Europe now faces a stark new security reality after US Vice President JD Vance’s speech at the Munich Security Conference. Vance made it clear that the US would no longer bear the primary responsibility for European security, sending shockwaves through NATO allies.

Compounding these concerns, the latest Military Balance report from the International Institute for Strategic Studies (IISS), an annual assessment of global military capabilities and defense spending, shows that Russia's defense spending has surpassed the European nations' combined defense budgets.

This new reality forces European nations to confront an uncomfortable truth: Russia's military investments continue to surge despite international sanctions, while Europe's collective defense capability lags behind. As US security guarantees grow increasingly uncertain, European leaders face urgent pressure to reimagine their defense strategies and capabilities.

Russian military expenditure reached $462 billion in PPP terms in 2024, marking an unprecedented 41.9% real-terms increase to RUB 13.1 trillion ($145.9bn).

The report indicates that such spending and associated fiscal pressures are likely to continue into 2025, with identifiable defense spending estimated to reach 7.5% of GDP.

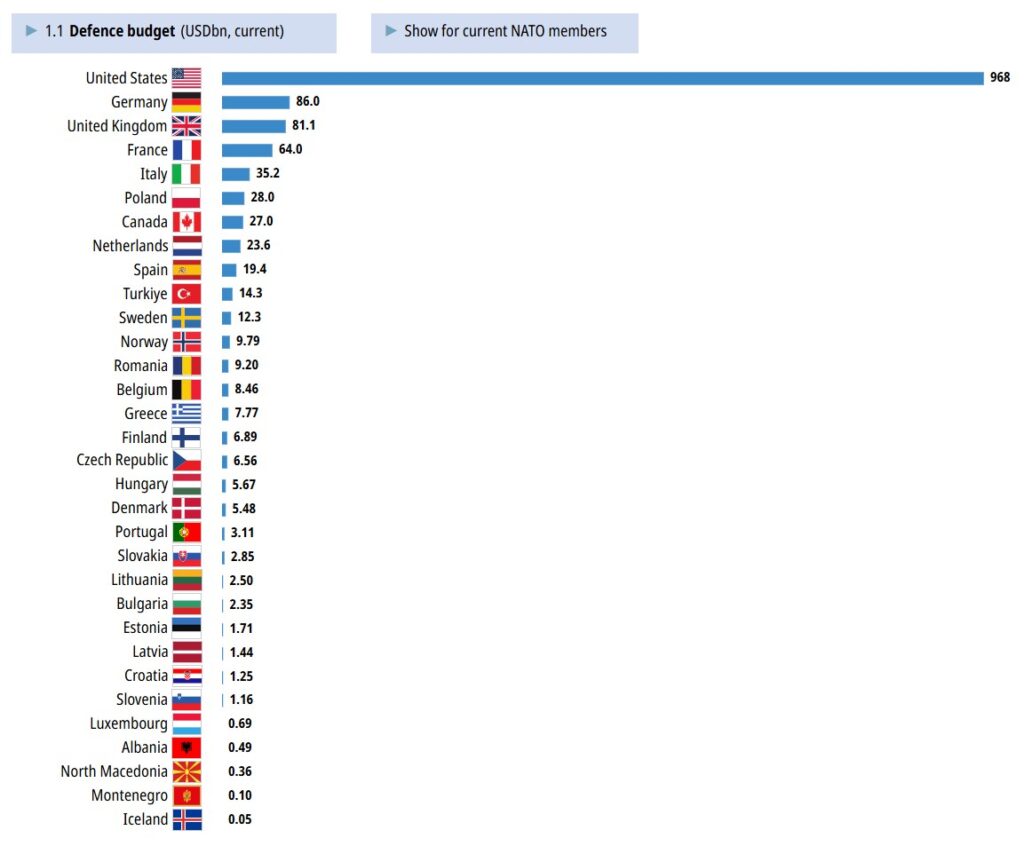

European defense spending, including the UK and EU member states, while growing significantly, reached $457 billion in 2024, marking the tenth consecutive year of growth with an 11.7% increase in real terms. This sustained growth began following Russia's 2014 invasion of Crimea, which elevated threat perceptions across the continent and rejuvenated long-standing commitments from NATO members to spend 2% of GDP on defense.

Germany led this expansion with a 23.2% boost in its defense budget, though political uncertainty following the collapse of its ruling "traffic light" coalition in November 2024 raises questions about future commitments. Poland emerged as a significant player, becoming the 15th largest defense spender globally in 2024, up from 20th place in 2022.

"Growth also accelerated," the report states, with the 7.4% real-terms uplift outpacing increases of 6.5% in 2023 and 3.5% in 2022. This surge reflects intensifying security challenges worldwide, with defense spending increasing to an average of 1.9% of global GDP, up from 1.6% in 2022 and 1.8% in 2023. The IISS notes that easing inflation allowed many countries to invest in new capabilities rather than just covering higher operating costs and wages.

NATO's new math

A heated debate over NATO's defense spending has erupted following Donald Trump's return to the presidency. Trump's call for European NATO members to raise spending to 5% of GDP - nearly triple the current 1.7% average - contrasts with NATO Secretary-General Mark Rutte's more modest proposal of 3%.

Meanwhile, despite international sanctions, "Russia can still bear the costs of war," the IISS reports. Moscow's defense spending is set to climb 13.7% in 2025 to reach RUB15.6 trillion - a staggering 7.5% of GDP and nearly 40% of federal spending. While this massive military investment strains Russia's economy, it appears sustainable in the near term.

European nations, however, face daunting fiscal realities. Though defense spending has grown by half since 2014, the IISS warns that "fiscal constraints may dampen [further] growth." Current budgets suggest a slowdown rather than acceleration, with 2025 projections showing more modest increases.

Trending Now

The path forward will likely be determined at the 2025 NATO summit in The Hague, as European leaders grapple with potentially weakened US security guarantees.

America's own defense spending remains constrained by the Fiscal Responsibility Act of 2023, with Trump's future defense priorities complicated by fiscal hawks within the Republican Party and possible reductions in overseas commitments.

While Europe grapples with its security calculations, the global defense landscape continues to evolve. Asian defense budgets continued moderate growth in 2024, consistent with their trajectory over the last decade. China's defense budget grew by 7.4% in real terms, outpacing the 3.9% average rate for the rest of the region despite significant uplifts in Japan and Indonesia.

In the Middle East and North Africa, spending surged nearly 10% in 2024, driven by a 72.9% real-terms increase in Israeli spending and growth in markets like Algeria. The regional average rose to 4.3% of GDP in 2024, up from 4.0% in 2023.

After seven years of cuts, Argentina showed signs of stabilization, receiving new P-3C Orion aircraft and signing a $300 million contract for 24 second-hand F-16s. In contrast, Sub-Saharan Africa experienced a 3.7% decline in defense spending, with Nigeria's defense budget falling by over 50%, while Burkina Faso, Mali, and Niger increased their budgets by 23.6%, 13.4%, and 32.3%, respectively.

GDP metrics mask true military capabilities

The IISS raises significant concerns about the focus on percentage-of-GDP metrics, warning that it "masks actual capabilities, contributions, sustainability and effectiveness of spending while also incentivizing states to adopt broader definitions of defense spending."

Many countries are increasingly using off-budget supplementary funding instruments to bolster their reported defense spending, creating volatility and reducing transparency. The report emphasizes that this growth in spending, coupled with strategic and political pressure to continue increases in defense spending, comes at a time of high fiscal pressures, including the need to mitigate climate change and respond to demographic shifts.

Read more: