UK Royal Marines “champing at the bit” to receive the order to seize Russian shadow fleet tankers — The Guardian

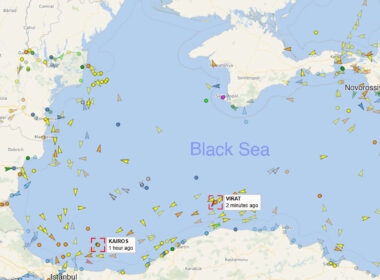

Defense sources confirmed military seizure options in discussions with NATO allies, while Lloyd's List Intelligence tracked 23 rogue vessels in British waters in January alone, the Guardian reported.