In Kyiv, air raid sirens wail as people rush to metro stations for shelter. Above, Russian missiles—paid for by European energy purchases—streak across the sky toward power stations and apartment buildings.

Despite this deadly reality, the European Commission’s long-anticipated roadmap towards ending Russian energy imports, released on May 6, revealed a disturbing timeline: the EU will continue sending billions to Russia until the end of 2027.

This money directly finances missiles striking Ukrainian cities and infrastructure.

While the roadmap outlines a path to phase out remaining dependencies, its gradual approach raises serious questions about Europe’s commitment to energy security and Ukraine’s protection when faster alternatives clearly exist.

Russia still receives €23 billion from European gas taps

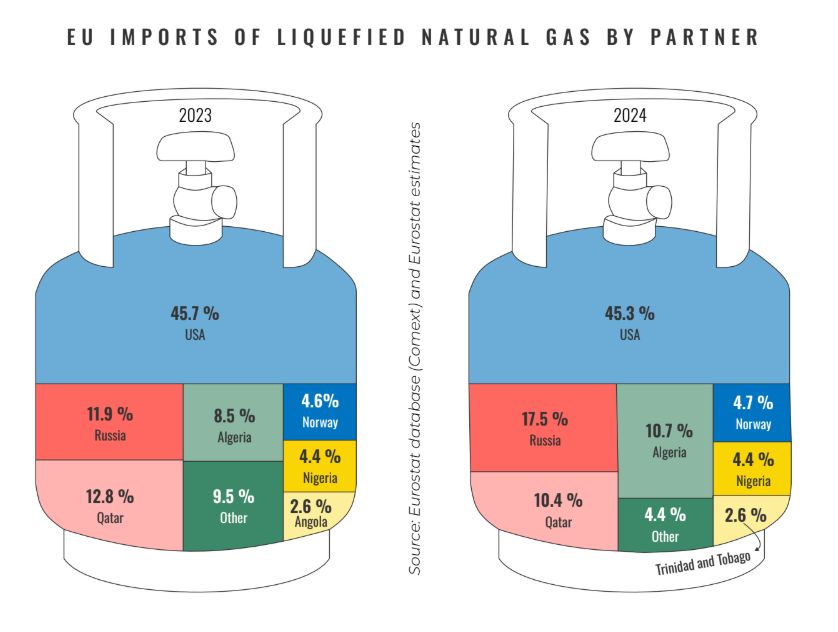

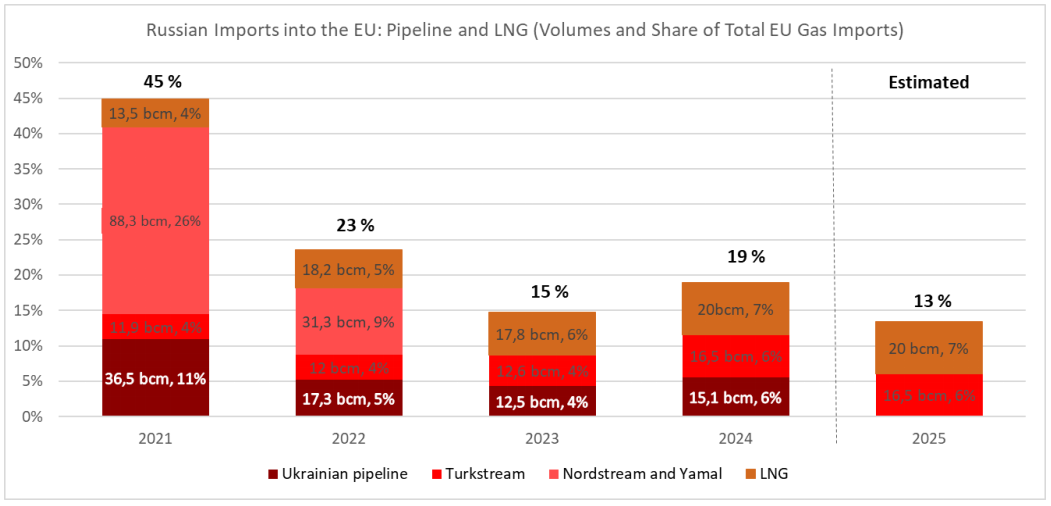

In 2024, the EU still imports 52 billion cubic meters of natural gas from Russia—32 bcm via pipeline and 20 bcm as LNG—representing 19% of total gas imports.

Though this marks a reduction from the 45% share in 2021, these continuing imports generated €23 billion for Russia last year alone.

Behind these cold numbers lies a stark truth: this massive financial flow directly fuels Russia’s military machine, purchasing the very missiles that Ukrainian families dodge on their way to school and work.

The EU’s gradual approach means these deadly transactions will continue for years unless policy changes.

A three-step plan that’s two years too slow

Looking at the details, the Commission proposes three steps that look reasonable on paper but ignore Ukraine’s burning reality:

- Ban new long-term Russian contracts and existing spot market contracts by end-2025

- Prohibit remaining Russian imports under existing long-term contracts by end-2027

- Mandate national plans for Member States and increase transparency on gas supply contracts

The Commission justifies this timeline citing market readiness and legal predictability.

Yet the contradictions become apparent when examining the facts: Europe already has the infrastructure to accelerate this transition significantly.

Between 2022 and 2024, the EU commissioned 12 new LNG terminals and expanded 6 others, increasing total regasification capacity to 250 bcm/year—two times the current LNG import levels.

Further weakening the Commission’s cautious approach, global LNG supply is projected to grow by 200 bcm between 2025 and 2028, with experts anticipating downward price pressure from 2026 onward. By 2030, global LNG export capacity will expand by 50% compared to the existing supply.

When viewed against these market realities, the continued tolerance of Russian gas purchases becomes increasingly difficult to justify.

Voluntary purchases continue while Ukrainian infrastructure burns

At night, Ukrainian repair crews work in darkness, racing to restore electricity after the latest Russian strike on power stations. The missiles that caused this destruction were purchased with European energy money—from transactions that are completely voluntary.

The decision to potentially delay prohibiting spot market transactions with Russian LNG until end-2025 sends problematic signals to both European energy companies and the Kremlin.

These short-term, discretionary purchases—representing approximately one-third of current Russian gas volumes—could be eliminated immediately without commercial, legal, or technical obstacles.

Unlike long-term contracts, spot market transactions are immediate, short-term purchases that can be conducted anonymously through international hubs, allowing Russian LNG to be “whitewashed” and enter European markets undetected, creating a dangerous loophole in sanctions efforts.

Without swift action to cut off the spot market sales of Russian LNG, its volumes and revenues can remain at 2024 levels by the end of the year.

The human cost of this policy gap is clear: as European energy traders continue these optional purchases, Ukrainian engineers work through freezing nights to repair destroyed infrastructure, knowing the next strike is already being funded.

Looking for solutions, a recent policy report by Razom We Stand, Getting Rid of Russian Gas Dependency in EU Member States: A Case-by-Case Approach, demonstrates that even the most dependent Member States—Austria, Hungary, and Slovakia—could dramatically reduce dependency through reverse flow capacity expansion, access to new LNG terminals via interconnectors, and accelerated electrification in residential and industrial sectors.

Some EU states show what real energy independence looks like

While Brussels deliberates, several EU members have already demonstrated leadership in this transition.

Setting a powerful precedent, the Baltic States, Poland, and Finland have completely eliminated Russian gas imports.

Adding to these examples, Czechia stopped importing Russian oil in April 2025 following the completion of the TAL-PLUS pipeline expansion.

These success stories highlight a crucial insight: rapid disengagement is technically feasible when political will exists.

The striking contrast between these proactive states and others still dependent on Russian supplies exposes the fundamentally political—not technical—nature of continued Russian energy imports.

Beyond direct purchases, the Commission rightly identifies the need to prevent indirect imports through swap arrangements and LNG re-exports—a significant vulnerability in the current market structure.

This loophole creates another serious risk: without robust traceability mechanisms, Russian LNG volumes can be anonymized through international hubs, potentially undermining the roadmap’s effectiveness.

Given these vulnerabilities, the planned legislative proposal on transparency must therefore be implemented urgently.

Every cubic meter of Russian gas funds attacks on Ukrainian civilians

In a bombed-out apartment building in Zaporizhzhia, rescuers pull an elderly woman from the rubble as her neighbors weep. The missile that destroyed their homes was purchased with profits from Russian gas sales to Europe.

The connection is direct and undeniable: Russian energy revenues continue financing military aggression, including targeted attacks on Ukrainian civilian infrastructure.

While the roadmap acknowledges energy weaponization as a persistent threat, the proposed timeline fails to respond with appropriate urgency to this geopolitical reality. Every cubic meter of gas flowing from Russia to Europe translates directly into weapons used against Ukrainian civilians. The technical alternatives exist—only political courage is lacking.

Ukrainian stakeholders recommend the EU take stronger immediate actions:

- Implement an immediate ban on spot market purchases of Russian gas in summer 2025

- Ensure full transparency of all gas supply contracts, including origin and volume reporting

- Strengthen enforcement against sanctions circumvention through re-exports

- Provide financial and technical support for Member States transitioning away from Russian supply chains

Looking toward the future, the new roadmap represents an important evolution in EU energy policy and lays the groundwork for a secure, sovereign energy future.

However, its ultimate impact will depend not on the ambition of its targets, but on the decisiveness of implementation.

For Ukraine’s security and Europe’s energy independence, accelerating this timeline is not just possible—it’s necessary.

Editor’s note. The opinions expressed in our Opinion section belong to their authors. Euromaidan Press’ editorial team may or may not share them.

Submit an opinion to Euromaidan Press