Here is an explainer on how global sanctions are impacting the Russian economy and ordinary citizens.

Global sanctions and their impact on the Russian economy and society can become a major factor that will force the Russian government to end hostilities, regardless of the risks such a move may entail. War is a total waste of a country’s resources, and Russians are beginning to feel the pinch. Referring to available public data, we can now assess the real impact of global sanctions and the true state of Russia’s economy.

Diagnosing the “mad rhinoceros”

Russia’s gigantic expenses for its “special operation” in Ukraine are clearly detrimental to the Russian economy, but the main threat to Russia’s well-being is the unprecedented number of western sanctions.

Russian officials claim that the West suffers more from these sanctions than Russian citizens. Western leaders, on the contrary, speak of “sanctions from hell” that severely impact Russian companies and citizens. But, later they manage to find exceptions and delays allowing them to avoid the same sanctions and reconcile the competing interests of allies and partners.

To date, global sanctions have not much affected the Kremlin’s policy. The strengthening of the exchange rate of the Russian ruble and the reduction of the Bank of Russia’s key rate (the benchmark interest rate that determines bank lending rates and the cost of credit for borrowers, in particular, consumer and mortgage loans) enabled the authorities to convince ordinary Russians that there was nothing to worry about.

But, what is actually happening? According to the IMF, Russia stands relatively high in GDP ranking - eleventh in the world – and has a certain margin of stability.

Despite these markers, today’s Russia can be compared to a wounded rhinoceros that has gone mad, raging and destroying everything around it, while people try to shoot it down. The rhino has obviously been seriously wounded, perhaps even fatally. However, as the animal bellows and rages, no one knows for certain what it is really thinking and where it is heading.

How to make sanctions really painful for Russia, immediately

What have global sanctions achieved?

At the same time, the Russian economy is not a “black box”. It owes its relative strength primarily to the fact that it is market-based, that is, essentially public. Thus, it is possible for us to assess its approximate state, despite the fact that Russian authorities hide alarming data on its declining economy from the general public.

For example, product prices increased by 9-33% in April 2022 compared to the same period in 2021; in January, they rose by 2.6-9.4%; in February - 4.5-10%.

Global sanctions have seriously disrupted technological, production, and logistics chains. Accordingly, Russian manufacturers have seen costs spiraling. Even the prices of basic consumer products - milk and bread - have risen not only due to inflation but also due to the increase in the price of raw materials and packaging.

Many Russian industrial enterprises have reduced or ceased production due to contract breakage by foreign entities. It has become more difficult or even impossible for them to sell products, obtain materials and components, and service imported equipment

As it turns out, Russians have suddenly discovered that it is difficult or even impossible to find Russian analogs of machines, equipment, and even special packaging (for milk, canned goods, and pharmaceuticals, for example) required for production. Russian enterprises are forced to reorganize their logistics chains and search for new counterparties, thus incurring additional costs. For example, the delivery of goods to and from Asian countries takes much longer and is more expensive than delivery to and from the EU.

This year, AvtoVAZ was forced to postpone their traditional summer corporate vacation (when they stop production) to April. The “conditionally planned” downtime was used to restore supply chains and replace critically imported components with alternative ones.

Production was resumed only at the beginning of June, but not all models were included. Because of the sanctions, the Germans suspended cooperation with Russia. Now, China has taken over from the Germans: Bosch will be replaced by APG and Trinova products. The first model with a Chinese anti-lock braking system will be the Lada Largus. It is planned to produce 800 Largus vehicles per day.

Finding themselves in difficult situations, many Russian companies are forced to sell their products to foreign partners at a discount and lose part of their profits. Production in certain industries has become highly unprofitable. Many private owners are asking themselves whether they should keep their business or declare bankruptcy.

According to Rosstat, the turnover of companies working in Russia decreased by 12% in April 2022 as compared to March 2022. It dropped by 20-30% in oil production, wood processing, production of refined oil products, medicines, vehicles, and software development.

Unemployment seems to be almost non-existent in the Russian Federation. However, more and more companies are transferring workers to part-time jobs or sending them home on unpaid leave. In April 2022, the number of Russians looking for work increased and the number of resumes on relevant Russian websites increased much faster than the number of vacancies.

Yes, there is undoubtedly a shortage of underpaid unskilled workers in construction, raw material extraction, and processing industries. But the demand for highly qualified labor - in the financial sector, in sales and automobile maintenance, in procurement - has seriously declined.

Since the beginning of the war, Russia has relied heavily on revenues from oil and natural gas, which make up a significant share of its federal budget. According to the Ministry of Finance of the Russian Federation, in the first quarter of 2022, the share of oil and gas revenues reached 41.5%, while in the corresponding period of 2021 it was 30.53%. Taxes, fees, and payments for the use of natural resources reached 50%. During 2018-2021, this indicator remained within 21-32%.

Therefore, by refusing to import Russian oil and gas - as stipulated in the sixth package of EU sanctions against the Russian Federation - the EU and other countries have backed Moscow into a corner. Russia now faces a serious challenge for filling its budget coffers.

It will only get worse

Let’s consider the prospects of the Russian economy without additional risks.

Taking into account, to put it mildly, the frosty investment climate, it is unrealistic to think that a cluster of high-tech companies will emerge to help Russia and that these same companies will agree to export and fill Russia’s budget and enable Russia to “jump off the oil needle”, a conceptual metaphor often used in Russian political discourse. “Repairing the holes” (searching for new suppliers, technologies, markets, etc.) will take approximately one and a half years. And during this time, new “holes” will appear, and Russians will find themselves immersed in the dark ambience of the early 1990s.

The Russian economy will be restructured. But, it will only provide for products and services of mass demand, as well as goods required for their production - raw materials, other required materials, equipment, transport, and containers.

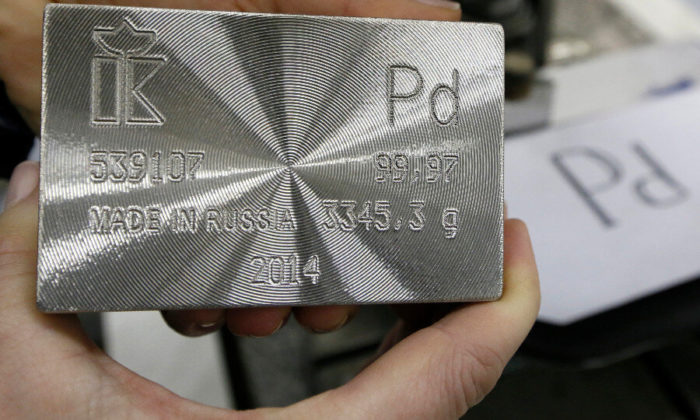

Provided that the current situation does not change, Russian metals and mining producers, which are crucial for the global economy, will continue to operate and export.

But, oil and gas sales will constitute the main revenue for the Russian government - in smaller volumes and with significant discounts.

In order to ensure employment, the Russian leadership will probably introduce public works, for example, infrastructure and construction projects. But, this will also lead to an increase in budget costs.

Due to the economic crisis and the sanctions (which have been introduced, but which have not yet entered into force), the amount of income in Russia’s federal budget will decrease. At the same time, additional expenses will appear, namely funds for the support of critically important industries (for example, the pharmacological sector), for the maintenance of Ukraine’s occupied territories, and for their own unemployed citizens.

In the end, only one question arises - where will Russia get the money?

One solution may be nationalizing banks (to prevent bankruptcies and fulfill their obligations to depositors) and manufacturing companies (to ensure the production of needed products, save jobs, and fill the budget). Today, there are already signs of movement in that direction. For example, one of the Renault factories was handed over to the Moscow government to produce cars under a Russian brand.

Another solution is printing more money. However, prices are expected to rise in all industries and regions of Russia. Money will depreciate, and the increase in nominal payments will not compensate for the general impoverishment of average Russians.

However, it should be understood that if Putin retains power, military spending will not be reduced as a matter of priority, partly because Putin would never allow himself to be defeated, partly to ensure social stability with promises and spectacles of “Russian power and grandeur.” Therefore, unless Russia is totally defeated, the Kremlin will continue to wage war until its resources are totally exhausted.

What global sanctions mean for ordinary Russians

Russian households, which in March demonstrated a frenetic demand for basic necessities, switched to a more economical mode in April-May due to uncertainty and a decrease in real incomes.

Currently, retail chains note demand for cheaper products. Sales of DIY products, furniture, clothing and footwear decreased in the regions. Fewer and fewer Russians visit restaurants and entertainment venues.

The supply of new cars has decreased significantly. Therefore, Russians will have to purchase their vehicles mainly on the used-car market. The real estate market shows the same picture. The quality of goods will decrease, in particular, due to a reduction in imports and, accordingly, competition.

Employers do not plan to index wages. Therefore, due to part-time work and unpaid vacations, nominal wages will decrease. Moreover, as inflation continues to grow, so will real incomes. In March 2022, accrued wages amounted to 120.9%, and the real wage index totaled only 103.6% (taking into account the price index).

It should be noted that 11% of Russians in 2021 already had incomes below the poverty line. A considerable part of the RF population survives thanks to social benefits. In some federal districts (North Caucasia, Siberia), 20-30% of inhabitants live below the poverty line. Under current conditions, the number of Russian citizens, for whom state benefits are the only source of income, will grow.

In its analytical reports, the Central Bank of Russia notes that the restructurization of the Russian economy will require redistribution of the labor force between industries and regions. Translated into human language, this means that the unemployed will have to change their profession, consent to low-skilled jobs, or move to another place, region, or city in order to get a job.

The majority of Russians will not be able to keep up with their loans, as banks have seriously tightened requirements for borrowers - both for individuals and businesses.

A number of foreign pharmaceutical companies have left the Russian market and Russian drug manufacturers face a shortage of raw materials. The search for alternative suppliers and registration of medicines will take at least a year and a half. Meanwhile, Russians face a shortage of indispensable medicines.

Popular foreign routes for the majority of Russians are now inaccessible - not only due to logistical and visa restrictions, but also because of the lack of ready money. Today, middle-class Russians are limited to excursion programs to Moscow, St. Petersburg, and/or a budget resort vacation in the Altai and Volga regions or in distant Karelia and Dagestan.

Conveying the truth to Russian society

Economics is not only about our present reality, but also about how we assess and prepare for the future. We work not because we are hungry today, but to have food tomorrow. We spend our holidays at the dacha, not by the sea, to save money for next year’s repairs and renovations. Therefore, as an example, a 5% increase in the price of sugar may make retirees grumble, or it may trigger panic buying and lead to a further price jump.

That is why Russian authorities try to convince their citizens that everything is under control. There are some difficulties, they say, but the problems are being solved and the situation will be stabilized very soon.

Of course, Russia has felt the effects of global sanctions before. The Russian government can look back to 2014, when global sanctions were selectively imposed. However, on the whole, the Russian economy adapted to new realities without a serious decline in the standard of living for the population.

On the one hand, this may accelerate economic problems in the Russian Federation. Russians may begin to purchase large amounts of foreign currency or will rush to search for any remaining imported goods.

On the other hand, raising awareness among the Russian population - namely that the Russo-Ukrainian war impacts their wallets and spending - may lead to such massive and widespread resistance and unrest that even the most repressive government will not be able to ignore it.

Read more:

- How to make sanctions really painful for Russia, immediately

- 10 tricks Russia uses to evade sanctions

- How EU would benefit from reducing its reliance on Russian gas

- The scope of the EU energy dependence on Moscow and practical ways out

- The EU oil embargo is not enough. How to curb Russia’s petroeuros

- International sanctions slam Russia’s finance, economy, culture, sports: a list

- How Western sanctions cripple Russia’s war machine: no modern tanks, navigation systems or drones