An energy scandal has erupted between Ukraine and its western neighbors, Hungary and Slovakia, centering on Russian oil transit.

On 24 June, President Volodymyr Zelenskyy imposed additional sanctions on Russian oil giant Lukoil, effectively halting its oil flow through Ukraine.

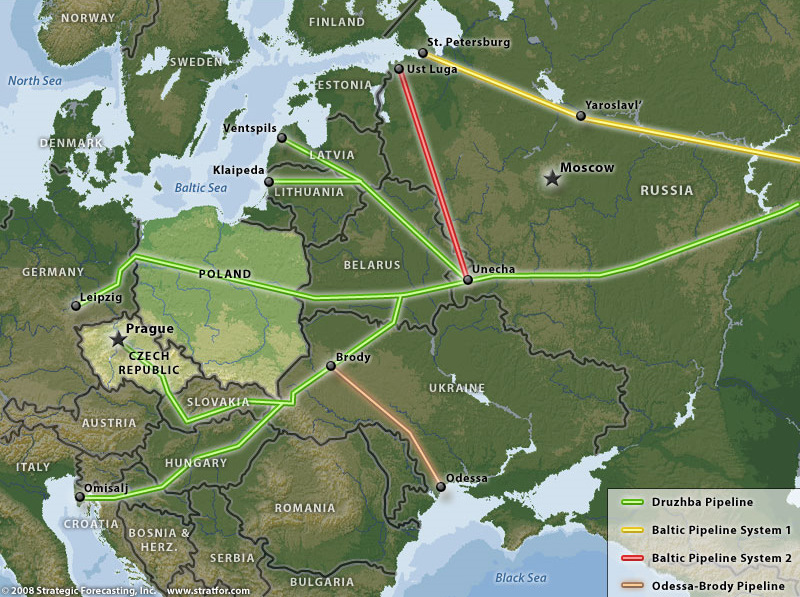

"Lukoil stopped pumping oil into the Druzhba pipeline, fearing potential asset seizure under the new sanctions regime," Ukrainian energy expert Mykhailo Honchar explains to Euromaidan Press.

Budapest and Bratislava have reacted with a barrage of threats against Kyiv, including:

- Appealing to Brussels for intervention

- Filing complaints with the World Trade Organization

- Initiating lawsuits

- Blocking weapons funding for Ukraine

- Threatening to cut off electricity and diesel supplies to Ukraine.

Hungary and Slovakia claim they have no alternative oil sources and accuse Ukraine of violating the EU Association Agreement.

Meanwhile, Ukraine's state energy company Naftogaz counters these claims, asserting that overall Russian oil transit to Hungary and Slovakia continues at previous volumes; only Lukoil's specific share has ceased.

Euromaidan Press investigates the underlying motives behind Hungary and Slovakia's vocal outcry and examines the potential consequences for Ukraine.

Manufactured outrage

Hungarian and Slovak officials have reacted strongly to Ukraine's decision to halt Lukoil oil transit. Gergely Gulyas, chief of staff for Hungarian Prime Minister Viktor Orban, accused

Ukraine of "blackmailing the two countries that are standing for peace and ceasefire." Slovak Prime Minister Robert Fico claimed Slovakia "has no intention of being held hostage to Ukrainian-Russian relations."

Energy expert Mykhailo Honchar counters these claims, highlighting two key points:

- MOL, a Hungarian company operating in Hungary, Slovakia, and Croatia, receives discounted Russian oil through an optimal route.

"Orban has a good margin from Putin. Why such hysteria? Because the margin is disappearing. Slovak sources indicate at least a 20% discount," Honchar explains.

He suggests this discount is Putin's payment for Hungary's role as a "Trojan horse" in the EU and NATO. In 2022, Hungary blocked EU oil sanctions against Russia. Budapest claimed Eastern European countries had no alternative to the Druzhba pipeline, leading the EU to make exceptions for Hungary, Slovakia, and the Czech Republic.

"They deceived the European Commission. Why the European Commission believed them, is another question, but essentially, that's what happened," the expert adds.

- Hungary has an alternative oil route: the Adria pipeline through Croatia. This pipeline, modernized in 2015, can supply oil from various sources, including Russian, via the Mediterranean market. However, this would be without the special discounted price.

The expanded Adria pipeline can supply:

- Hungarian Duna refinery (8 million tons/year)

- Slovak Slovnaft refinery (5 million tons/year)

- Small volumes to the Czech Republic.

With Adria's 14 million ton capacity exceeding the refineries' combined needs of 13 million tons, the claim that these facilities can't function without Russian oil via Druzhba is false.

“Hungary and Slovakia likely had a special arrangement with Lukoil, and now they're seeking to curry favor with the Kremlin for further benefits," Honchar concludes.

What are the consequences for Ukraine?

- Hungary and Slovakia appealed to the European Commission, claiming that Ukraine violates the EU Association Agreement regarding oil transit. However, the European Commission dismisses these concerns.

"There is no immediate harmful impact on EU oil supply security," European Commission spokesperson Olaf Hill said.

- Hungary and Slovakia threatened to cut off electricity supplies to Ukraine, which Kyiv imports due to generation deficits. This would be unpleasant for Ukraine but not critical, says Honchar.

Ukraine can import electricity from Poland, Romania, and Moldova, with whom it joined the EU energy system in 2022.

"They quickly reconsidered and pompously declared they wouldn't act like Ukraine and restrict electricity supply. But this is just a facade,” the expert notes.

- Hungary threatens arbitration court action against Ukraine. Honchar views this as an unlikely and time-consuming strategy.

"I think they're just threatening while studying how real their chances are of winning this court case," he says.

- Hungary is now focused on blocking €6.5 billion from the European Fund used to compensate EU member states for their expenses on weapons for Ukraine. EU foreign policy chief Josep Borrell, called this situation "a shame for Europe."

The web of interests

Ukraine's recent imposition of sanctions on Lukoil, rather than at the Russian invasion's onset, reflects a complex web of energy politics and strategic considerations.

Initially, Ukraine received diesel via Hungary through the Soviet-era Samara-Western Direction pipeline.

"In 2022, they started using it in reverse, with small volumes at first, and more significant amounts in 2023. This factor was likely considered," Honchar noted.

However, Hungary wasn't directly supplying diesel to Ukraine. The pipeline has an unloading station where any trader can bring diesel by rail, unload it, and pump it through the pipeline, as pipeline transport is the cheapest for oil and oil products.

"This was crucial when Ukraine couldn't receive fuel from the Black Sea due to port blockades. If Budapest suddenly blocks this pipeline now, we can easily maneuver," the expert added.

This situation remains a complex web of interests, which Viktor Orban seemingly wants to exploit by providing Ukraine with some electricity and diesel to blackmail it, says Honchar. Kyiv must withstand this pressure.

"We must show these Trojan horses of Russia that our position is unbreakable. If they prioritize money, they'll face more problems than us," the expert stated.

The question remains why Ukraine banned only Lukoil's transit, as profits from other Russian oil companies also fund the war.

"Perhaps this is a 'black mark' for Hungary, showing that Ukraine has ways to influence this country as well," Sergey Vakulenko, a senior fellow at the Carnegie Endowment for International Peace, suggested to DW.

This raises questions about the overall expediency of Russian oil transit through Ukraine. According to Bloomberg, Russia earns about $6 billion annually from oil supplies through Ukraine. However, Mykhailo Honchar believes it would be more beneficial for Kyiv to maintain this partnership.

"EU and NATO countries are our partners. Governments change. But if any block EU support for Ukraine, Kyiv's approach will also change," predicts the expert.

Read more:

- European Commission stalls on Hungary-Slovakia request over Ukraine's Lukoil sanctions

- Hungary again blocked EU fund for Ukraine’s military aid

- Slovakia and Hungary say Ukraine suspended transit of oil from Lukoil