Wait, didn’t the EU ban Russian gas?

Yes and no. One headline says the EU banned Russian gas. The next says imports hit a record high. Both are true.

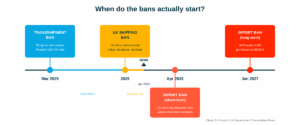

The answer is simpler than it looks: the EU announced a ban, but that ban doesn’t take effect until 2027. Until then, European companies can legally keep buying Russian gas.

That’s why imports rose in 2025 even as restrictions made headlines. The policies work differently than the headlines suggest.

So what’s actually legal right now?

The EU has adopted three measures against Russian LNG. Each targets a different part of the supply chain—and they don’t all work yet.

- Transshipment ban (March 2025): EU ports can no longer serve as transfer hubs for Russian gas heading to Asia. Previously, tankers would arrive at Belgium’s Zeebrugge, reload cargo onto other ships, and sail to China or India. That’s now prohibited.

- Import ban (April 2026 / January 2027): EU companies will be prohibited from purchasing Russian LNG. Short-term contracts end in April 2026. Long-term contracts become void in January 2027—including those held by France’s TotalEnergies (runs until 2041) and Germany’s SEFE (until 2038).

- Shipping services ban (UK only, 2026): Britain announced it would ban UK companies from providing ships, insurance, and maintenance for Russian LNG. The EU has proposed no equivalent measure.

Who’s still buying?

France leads all importers. In 2025, 87 tankers delivered 6.3 million tonnes of Russian gas to French ports—over 40% of the total amount Russia’s Yamal terminal shipped to Europe. Behind those numbers sits a name: TotalEnergies, the French energy giant that owns 20% of Yamal and purchases 4 million tonnes annually.

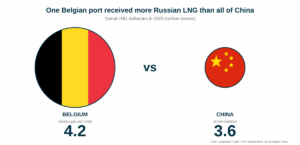

Belgium’s Zeebrugge terminal took in 58 ships carrying 4.2 million tonnes. China, supposedly Russia’s new energy partner, received less, just 51 ships delivering 3.6 million tonnes.

Three years into Moscow’s promised “pivot to Asia,” the EU remains Russia’s best customer. The bloc received 76.1% of all Yamal exports in 2025, up from 75.4% the year before.

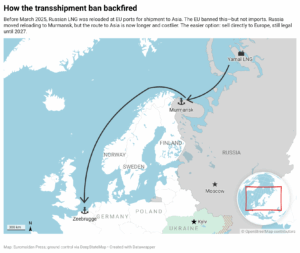

Didn’t the transshipment ban help?

It backfired.

Before March 2025, some Russian LNG arrived in Europe, got reloaded onto different ships, and continued to Asia. After the ban, Russia moved the reloading operation to its own waters near Murmansk.

But cargoes heading to Asia now face longer voyages and higher costs. The easier option? Sell directly to Europe, where purchases remain legal until 2027.

The transshipment ban narrowed Russia’s access to Asian markets but pushed more gas toward European buyers in the interim. That’s one reason imports increased even after the measure took effect.

What could actually stop this?

The tankers.

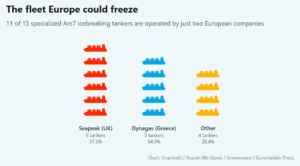

Russia’s Arctic LNG operations depend on 15 specialized Arc7 icebreaking vessels—the only ships capable of navigating frozen Arctic waters year-round. Eleven of them are controlled by just two European companies: UK-based Seapeak (six ships) and Greek-owned Dynagas (five ships). Together, they handle over 70% of Yamal’s exports.

Russia cannot replace them. US sanctions block construction at Russian shipyards. The first Arc7 tanker Russia tried to build domestically hasn’t progressed beyond short test runs.

Here’s the leverage: LNG accounts for only 9% of Russia’s fossil fuel export revenues—crude oil generates far more. But it’s the one stream Europe actually controls. The EU buys nearly half of Russia’s LNG exports. Unlike crude, which Russia redirected to India and China after 2022, Arctic LNG can’t easily pivot. The specialized tanker fleet is too small, the routes too long.

The UK moved to cut off its shipping companies. The EU, which controls more of the critical fleet, has not.

How much money are we talking about?

In 2025 alone, the EU paid €7.2 billion ($8.4 billion) to Russia’s Yamal LNG terminal—more than the year before.

Greenpeace calculated that $9.5 billion in Yamal taxes between 2022 and 2024 could fund 271,000 Shahed drones. The 2025 revenue alone could cover roughly 240,000 more.

Since February 2022, the EU has paid Russia €213 billion for energy. It has sent Ukraine €167 billion in aid.

The December 2025 legislation guarantees Europe will eventually stop buying Russian gas. But between now and January 2027, every tanker that docks at Zeebrugge or Montoir adds to the ledger.