Belgium blocked the EU’s plan to use €183 billion ($196 billion) in frozen Russian assets to fund Ukraine at the October 23-24 Brussels summit, refusing to move forward until other member states provide legally binding guarantees they’ll share litigation risks if Russia retaliates or sues for asset return.

The summit concluded with leaders asking the European Commission to prepare “options for financial support” for Ukraine through 2027—language considerably weaker than the €140 billion ($150 billion) “reparations loan” that Germany and Poland had pushed heading into the meeting.

Belgium, which holds most frozen Russian funds through Brussels-based Euroclear, would not accept sole responsibility for potential Russian retaliation or international legal challenges.

Why this matters

Ukraine spends $172 million daily on defense. Within weeks of the February 2022 invasion, Europe froze €183 billion ($196 billion) in Russian central bank assets, yet has managed to transfer only interest earnings—not the principal—to Ukraine. The existing G7 loan program, using only windfall profits, provides a $50 billion total—far short of Ukraine’s estimated $100-150 billion annual requirement, according to British economist Timothy Ash.

Germany’s Friedrich Merz warned that without the frozen assets mechanism, Berlin fears being left to shoulder Europe’s Ukraine costs alone.

Polish Prime Minister Donald Tusk insisted December must be the “final deadline” for a yes-or-no decision.

If the December summit fails to break the deadlock, Ukraine will remain dependent on annual aid packages subject to parliamentary approval and the six-month sanctions renewal cycle. Hungary or other member states can threaten to veto either.

Without mobilizing the Russian assets principal, European defense support would continue through national budgets at current levels: Germany allocated €7.1 billion ($7.6 billion) for Ukraine in 2024, France €3 billion ($3.2 billion), and most other EU states contributed under €1 billion ($1.1 billion) annually.

Three core demands

According to Belgian Prime Minister Bart De Wever’s statements at the summit, when European Council President António Costa said the bloc must “work out the technical, legal, and financial details,” he was referring to Belgium’s three core demands.

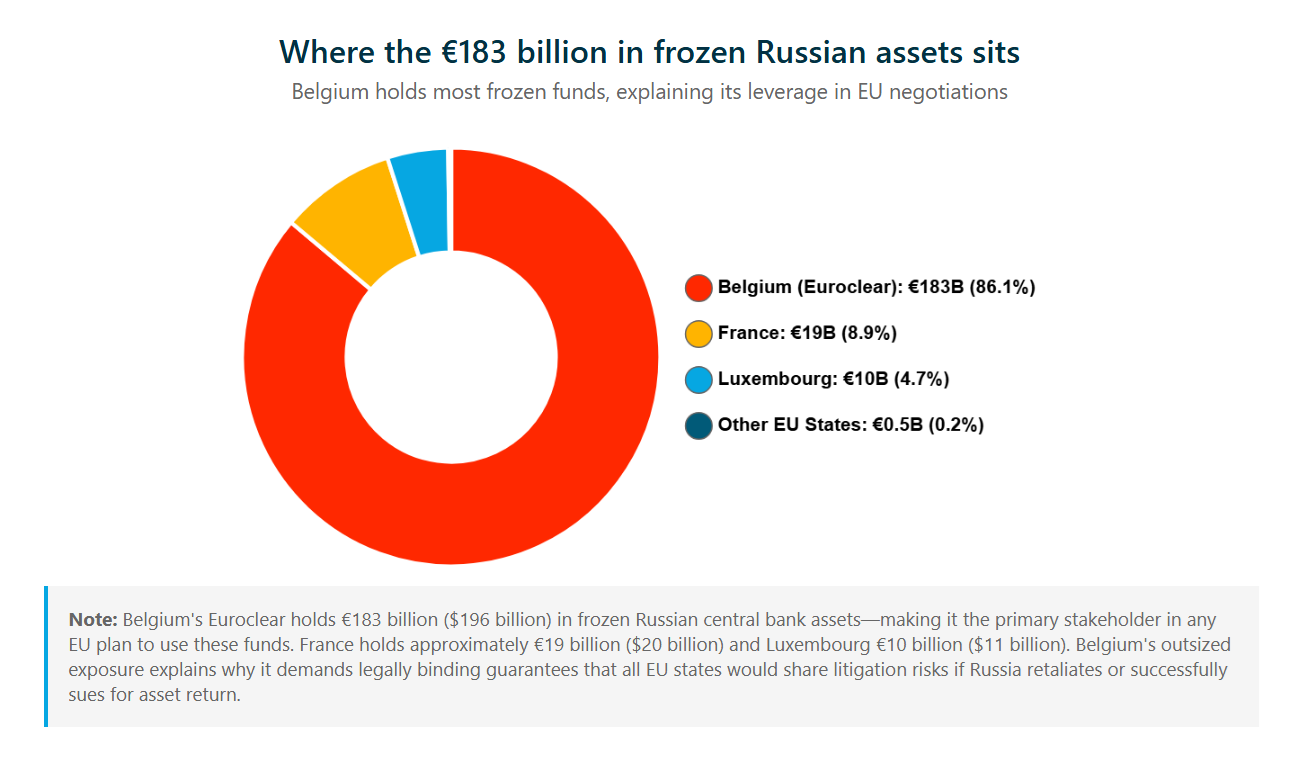

Technical aspects: Belgium wants transparency about which other countries hold frozen Russian assets and how much. While Euroclear holds €183 billion ($196 billion), France has roughly €19 billion ($20 billion) and Luxembourg €10 billion ($11 billion), according to European Parliament research. De Wever demanded these countries contribute their share:

“The fattest chicken is in Belgium but there are other chickens around.”

Legal aspects: The Commission must establish what De Wever called a “solid legal basis” for converting frozen assets into loan collateral without technically confiscating them. The proposed mechanism would transfer Russian cash to a Special Purpose Vehicle in exchange for zero-coupon bonds—essentially swapping liquid money for IOUs that generate no interest. This allows Brussels to claim Russia still “owns” bonds of equal face value, making it legally distinct from outright confiscation.

Belgium disputes this distinction. As De Wever argued earlier this month:

“If I take your money and I use it, I think you will say that’s a confiscation.”

Belgium fears facing arbitration claims in international courts—potentially before judges in Singapore, Hong Kong, or other jurisdictions where Russia maintains legal standing—and being ordered to return billions while other EU states avoid liability.

Financial aspects: Belgium demands legally binding guarantees—not just political assurances—that all EU member states would share the cost if Russia successfully sues for asset return or if the money must be repaid after a potential peace deal. German Chancellor Merz indicated Germany expects to contribute proportionally by economic size, but Hungary has already said it will not offer guarantees.

Belgium also faces losing €1.3 billion ($1.4 billion) annually in corporate tax revenue from Euroclear’s earnings on the frozen funds—money it currently spends on Ukraine aid.

An unchanged position

Trending Now

The summit text represents a successful Belgian effort to water down earlier language that would have called for a concrete legal proposal.

Belgium agreed not to block the EU from continuing work on the idea, but this falls far short of actual commitment.

Since early October, De Wever has maintained that Belgium fears facing arbitration claims in international courts and being exposed to Russian retaliation while other member states avoid consequences. Commission President Ursula von der Leyen assured reporters that “the risks have to be put on broader shoulders,” but acknowledged the bloc still needs to work out how to make that happen in practice.

Contrasting success

The summit’s paralysis on frozen assets stood in sharp contrast to leaders’ ability to approve the EU’s 19th sanctions package against Russia, including a ban on Russian liquified natural gas imports starting in 2027 and additional restrictions on the “shadow fleet” Moscow uses to evade oil sanctions.

For the first time, the EU sanctioned two Chinese refineries that were processing and selling Russian oil.

These measures followed the United States hitting two Russian fossil fuel giants with sanctions—a move French President Emmanuel Macron called “a true turning point,” noting that “until now, the US had refused.”

Ukrainian President Volodymyr Zelenskyy, who attended the summit, told reporters Ukraine needs the money in 2026, “and better to have it at the beginning of the year, but I don’t know if it’s possible.”

The December reckoning

The December summit will determine whether the Commission’s legal and financial proposals can satisfy Belgium’s demands for concrete, legally binding risk-sharing commitments. If they cannot, the €183 billion ($196 billion) principal will remain frozen—a gap between Europe’s stated support and its willingness to act that has persisted for more than three years since the assets were first immobilized in April 2022.

If Brussels pursues the plan, Russia has threatened a “very painful, very harsh” response.

Russia’s specific retaliation options include seizing Western corporate assets still operating in Russia (estimated at over €200 billion), targeting European financial institutions in international courts, or weaponizing energy supplies to countries still dependent on Russian gas.

Correction: An earlier version of this article claimed Belgium demands compensation for revenue loss as part of the frozen Russian assets deal. This interpretation is not backed by facts, and we have removed it.