Ukraine’s banking sector underwent fundamental changes since 2014. Driven by the National Bank, this process culminated in the removal of more than half of the banks from the market. As a consequence, bank assets in relation to GDP declined significantly.

One legacy of the financial and economic crisis is a huge stock of non-performing loans in banks’ balance sheets, which is a drag on new lending, and which needs to be resolved. Significant progress has been made in restoring the capital base of the sector; the respective capital adequacy ratio has doubled. This has increased confidence in the financial system and also helped to relax the liquidity situation. Another unintended legacy of the crisis is the dominant position of state-owned banks: The nationalization of PrivatBank implies that the four biggest banks in the country are now owned by the state.

However, significant homework remains to be done to see a sustainable restart in lending. The key issue of creditors’ protection must be mentioned here, as the legal framework needs a substantial overhaul to reduce lending risks that became all too obvious during the crisis.

Market overview

The banking sector continues to shrink, but at a lesser pace than before. Currently, there are 86 active banks in Ukraine, after 180 in early 2014 and 93 in the beginning of this year. Exits from the market concern now mainly smaller banks; the clean-up among the bigger institutions in the country seems to be over after the nationalization of PrivatBank at the end of last year. The dramatic shake-up observed during the last years has also reduced banking penetration: Bank assets were equivalent to 82% of GDP in 2014; this number dropped to 54% in 2016. In this regard, Ukraine is now a laggard in the region, where penetration stands between 67% and 89% of GDP.

Bank asset quality

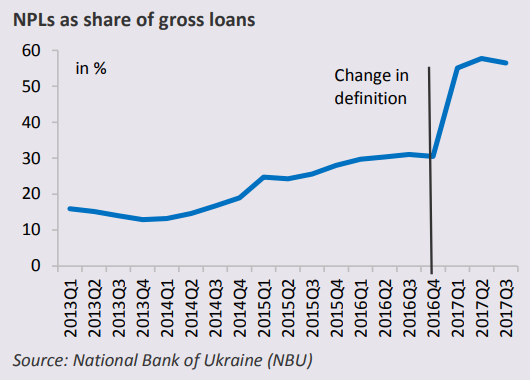

Apart from the removal of failed banks from the market, the deterioration of the asset quality of performing banks was another consequence of the financial and economic crisis. Due to a tightening of loan classification criteria by the National Bank (NBU), as well as other factors, the ratio of non-performing loans to gross loans peaked at almost 58%. This implies that system-wide, more than half of the loan book is non-performing, which is an exceptionally high number (in Poland, this ratio stands at 4.1%).

As a consequence, most banks were forced to recapitalize, to rebuild their capital base. This came through different instruments (injection of fresh equity, debt-equity swaps) but eventually led to a recovery in the regulatory capital adequacy ratio. This ratio almost doubled, from below the norm of 7% (2015) to 15% currently.

Economic losses

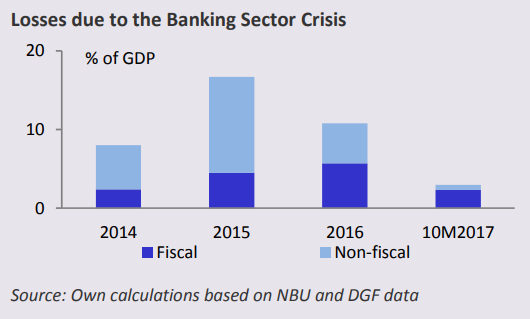

The necessary recapitalizations by private sources, but also the state (e.g. PrivatBank, which received already three injections of capital) is one aspect of the losses due to the crisis. Other aspects are the (fiscal) costs of paying out insured deposits of failed banks by the Deposit Guarantee Fonds, but also lost uninsured deposits by households and corporates, to name but a few. The following figure shows an estimate of the fiscal and non-fiscal losses until now.

Overall, economic losses equivalent to almost 40% of GDP have been recorded during 2014-2017. If one looks only at the fiscal part of these losses, this figure amounts to 14.5% of GDP. This is significantly higher than in the previous crisis of 2008 (4.5%), but rather moderate in international comparison, where losses in the well-known cases of Iceland, Ireland, Türkiye and Greece ranged between 27% and 44% of GDP.

Challenge: State-owned banks

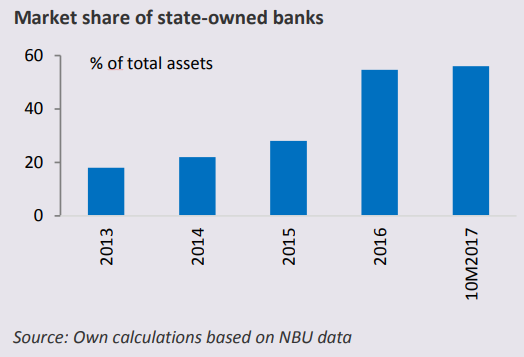

The nationalization of PrivatBank at the end of 2016 was a necessary step to remove a significant threat to financial stability, but it came with certain side effects. The market share of state-owned banks, which was already on the rise during the previous years, jumped suddenly to more than 50% in terms of assets (and to even higher levels in certain segments). This came mainly at the expense of private domestic banks, which saw a decline in market share. Western banks were able to increase their market share, while banks with Russian capital shrank.

The four biggest banks in the country are now owned by the state, which poses different challenges. One is about a level playing field with (domestic and foreign) private institutions. Here, it is of paramount importance to run these banks on strictly commercial terms, with independent supervisory boards and a strong governance framework. In the medium-term, the issue of privatization must be firmly put on the agenda, even though this depends also on external factors, e.g. the interest of private (foreign) banks and investors in these assets.

One factor complicating this process is the high level of non-performing loans (NPLs) already mentioned, especially in state banks. While PrivatBank is a special case with 86% of NPLs, the other banks have a ratio of 58%, far above the respective values of private domestic and Western banks. The resolution of this high stock of toxic assets is another key challenge that must be addressed before selling these banks to new owners.

Conclusion

The banking sector is in much better shape than in previous years. Thanks to reforms initiated by the National Bank of Ukraine, banks have started to rebuild their capital; the liquidity situation has also improved and confidence in the system (as evidenced by deposits) is gradually returning.

Nevertheless, one should have realistic expectations about the future, and the road to full recovery will be a long and winding one. Without significant progress in legal reforms, banks will be hesitant to significantly boost lending. While we see some recovery in lending, the volumes are low and the pace is slow. There is ample international evidence that the quality of judicial processes is correlated with the lending spread, i.e. the difference between lending and deposit rates. Progress on that front is therefore needed, which is an issue for the Parliament (to adopt the respective legal acts) and the court system (to implement them).

A more comprehensive analysis is provided by the Policy Briefing PB/10/2017 „Banking Sector Monitoring Ukraine.”

The group advises the Government of Ukraine on economic policy issues since 1994. It is funded by the German Federal Ministry for Economic Affairs and Energy and implemented by the consulting firm Berlin Economics. The members of our group analyze current economic policy problems and present concrete and independent recommendations to high-ranking decision makers within the Ukrainian government.

Read more:

- World Bank forecasts slight increase in Ukraine’s GDP growth rate in 2018

- Ukrainian banks, enterprises, media and energy companies under powerful cyber attack, including Chornobyl NPP

- Nationalization of Privatbank: a promising chapter in Ukrainian reforms

- Nationalization of PrivatBank, Ukraine’s largest bank, explained

- ‘Russian Banking System on Brink of Collapse’ and other neglected Russian stories

- SWIFT software producer stops working with two Russian banks

- Banks, business and trade: chaos and opportunity in Ukraine

- Russia considering introducing Islamic banking to get around Western sanctions