When asked about the movement of plywood from Russia, his response was casual and telling: "It doesn’t even have to stay here. If we arrange everything in advance, we can reload it right away."

For Artur, this was nothing out of the ordinary. Clients visited him regularly, seeking ways to keep the flow of Russian timber into European markets alive—despite the sanctions.

This exchange is just one piece of a far-reaching investigation by environmental watchdog Earthsight, which spent nine months uncovering how "blood timber" continues to reach the EU. Their findings reveal a staggering reality: since sanctions took effect in July 2022, timber worth over €1.5 billion has still been laundered into the EU, with an estimated twenty container loads arriving daily.

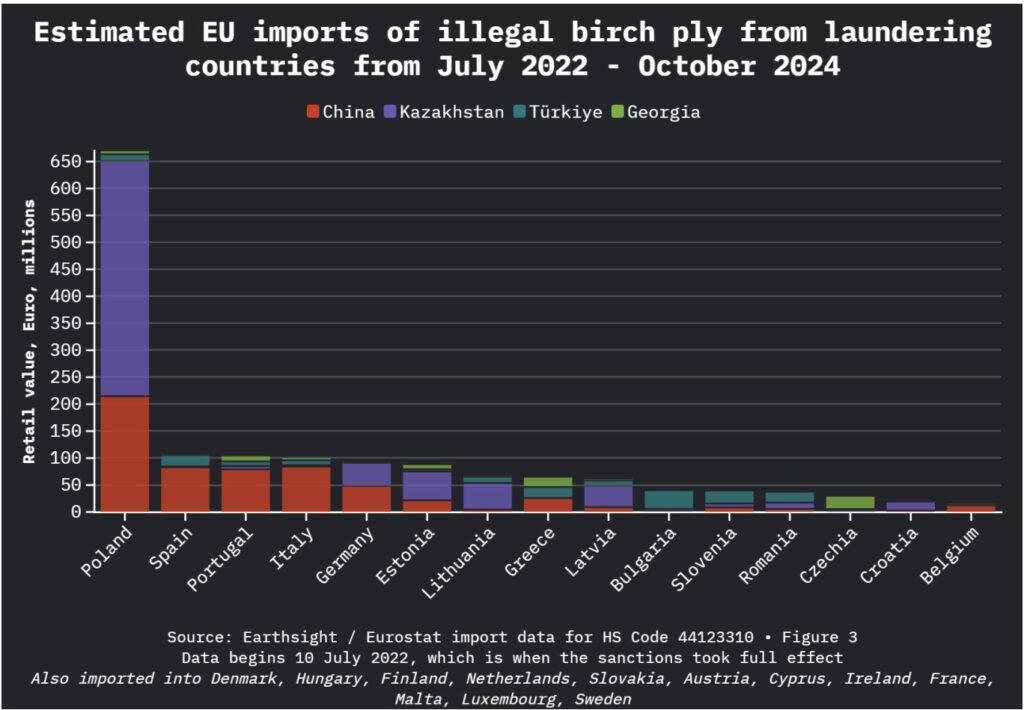

Particularly striking is that Poland, which has positioned itself as one of Ukraine's strongest supporters in its fight against Russian aggression, emerges as the largest importer of this sanctioned timber. Together with Italy, Germany, Spain, Portugal, Estonia, and Greece, these countries account for the majority of suspect imports. Still, Poland's role stands out—it represents a third of all recent imports of suspect birch plywood to the EU.

Despite the sanctions, trade data confirms that every EU member state has received at least some volume of suspect birch plywood in 2024.

Russia’s war machine runs on timber

The European Union swiftly banned wood products from Russia and Belarus following the invasion of Ukraine, recognizing the economic and strategic significance of the forestry sector to both countries. Despite these sanctions, timber remains a crucial revenue source for the Russian military, which controls vast forested areas—spanning more than 1.5 times the size of Belgium—and profits directly from timber sales. In Belarus, the situation is even more disturbing: the country's largest wood processor is its network of penal colonies, where political prisoners endure forced labor under brutal conditions to supply the industry.

Among Russia’s timber exports, birch plywood stands out as the most valuable. Long prized in construction for its strength and durability, it has also become a sought-after material in interior design, fueling demand for high-end kitchens, flooring, furniture, and toys.

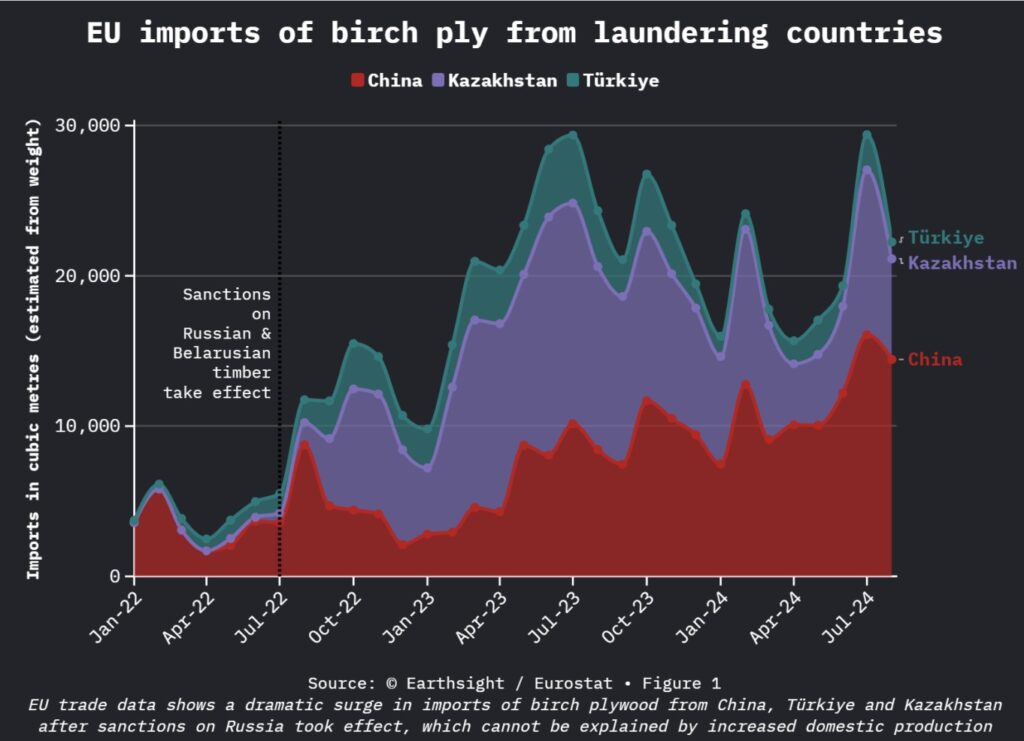

Before the sanctions, Russia and Belarus supplied more than half of the EU’s annual consumption of 1.7 million cubic meters of birch plywood. While prices have surged since the ban, the material remains widely available across European markets, raising urgent questions about its true origin and how much sanctioned plywood is still slipping through the cracks.

Türkiye, Kazakhstan, and China move Russian timber

The investigation exposed three primary routes for circumventing sanctions, each with distinct characteristics.

A representative from Segezha, Russia's largest logging firm, explained their method bluntly: "You’ll work with a Turkish factory. I’ll give you a contact. We sell the veneer to Türkiye as usual, and you buy Turkish plywood in Europe. On paper, we don’t know each other."

In Kazakhstan, a complex network of trading companies emerged. One prominent player, Initiative 2015, began exporting birch plywood in mid-2023 and quickly became Kazakhstan's largest exporter to the EU. When investigators visited the registered address of one of Initiative's connected companies, Euro Plywood, they found only a furniture market. The building manager explained they operated under the name PinskDrev – a Belarusian state-owned manufacturer.

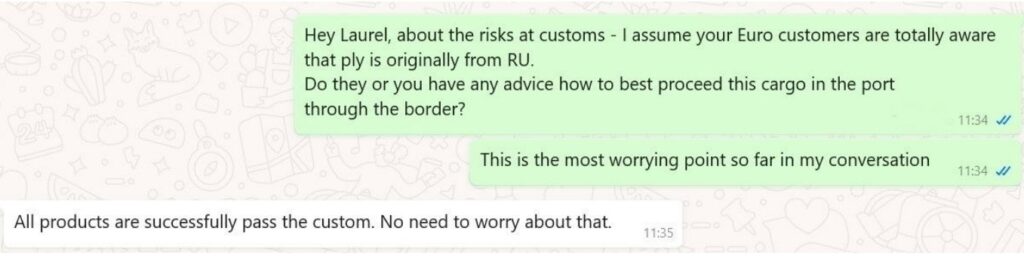

The Chinese route proved particularly brazen. A representative from Linyi Camel Plywood, claiming to ship 800 containers monthly to over 100 countries, shared photographs of their warehouse filled with boxes bearing Russian manufacturers' logos. Another Chinese firm, Tianma Lvjian, offered to provide certificates falsely claiming Chinese origin, boasting of recent large shipments to Spain, Italy, Greece, and Poland.

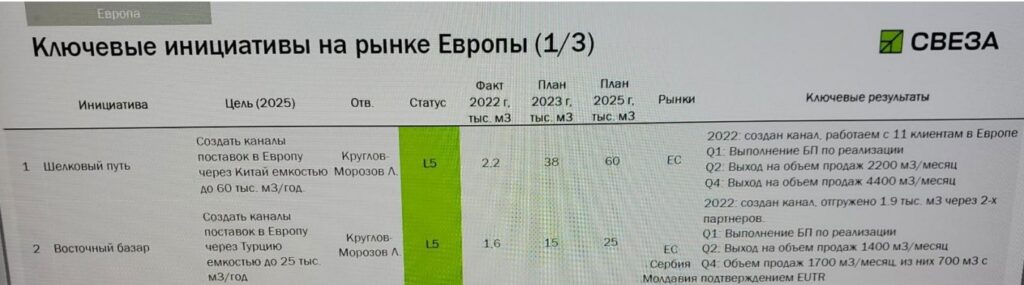

Internal documents from Russian manufacturer Sveza revealed sophisticated laundering operations, with different routes given nicknames: the Turkish route was known as the Oriental Bazaar, and the Chinese channel was dubbed the Silk Road. One presentation to senior management bragged about shipping 2,200 cubic meters of plywood disguised as Chinese to 11 different EU clients in late 2022.

exports of birch plywood to the EU in breach of sanctions. Photo: Earthsight.org.uk

SAABR Global Wood exemplified the Turkish connection. The company didn't exist before May 2023, when it suddenly began both importing and exporting birch plywood. Trade records showed all its imports came from Sveza in Russia, while its exports were declared as either Kazakh or Turkish origin. When investigators visited SAABR's warehouse in Gebze, they found Russian plywood in stock but no sign of any manufacturing capability.

EU giants still buy birch ply from Putin’s allies

The investigation found evidence that goods from seven of Russia's ten biggest birch ply manufacturers are still being sold in the EU. These include two firms whose largest shareholders are billionaire oligarchs who met with Putin on the day Russia invaded Ukraine. One of these, Alexei Mordashov, is himself under EU sanctions, while Vladimir Yevtushenkov controls Russia's largest logging firm.

A Plyterra sales manager boasted of their operation's scale: "I can tell you that right now, about 100 trucks are in movement. And they go. Ply is getting produced, trucks are being filled, and this whole process is happening continuously... a permanent stream is flowing through this channel to long-term clients."

The investigation identified several major European companies receiving laundered plywood. Walltopia, the world's largest manufacturer of artificial climbing walls and supplier to the 2024 Paris Olympics qualifiers, has received plywood through Turkish firms identified as laundering Russian material. Previously, 90% of its Russian birch ply came directly from Sveza.

Camel Plywood’s salesperson. Photo: Earthsight.org.uk

Polish furniture manufacturer Werxal purchased containers from Intop in early 2024, with products sold through hundreds of stores, including major retailer BlackRedWhite. Estonian company Technomar & Adrem, one of Initiative's biggest customers, produces flooring sold to high-profile projects, including Radisson, Hilton, and Marriott hotels.

Some European buyers may claim ignorance, but others were fully aware of their supplies’ true origin, as Earthsight’s undercover meetings revealed.

EU sanctions in name only

Despite warning signs evident since early 2023, enforcement efforts have been largely ineffective. Even when the EU introduced additional tariffs, smugglers quickly adapted, exploiting enforcement blind spots to continue funneling Russian plywood into Europe.

As one Russian manufacturer's representative noted, "This rather looks like legalization. They threw the 15% customs on top of it and let it work."

Each time a loophole closes, another opens – after Lithuanian imports decreased, Latvia's increased. Traders seamlessly reroute shipments, ensuring Russian timber continues flowing into Europe under false labels. While Poland remains the largest destination, much is now being re-exported to other EU states.

As one logistics operator explained: "We have done it since the beginning of this whole thing [since sanctions began], and we always figured out how to move it through the border."

The investigation reveals the urgent need for coordinated action across the EU. While sanctions have reduced Russian wood imports by about eighty percent, starving the regime of an estimated €10 billion in exports, the remaining trade undermines these efforts. The European Commission and member states must take urgent, coordinated action to halt this trade, with Poland, as the largest importer of blood-stained birch, leading the charge during its current EU Presidency.

The EU faces a choice: continue the charade of ineffective sanctions while financing Russia’s war machine or finally enforce the restrictions it claims to support. As long as these loopholes remain open, Europe remains complicit.

Read more:

- EU proposes Russian aluminum ban in new sanctions package

- EU sanctions cost Russia € 400 billion, says French foreign minister

- Nine European companies supply $66 million in military-linked equipment to Russia despite sanctions