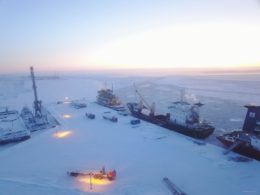

President Volodymyr Zelenskyy signed the decree on 1 May 2025, implementing a decision by Ukraine's National Security and Defence Council that extends sanctions to major LNG operations, including Yamal LNG, Arctic LNG 2, and Murmansk LNG.

The Ukrainian government has communicated these sanctions to the European Union, United States, and other allies, urging them to adopt similar measures as part of a coordinated strategy to cut off Russia's energy revenue streams that continue to fund the war in Ukraine.

LNG operations fund Kremlin's war machine

Novatek's LNG operations have become a strategically important revenue stream for the Kremlin following the end of pipeline gas transit through Ukraine. The Finnish think tank CREA reported that European ports received 17.5 million tons of Russian LNG in 2024, valued at €7.3 billion, substantially exceeding Gazprom's revenue from pipeline transit through Ukraine, which amounted to just €5.8 billion during the same period.

Novatek's unrestricted LNG exports to European and global markets remain "a dangerous loophole in the sanctions regime and a growing revenue stream for the Kremlin," despite the EU significantly reducing pipeline gas imports from Russia, according to the energy security advocacy group Razom We Stand.

The sanctioned entities include not only production facilities but also Novatek's international trading operations in Singapore and Switzerland, which have enabled the company to circumvent previous restrictions. These trading arms – including Yamal Trade Pte. Ltd, Novatek Gas & Power Asia Pte. Ltd., and Novatek Gas and Power GmbH – have been central to maintaining Russian gas export capabilities despite existing sanctions.

Military-industrial connections exposed

Security analysts have identified alarming connections between Novatek and Russia's military-industrial complex. Independent investigations have documented Novatek's supply of natural gas to ammunition factories operated by Russia's Ministry of Defence.

These findings align with Ukraine's intelligence reports that the company has participated in recruitment efforts for the Russian military and provided financial support through the Muzhestvo Foundation for forces deployed in Ukraine.

Employees of Novatek's security structures, including affiliated private security companies, have been recruited and deployed in combat operations in Ukraine, with payments facilitated through the Courage Foundation.

Private sector gas dominance grows

While Gazprom's pipeline exports to Europe collapsed following Russia's full-scale invasion of Ukraine in February 2022, Novatek's presence in the EU energy market has expanded significantly. Data shows that the difference between the volumes provided by these two companies has fallen dramatically, with Novatek closing in on Gazprom's traditionally dominant position in European markets.

The 14th EU sanctions package, implemented in late March 2025, banned the transhipment of Russian LNG in EU ports, but experts have noted various implementation challenges and remaining gaps in enforcement.

The broader REPowerEU initiative aims to completely phase out Russian fossil fuel imports by 2027, though progress has been uneven across different energy sectors.

CEO Mikhelson avoids Western sanctions

Among the individuals affected by Ukraine's latest sanctions is Novatek CEO Leonid Mikhelson, who has notably avoided full Western sanctions despite his company's documented role in supporting Russia's war economy.

Financial analysis reveals Mikhelson has secured preferential treatment from the Russian government, including exclusive development rights and tax concessions.

Ukrainian sanctions against Mikhelson personally have been in place since October 2022.

Svitlana Romanko, Founder and Executive Director of advocacy group Razom We Stand, called the decision "a landmark decision" that "targets the heart of Russia's LNG export expansion strategy." She emphasized that "every dollar Novatek makes fuels the missiles that rain down on Ukrainian cities" and called the situation "a test of moral clarity, economic rationale and geopolitical resolve."

Sanctions target loophole between state and private gas producers

Ukraine's blacklisting of Novatek represents a strategic move to close a critical sanctions loophole that has allowed Russia to maintain substantial gas revenues despite Western restrictions. Unlike state-owned Gazprom, which has faced significant sanctions affecting its pipeline exports, Novatek – as Russia's largest private gas producer – has largely evaded comprehensive Western sanctions on its core LNG business.

Call for coordinated international response

Razom We Stand is calling on policymakers, civil society, and financial institutions in the EU, US, and allied countries to "respond swiftly to Ukraine's action and close the remaining channels through which Russian fossil fuels reach global markets."

The Ukrainian government has emphasized through these sanctions that cutting off Russia's energy revenue streams remains one of the most effective non-military means of diminishing Russia's ability to sustain its war effort.

Razom We Stand urged "all international leaders to finally and urgently tighten sanctions against Russia, following the example of these new Ukrainian sanctions, to dry up Russia's war financing and end its brutality against Ukraine."

Razom We Stand calls on policymakers, civil society, and financial institutions in the EU, the US, and allied countries to respond swiftly to Ukraine's action and close the remaining channels through which Russian fossil fuels reach global markets.