Losses of industrial capacities

In 2014, the banking sector sustained 53 billion UAH losses ($1.4 billion). Simultaneously, depositors withdrew their deposits worth almost 60 billion UAH ($4.5 billion), which accounted for 13.7% of the total deposits in the country. Foreign currency deposits fell by over one third to 19.4 billion UAH ($1.46 billion). The hryvnia exchange rate rose twofold against 2013 rates, up to almost 16 UAH, and later reached the rate of 22 UAH for 1 USD.

The nominal GDP dropped in 2014-2015 and has never fully restored by now.

Of course, it is impossible to accurately count how much Ukraine has lost due to the occupation since it is not enough to put together the costs of the lost regional assets and their production volumes to get figures of actual losses. However, the presidential representative in the Verkhovna Rada, MP Iryna Lutsenko, assessed the losses as reaching up to more than $50 billion.

Steel giants

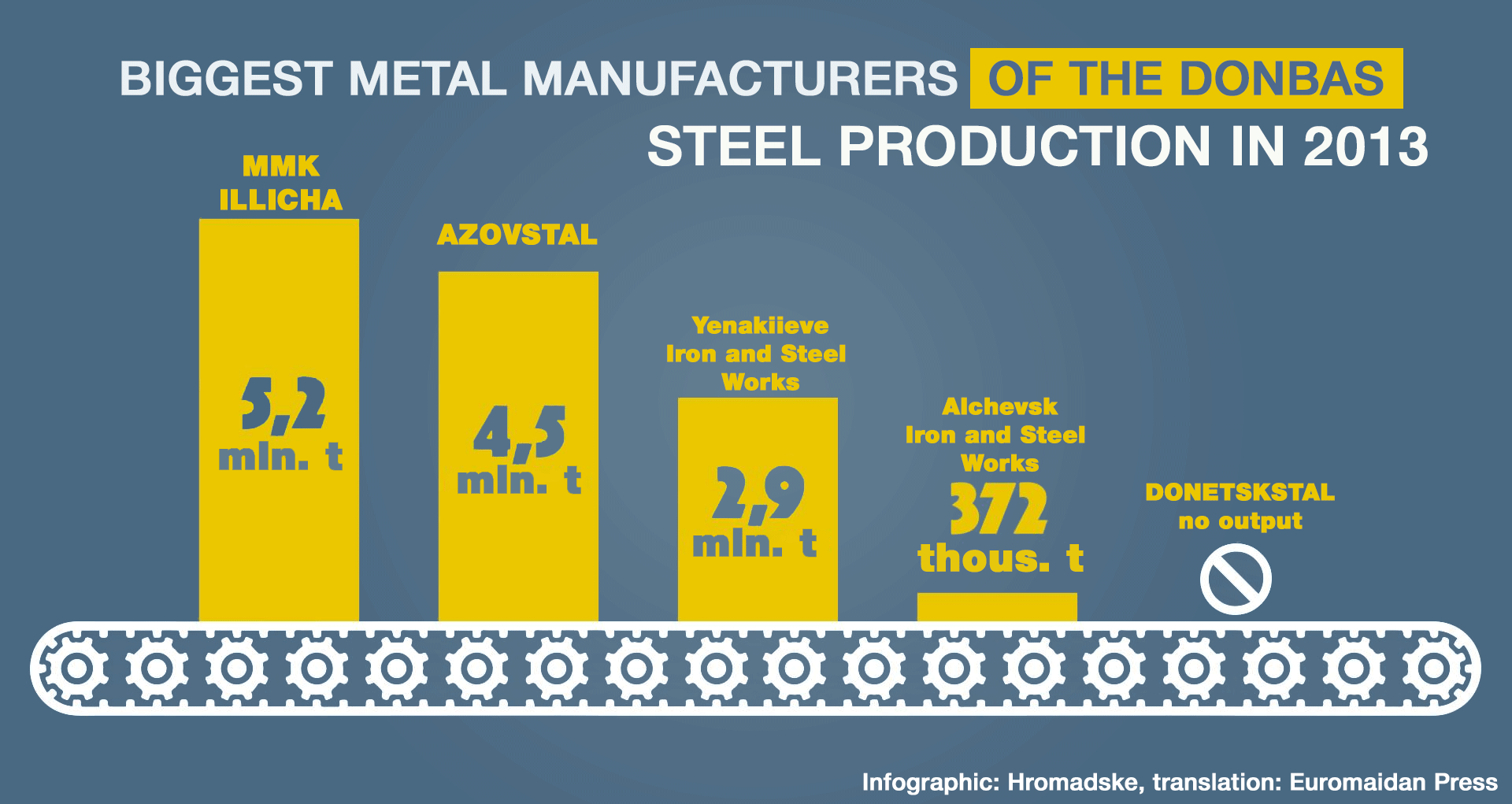

The Luhansk and Donetsk oblasts accounted for one-fourth of Ukrainian exports of metal products ($17 billion a year). More than 80 Donbas metal manufacturers exported their products to some 50 countries. It contributed to Ukraine's 10th position in the world's crude steel production rating.

In 2013, oligarch Akhmetov's Yenakiyeve Metallurgy Plant, part of Metinvest holding, earned an income of about 12 billion UAH ($1.42 billion), paying over 300 million UAH ($35.7 million) of taxes in Ukraine's budget.

But in 2014, steelmaking reached its record low in Ukraine.

Some of the ironworks - particularly the Yenakiyeve Metallurgy Plant, the Alchevsk Metallurgy Combine, and Donetskstal - found themselves in the occupied territories and suspended most of the production. But they continued paying taxes to Ukraine for three more years from the beginning of the war. For instance, the Metinvest holding's facilities located in the uncontrolled territory paid more than 1 billion UAH ($37.4 million) in taxes in 2017

The "republics" were not satisfied with such a situation. In February 2017, the "LNR parliament" decided that all Ukrainian businesses must be re-registered in the "LNR taxation system," otherwise the enterprises would be nationalized. Simultaneously with this decision, Ukrainian MP Semen Semenchenko initiated an economic blockade of the occupied Donbas in March 2017.

The "LDNR" events hit other iron and steel enterprises. The so-called "DNR transport ministry" took control of major part of the Donetsk railways, and the 2014 terror attacks destroyed dozens of bridges and crossing loops, which cut off cargo transportation routes. It resulted in an almost two-fold decrease of production at Dnipro and Mariupol metallurgy combines, and at Azovstal.

Reselling coal to Ukraine

In 2013, coal production reached about 84 million tons in Ukraine, the share of the Donbas was 75%. With war, two-thirds of the mines ended up in the occupied territory and partially shut down their activities. Ukraine's coal production dropped to half in 2015.

The occupied mines continued shipping coal to free Ukraine in the first years of occupation. Only in 2017, Akhmetov's DTEK noticed that it had shut down their mines because of damages to the transport infrastructure and military actions.

The war blocked the full-scale work of Mariupol ports, as well as the Donetsk railways. More than 50 shipping stations stopped the shipping of raw materials, which caused some 500 million UAH losses monthly since August 2014.

According to the UN data, the infrastructure of Luhansk and Donetsk oblasts suffered $440 million losses in 2014, and the gross loss of the regional industry was 26 billion UAH ($1.9 billion).

The biggest issue for the Ukrainian economy was losing the production facilities of anthracite (a type of coal) since half of the thermal power plants in Ukraine used it.

The Government decided to start importing coal and in 2016 imposed the "Rotterdam+" formula for calculating the price of the imported coal, which added a 12-month average coal price in the ports of Amsterdam, Rotterdam, Antwerpen together with the shipping costs.

In the same year, the cost of electricity produced in Ukrainian thermal power plants doubled.

In February 2017, the National Anti-Corruption Bureau (NABU) suspected that anthracite from the occupied territories was shipped as imported under Rotterdam+ and that revenues from the scheme were distributed between DTEK, Donbasenergo, and Tsentrenergo. Some experts counted that Ukrainians overpaid 35 billion UAH ($935 million).

[NABU has conducted another search in this case in February 2019 and still hasn't submitted the case to the court in about two years so far. Meanwhile, there are rulings of courts confirming that the energy watchdog which imposed the formula acted within its competence, EURACOAL assessed the coal-pricing methodology as positive, and the Kyiv Judicial Examinations Research Institute confirmed the economic feasibility of the formula and absence of any loss. Even if Ukraine buys coal produced in occupied territory, it pays a larger price because the coal isn't shipped directly anymore. Though this fact doesn't exclude possible misuse of the formula by buyers who can be in collusion with Rusian sellers and the question could be why they buy coal namely via Russia, yet it is not subject to a NABU investigation - Ed.]

Another problem is the so-called re-labeled coal from the uncontrolled territories. According to experts, the "republics" mostly develop enterprises which produce the coal which can be re-labeled as Russian [the Donetsk coal basin extends from the left bank of Dnipro River in Dnipropetrovsk Oblast throughout Luhansk and Donetsk up to Don River in Russia's Rostov Oblast, some mines in Ukraine's Donbas share the same coal-bearing layers with Rostov mines, - Ed.]. Such coal can be presented as mined in Rostov, sold to Poland via Belarus and then back to Ukraine.

For example, non-coal-producing Belarus exported $50.36 million worth coal to Ukraine in 2018, which is about 800 times higher as in 2017. Its exports of anthracite skyrocketed 307-fold to about $9 million. Though, Ukrainian energy minister Ihor Nasalyk assured that the shipments didn't originate from the Donbas.

Relocation to Russia: machine building in occupation

The Donbas produced trams, locomotives, industrial equipment which was mostly sold in Russia - up to 60% of Ukrainian exports in this branch. For example, locomotive producer Luhanskteplovoz earned more than 150 million UAH ($4 million) in 2013 but ended 2017 with 260 million UAH ($6.9 million) pure losses.

At the beginning of the war, Ukraine's Donetsk Oblast Military and Civil Administration reported that militants haul away the equipment from Donbas industrial enterprises by truckloads. In March 2016, the Ukrainian military intelligence informed that over 20 large plants were moved to Russia. Among them were the state company Topaz among them, which produced radio-electronic systems, Luhansk cartridge factory, Khartsyzk machine building plant.

Economical blockade: emergency mode

According to PM Volodymyr Groysman, the blockade in winter 2016-2017 caused some $3.5 billion losses for the mining and metals sector. About 75,000 jobs were cut. According to Dragon Capital, Rinat Akhmetov's Metinvest alone lost $5-$10 million monthly. Ukrainian Railways reported a $8.4 million UAH ($224,000) loss in the first month of the blockade.

Read more on the "Donbas blockade" of 2017:

- Donbas coal blockade: 5 things you need to know

- Will the makeshift blockade in Donbas hit the Russian-backed enclaves’ economy?

- Donbas “republics” seize Ukrainian assets blaming blockade

- Ukraine imposes official blockade on occupied territories demanding stolen assets back

Restoration of the region

In the pre-war year, Ukraine spent a record amount of 13 billion UAH ($347 million) to support miners and compensate for the difference between the coal-selling price and the actual cost of its production. The same subsidy was planned for 2014.

"For now, Ukraine doesn't sustain losses by subsidizing coal-miners, but the coal enterprises in the controlled territory are provided with 2-2.5 billion more UAH ($53-$66 million)," states Business.Censor's editor-in-chief Serhii Holovniov.

The share of coal subventions in all allocations from the state budget for Donetsk and Luhansk oblasts is 30%. In pre-war years these provinces also received investments for projects of state importance, as well as compensations for value-added tax.

Regional enterprises also needed significant investment in modernization, and some of them were heavily indebted. For instance, Donetsk Railways' debt was 4 billion UAH ($500 million) and President Petro Poroshenko remitted the debt only in January 2019.

Industrial giants were unprofitable too. In 2013, the Alchevsk Metallurgy Combine (AMK) generated a net loss of about 2 billion UAH ($200 million). And at the end of 2017, it reached over 48 billion UAH ($1.8 billion). The corporation ISD which owned AMK informed it lost control ovee the asset.

The Donetsk Oblast authorities stated that more than 5,000 enterprises located in the uncontrolled territory re-registered in the Ukraine-controlled territory. Then governor of the oblast Oleksandr Kykhtenko mentioned that in 2014, more than 50% of taxes collected in Donetsk Oblast (19 billion UAH or $1.4 billion) came from the enterprises situated in the territory of the so-called DNR. According to Ukrainian State Treasury, even in 2018, some 7 billion UAH ($187 million) in taxes originated from the uncontrolled territory.

Read also:

- European Court of Human Rights hints Russia responsible for Donbas damages

- What assets did Russia’s puppet republics seize from Ukraine? Full list

- Coal from occupied Donbas is being sold to Poland – media

- #DonbasReports: 62 attacks, 1 KIA, 1 WIA. Blockade campaigners detained in Kyiv

- Moscow blocking maritime shipping to Ukrainian ports on Sea of Azov

- No longer ATO, not yet a war. Ukraine adopts controversial “Donbas reintegration” bill

- Ukrainian soldiers battle wildfires, along Russian-backed separatists, in war-torn Donbas

- Damages caused by the War in East Ukraine (2014)

- Donbas losses approaching UAH 12 billion (2014)

- The rise and decline of Donbas: how the region became “the heart of Soviet Union” and why it fell to Russian hybrid war

- 12 facts about the Donbas that you should know

- Moscow increasingly acknowledges it controls Donbas regimes, Kirillova reports

- Minister of Ecology: Russian troops are ruining Donbas’ environment

- Donbas is not only a zone of war, but ecological catastrophe as well

- A warning sign in the Donbas: Moscow replacing local people with Russians

- Three years after sham referendums in Donbas, no Russian Spring

- Stages of Russian occupation in a nutshell

- Policy shift shows Russia preparing to recognize its puppet republics in Donbas

- Fears of radioactive disaster as Russian proxies plan to flood nuclear test site in Donbas

- Donbas on the brink of environmental catastrophe