Discounts on Russian oil sold to China reached a new high this week, Reuters reports. The trigger was US President Donald Trump’s statements about signing a trade deal with India, which reportedly involves ending purchases of Russian crude.

However, Indian Prime Minister Narendra Modi has not said anything about halting Russian oil imports, creating market uncertainty.

Prices and discounts: ESPO blend and Urals

According to Reuters, discounts on ESPO Blend oil have risen from $7–8 per barrel in previous months to nearly $9 per barrel. Discounts on the Urals grade, exported from Baltic ports to India, are also expected to increase, currently standing at $12 per barrel.

Emma Li, an analyst at Vortexa, notes that if India were to reduce Russian oil imports, discounts could rise further, encouraging private Chinese refineries to increase purchases.

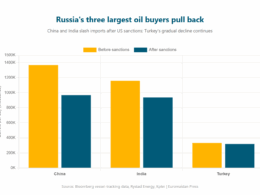

Chinese state-owned refineries have paused Russian oil purchases since October, following US sanctions on Lukoil and Rosneft, he added.

A deal with the US doesn't mean India will stop imports

JPMorgan analysts believe that even after a trade agreement, India is unlikely to completely stop importing Russian oil.

According to them, India will continue to import 800,000 to 1 million barrels per day.

Trending Now

Russia's budget in deficit

In January 2026, Russia’s federal budget revenues from oil and gas fell nearly in half compared to the same period in 2025, reaching their lowest level since July 2020.

Key reasons:

- Lower global oil prices

- Ruble appreciation, which reduced foreign currency revenue to the budget

Oil and gas revenues are critical to Russia, traditionally accounting for a major share of government finances.

In 2025, Russia’s federal budget recorded a deficit of 2.6% of GDP, largely due to increased defense spending after the full-scale war against Ukraine.