As the two-year mark of Russia’s full-scale invasion of Ukraine approaches, European aluminum producers, backed by four EU countries, are advocating for an embargo on inexpensive Russian aluminum imports, Politico reports.

This move is part of a broader discussion on the 13th sanctions package, which is expected to be unveiled by 24 February, symbolizing the EU’s ongoing response to the conflict. Despite this push, the proposal faces considerable resistance from some member states, highlighting the complexities of balancing economic interests with political objectives, Politico notes.

Amid Russia’s ongoing invasion of Ukraine, Europe continues to procure 9 percent of its aluminum imports from Russia, contributing approximately €2.3 billion in 2022 to Moscow’s war machine, as highlighted by Politico. This underscores the substantial economic impact of these ongoing import activities.

The proposal, initiated by Lithuania and supported by Estonia, Latvia, and Poland, encounters skepticism from industrial heavyweights like Italy, who are concerned about the potential for rising costs. As per Politico, EU diplomats, speaking anonymously, expressed doubts about achieving consensus for a full ban within the tight timeline, given the substantial volumes of aluminum involved.

European aluminum producers are in a bind, grappling with high energy prices and stiff competition from cheaper imports. The EU’s association of aluminum producers has been vocal since the fall, urging Brussels to sever Russian aluminum imports entirely to alleviate some of these pressures.

However, opposition from European industrial consumers underscores the stakes involved. The EU grouping of industrial consumers, FACE, described potential sanctions on aluminum as “a kind of economic tactical nuclear bomb,” highlighting the potential fallout for Italian, German, and other EU manufacturing sectors.

The forthcoming sanctions package, according to Politico, is expected to focus on new listings of individuals and restrictions on exporting dual-use goods and battlefield products to Russia. These measures reflect the EU’s cautious approach, aiming to balance support for Ukraine with the economic realities facing its member states.

In discussions leading up to the announcement, the strategic timing and scope of the sanctions package have been topics of intense debate among EU diplomats. Some argue for a more ambitious stance, while others caution against actions that could strain the EU’s internal cohesion or economic stability.

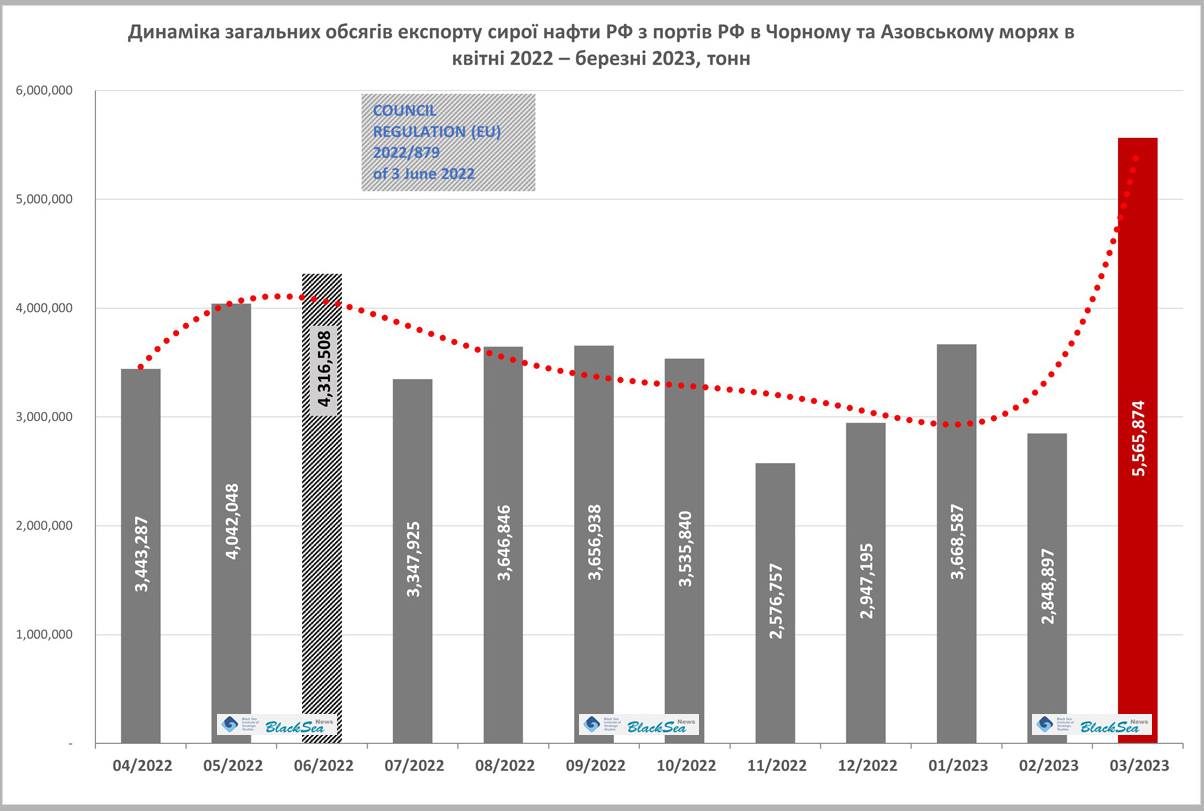

In December 2023, the European Union implemented its most recent 12th sanctions package, which involved prohibiting the import of Russian diamonds, tightening controls on Russia’s procurement of military-use goods, and imposing stricter regulations on the $60-per-barrel price limit for oil.

In January 2024, the Council of the European Union renewed economic sanctions against Russia for its aggression against Ukraine, which were first imposed in 2014.

The EU’s sanctions currently consist of a broad spectrum of sectoral measures, including restrictions on trade, finance, technology and dual-use goods, industry, transport, and luxury goods. The sanctions also include a ban on the import or transfer of seaborne crude oil and certain petroleum products from Russia to the EU, restriction of access to the SWIFT banking system for several Russian banks, suspension of the broadcasting activities and licenses of several “Kremlin-backed disinformation outlets.”

Read also:

- US imposes sanctions on key procurement network supporting Iran’s missile and UAV programs

- EU imposes sanctions on Russian internet censorship agency

- Russian drone manufacturer ‘Orlan-10’ ramps up production despite sanctions, Inform Napalm reports

- Russian billionaire family exploits EU sanctions loopholes to support Russian military – investigation