Both partnerships are leading to infrastructure investment projects and Ukraine has been eager to pursue development of the “Trans-Caspian international transport route” which will bypass Russia and complement China’s “New Silk Road” policy. Moreover, on the 1st of January 2016 the Deep and Comprehensive Free Trade Agreement with the EU came into effect and should have a very beneficial impact on Ukraine’s drive to improve trade with Europe.

Nevertheless, Ukraine’s business climate remains stifling and foreign direct investment is unlikely to be forthcoming until political stability is achieved and red tape is reduced.

Currently, Ukraine ranks a dismal 96th on the World Bank’s “Ease of Doing Business Survey” and much economic activity remains mired in customs tariffs, corruption and paperwork.

Ukrainian authorities would do well to follow the example of Georgia’s Mikheil Saakashvili who took an axe to red tape while in office. Simplifying tax administration, opening new markets and improving education are all essential for boosting private entrepreneurship.

The introduction of electronic payments should improve the situation and some degree of regulation has occurred. Anders Aslund notes that 15773 obsolete Soviet standards have been struck off and certain key tax reforms have been made yet the drive to implement EU standards still has a long way to go.

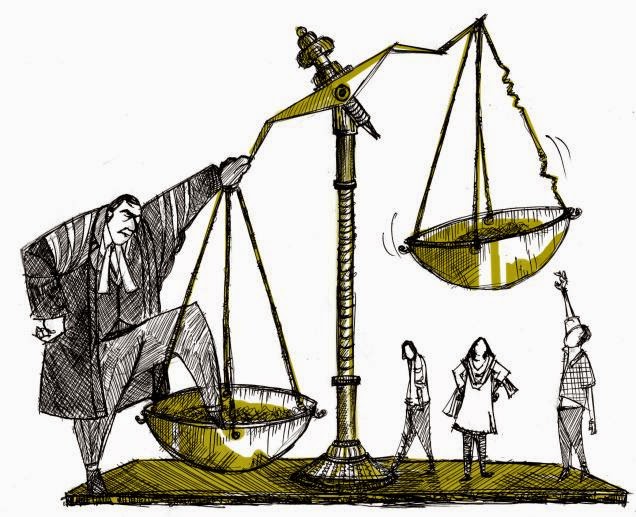

However, the last great hurdle to deregulation, privatization and a better business climate is Ukraine’s 1833 state-owned companies which are a warren of corruption and illegitimate activity.

Anders Aslund, along with several other experts, have stated that the vast majority of these companies, or about 1600, are of little or no value and exist simply to extract subsidies from the state.

The extraordinary number of these ‘vampire’ firms which exist purely as cash cows to be milked by shady oligarchs becomes immediately apparent when one considers that France has only 50 state-owned firms and Britain even fewer. Given this state of affairs, Ukraine should sell off these 1600 enterprises through a transparent auction process at the regional level and give the proceeds to regional governments to motivate faster sales.

The 100 or so largest companies of real value, mainly in energy and transport, should be open to foreign bidders and international investors through an open and competitive bidding process.

Lastly, about 120 armament companies belong to Ukroboronprom and are a key national security interest which must be cultivated and developed with the aid of Western partners. Since the rift with Russia, the Ukrainian arms industry has been hit hard by the cancellation of many planned joint projects with Russian counterparts.

For obvious reasons, the government should take action to ensure the stability and survival of the country’s indigenous arms industry and Russian companies should be banned from holding shares in the Ukrainian defense industry.

In terms of banking reform, there have been many encouraging changes since the Euromaidan.

In the past the banking system was replete with dozens of ‘pocket banks’ which were used predominantly to launder money or swindle government funds. However, since Poroshenko came to power the government has passed legislation requiring all banks to declare their ultimate owners and reducing the threshold for mandatory disclosure of ownership from 10 to 1%.

These measures will go a long way towards ensuring the legitimacy and credibility of the banking system, as well as preventing oligarchs from hiding their corrupt activities behind corporate anonymity. Anders Aslund has noted that 68 out of 180 banks have been closed and 40-50 more are likely to be shut down in coming months, with ‘little or no detriment to the Ukrainian economy’. Finally, the country’s 20 biggest banks have already undergone stress tests with 40 more scheduled for May.