses. He said Western long-range missiles allow “fire fist” strikes so powerful and accurate Russia struggles to counter them.

The officials’ statements suggest Ukraine’s interdiction campaign targeting Russian rear areas is succeeding. This campaign is central to Ukraine’s plan to gradually degrade Russia through asymmetric attrition while minimizing its own losses, even if territorial gains are slower.

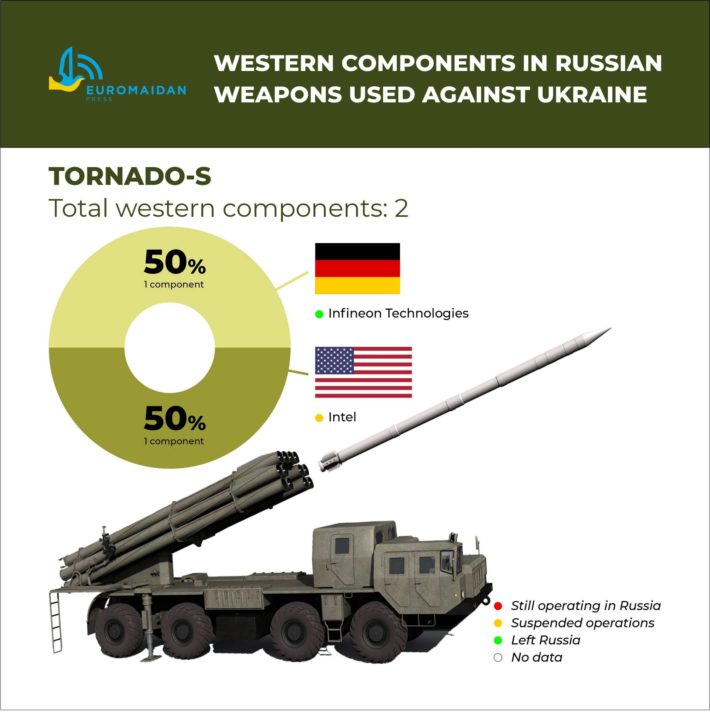

A joint report by the KSE (Kyiv School of Economics) Institute and Yermak-McFaul International Working Group on Russian Sanctions has revealed how despite Western sanctions, Russia is continuing to circumvent restrictions to gain access to crucial components for replenishing its missile stockpile and sustaining strikes in Ukraine.

The report finds that Russia continues to source Western-made components for its military hardware despite existing sanctions. A large portion of Russia’s modern weaponry relies on sophisticated electronics imported from countries such as the US, the UK, Germany, the Netherlands, Japan, Israel, and China. These components, in some cases, are dual-use goods that are commercially available and challenging to control via export restrictions.

The London-based Royal United Services Institute (RUSI) estimates that over 450 different types of foreign-made components are used in 27 different Russian equipment systems. Remarkably, about ten companies supply over 200 of these components, nearly half of the total. Many of these components are subject to US export controls, yet Russia manages to obtain them, possibly through third-party intermediaries.

Russia has developed a system for concealing the original source of these items, often using third countries as intermediaries. A significant portion of the computer components used in Russian ballistic and cruise missiles are allegedly procured for non-military use in Russia’s space program, ROSCOSMOS, which has been utilized to acquire technology with both civilian and military applications.

Companies worldwide, including those in the Czech Republic, Serbia, Armenia, Kazakhstan, Türkiye, India, and China, appear willing to take risks to meet Russian procurement demands

from the text

An investigation found that since the start of the full-scale invasion in 2022, 75% of US microchips were supplied to Russia through Hong Kong or China, despite manufacturers claiming to have suspended all operations with Russia. This is primarily possible due to lesser-known chip traders and shell companies which can evade US sanctions more easily than established distributors.

The debate around whether sanctions have been effective so far is mixed. The Center for Strategic and International Studies reports that shortages of certain high-end components are causing the Russian Ministry of Defense to substitute them with lower-quality alternatives. Yet, the Free Russia Foundation suggests that the sanctions regime was only able to disrupt the access to Western technology in the short term, with Russia quickly establishing alternative routes. Consequently, Russia’s imports of dual-use goods now exceed pre-war levels.

The KSE Institute and Yermak-McFaul Foundation note that although Russia has systematically implemented import substitution programs since 2014

the report

1. Long-term Stocks: Research has revealed that Russia maintains stocks to fulfill long-term contracts, equivalent to roughly three years of production. Hence, any restrictions aiming at production will experience a lag in impact. However, during times of war, when production needs increase significantly, Russia is likely to utilize these stocks.

- Long-term Stocks: Research has revealed that Russia maintains stocks to fulfill long-term contracts, equivalent to roughly three years of production. Hence, any restrictions aiming at production will experience a lag in impact. However, during times of war, when production needs increase significantly, Russia is likely to utilize these stocks.

- Illicit Channels and Grey Areas: Evasion of sanctions has been noticed in several instances. Tactics involve using intermediaries in countries not under sanctions, restructuring companies to hide sanctioned entities or individuals, and shifting final assembly to Russia after purchasing components instead of buying finished sanctioned products. Additionally, sanctioned Western components have been identified in drones that Iran supplied to Russia.

- Inconsistent Export Controls and Weak Enforcement: The success of the above evasion schemes is largely due to loopholes in the sanctions and export controls regime. Enforcement issues, particularly concerning the identification of end users of products, are partly responsible. The issue is further exacerbated by inconsistencies in the list of dual-use goods across sanctioning nations, which doesn’t align with the customs codes of the Harmonized System (HS). As a consequence, it becomes challenging to identify if a particular shipment falls under sanctions. The US has recently issued a list of HS codes that need special attention, and the EU is expected to follow suit.

Long-term Stocks:

Research has revealed that Russia maintains stocks to fulfill long-term contracts, equivalent to roughly three years of production. Hence, any restrictions aiming at production will experience a lag in impact. However, during times of war, when production needs increase significantly, Russia is likely to utilize these stocks.

Research has revealed that Russia maintains stocks to fulfill long-term contracts, equivalent to roughly three years of production. Hence, any restrictions aiming at production will experience a lag in impact. However, during times of war, when production needs increase significantly, Russia is likely to utilize these stocks.

Illicit Channels and Grey Areas

Evasion of sanctions has been noticed in several instances. Tactics involve using intermediaries in countries not under sanctions, restructuring companies to hide sanctioned entities or individuals, and shifting final assembly to Russia after purchasing components instead of buying finished sanctioned products. Additionally, sanctioned Western components have been identified in drones that Iran supplied to Russia.

Inconsistent Export Controls and Weak Enforcement

The success of the above evasion schemes is largely due to loopholes in the sanctions and export controls regime. Enforcement issues, particularly concerning the identification of end users of products, are partly responsible. The issue is further exacerbated by inconsistencies in the list of dual-use goods across sanctioning nations, which doesn’t align with the customs codes of the Harmonized System (HS). As a consequence, it becomes challenging to identify if a particular shipment falls under sanctions. The US has recently issued a list of HS codes that need special attention, and the EU is expected to follow suit.

Russian titanium giant Avisma is not sanctioned by USA or the EU

This ship is not sanctioned, at all

This ship is not sanctioned, at all

2. Artillery Russia is facing difficulties supplying artillery shells. The number of artillery rounds has contracted significantly – approximately 75% - since last summer, when Russia was launching between 40,000 and 50,000 rounds per day in the Donbas. Nonetheless, stockpiles remain numerous, even if some are old and less reliable.