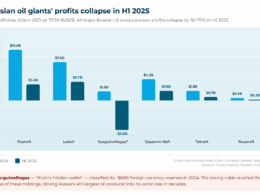

While Ukraine fights Russia’s invasion with constrained Western support, Hungary publicly plots to circumvent US sanctions against the oil giants funding Moscow’s war machine.

Hungarian Prime Minister Viktor Orbán announced Friday his government is “working on how to circumvent” Trump’s Wednesday sanctions on Rosneft and Lukoil—creating the spectacle of America’s closest EU ally openly defying its pressure campaign just hours after Trump called them “tremendous sanctions.”

The contradiction reveals what drives Europe’s energy relationship with Moscow: not necessity, but political will. Hungary imports 90% of its gas and 65% of its oil from Russia despite having viable alternatives.

Trump’s ally in the crosshairs

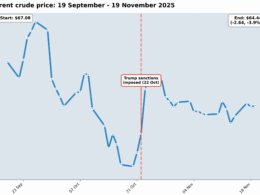

The US Treasury designated Rosneft and Lukoil on 22 October, targeting companies that export 3.1 million barrels daily—70% of Russia’s overseas crude sales. This threatens immediate disruption for Hungary and Slovakia. Hungarian oil and gas company MOL’s refineries in both countries process 14.2 million tonnes of Russian crude annually via the Druzhba pipeline.

Trump described the move as pressure on Putin. “I just felt it was time. We’ve waited a long time,” he said on Wednesday.

However, within 24 hours, Orbán announced his circumvention plan in a state radio interview, providing no details about the scheme.

The workaround playbook

Hungary has done this before. When Ukraine sanctioned Lukoil in 2024, MOL struck deals to “take over ownership of the affected crude oil volumes at the Belarus-Ukraine border,” as MOL said.

The legal maneuver allowed imports to continue by transferring ownership before oil entered Ukrainian territory.

Whether this works against US sanctions remains unclear. American measures typically focus on the ultimate source rather than border transfers, but enforcement depends on Trump’s political will to pressure his ally.

Alternatives Hungary refuses

Trending Now

Croatia’s Adria pipeline has been connected to Hungarian infrastructure since 2015 and has a capacity of 14.3 million tonnes annually—more than Hungary’s refineries need. MOL reported in October 2024 that it can process 30-40% non-Russian crude and plans to reach 100% capability by the end of 2026. The company operates a 9.57% stake in Azerbaijan’s ACG oil field and has tested over ten alternative crude grades.

A May 2025 study found Hungary and Slovakia “have exploited” their EU exemption from the Russian oil embargo, maintaining imports above pre-invasion levels “in violation of the intent of EU legislation.” The price difference—Russian oil trades at steep discounts—explains the preference.

The broader pattern

Orbán has repeatedly used veto threats to extract concessions from the EU, blocking sanctions packages worth billions. Trump had previously conditioned US sanctions on NATO allies stopping Russian oil purchases.

His October sanctions broke that pattern, but he immediately confronted the reality that his ally plans to evade them.

China’s state oil giants have suspended Russian crude purchases following the sanctions, and Indian refiners are cutting imports. But in Budapest, Trump’s closest European ally is already plotting workarounds to keep Russian oil flowing, turning “tremendous sanctions” into a test of whether friendship trumps policy.