Ukraine's dollar bonds surged on expectations that newly re-elected US President Donald Trump will end the war with Russia, Bloomberg reports.

Trump has consistently maintained he could broker peace between Moscow and Kyiv within 24 hours of taking office, arguing that his personal relationship with both Russian President Vladimir Putin and Ukraine's leadership would help secure a deal.

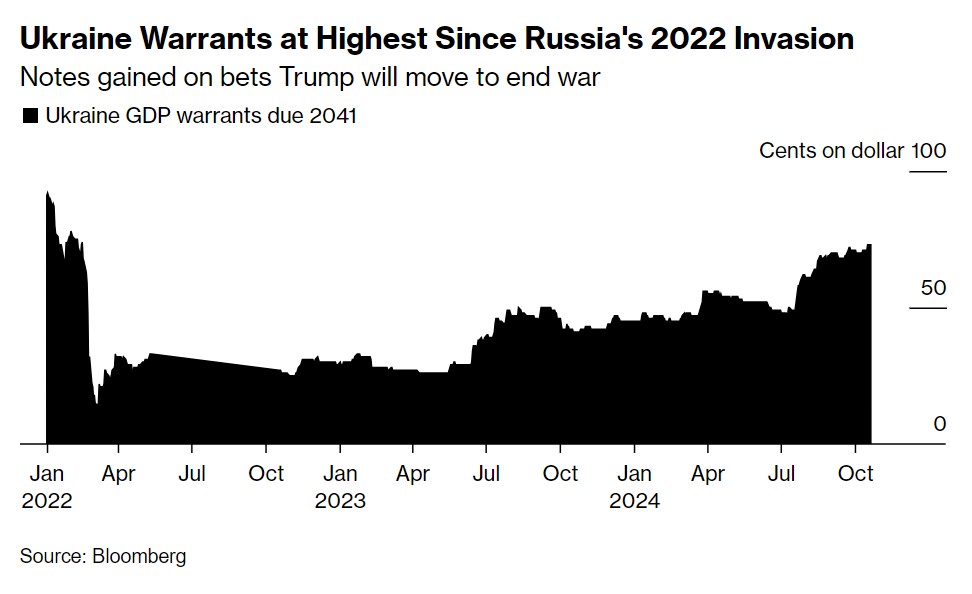

Ukraine's GDP warrants, debt securities linked to economic growth, traded at 74 cents on the dollar - levels not seen since Russia's 2022 invasion. Fund managers increased their holdings of Ukraine's dollar bonds in recent weeks as Trump's victory became more likely.

Ukraine's 1.75% notes due in 2035 jumped 1.8 cents to 47.3 cents on the dollar, leading emerging market gains.

"Bonds reflect the probability that the war could end sooner rather than focusing on what shape that deal would look like," said Thys Louw, portfolio manager at Ninety One UK Ltd.

The Ukrainian bond rally contrasted with broader emerging markets, where currencies and stocks declined on expectations of potential new trade tariffs. Eastern European currencies were particularly affected, with the Hungarian forint falling to its weakest level since late 2022.

Significant challenges remain for peace negotiations. Russian forces continue to advance, and the prospect of finding common ground remains distant. While Ukrainian President Volodymyr Zelenskyy maintains his commitment to fighting, Ukraine's military heavily depends on US aid.

Zelenskyy said today that Trump's "peace through strength approach" could help end the conflict, adding that Ukraine continues to rely on the United States' "strong bipartisan support."

Read more:

- Trump pledges to end Ukraine war, Kremlin holds back congratulations

- Ukrainians financed defense needs by $ 7 billion in 2024

- Ukrainian investments in military bonds surge by $ 385 million in July