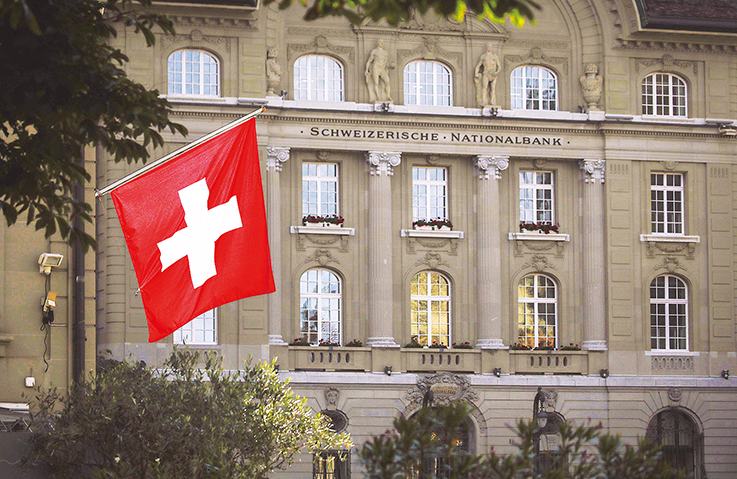

The Swiss government has frozen an estimated $8.81 (7.7 billion Swiss francs) billion worth of Russian financial assets, Reuters reported on 1 December, representing a further tightening of economic sanctions on Moscow for its invasion of Ukraine.

The asset freeze now includes an additional 300 Russian individuals and 100 companies sanctioned by Switzerland over the past year, according to the State Secretariat for Economic Affairs (SECO).

While substantial, the frozen Russian funds constitute just a fraction of total wealth. According to the Swiss Bankers Association, Swiss banks hold an estimated $164 billion overall in Russian assets.

Four reasons the West should finally seize Russia’s frozen assets for Ukraine

During a visit to Kyiv last month, Swiss President Alain Berset pledged increased support for Ukraine, discussing using profits from Russia's frozen assets to help finance the country's reconstruction.

But Switzerland has stopped short of allowing exports of Swiss-made weapons to Ukraine, citing its neutrality laws, despite calls from other countries to do so.

Earlier, European Union leaders endorsed proposals to use billions of euros from frozen Russian assets to help rebuild Ukraine. The EU Commission reportedly plans to unveil its legislative proposal to impose a windfall tax on profits generated by the Russian frozen assets in December.

Read also:

- EU backs using profits of frozen Russian assets to aid Ukraine’s rebuilding

- US Congress approves bill on transfer of Russia’s frozen assets to Ukraine

- Czechia freezes all Russian state assets

- Bloomberg: EU to unveil plan to tap frozen Russian assets in December, sources say