A major investigation has uncovered Russia's massive hidden war spending through forced bank loans - a scheme that now threatens its economy.

Former Morgan Stanley and Bank of America executive Craig Kennedy analyzed unusual patterns in Russia's corporate debt to expose this secret financing system. His findings show that Russia's ability to fund its war relies on a precarious financial scheme that's beginning to unravel.

Here's what you need to know about this financial time bomb and why it matters for Ukraine's future.

What's happening?

Russia has been hiding half its war costs through secret bank loans, reveals a groundbreaking investigation by Craig Kennedy, former vice chairman at Bank of America Merrill Lynch.

While Russia’s official defense budget appears manageable to outside observers, Kennedy uncovered a massive hidden financing scheme operating through Russia’s banking system. This secret funding mechanism has created such severe economic problems that it could force Moscow to reconsider its ability to sustain the war.

The scheme was discovered by tracking unusual patterns in Russia’s corporate lending that began right after the invasion.

How much is Russia really spending on the war against Ukraine?

The official 2025 defense budget is $126 billion (32.5% of government spending), which most analysts thought Russia could handle.

But Kennedy’s investigation revealed a second, hidden track: Since 2022, Russia has forced banks to give about $210-250 billion in loans to military contractors.

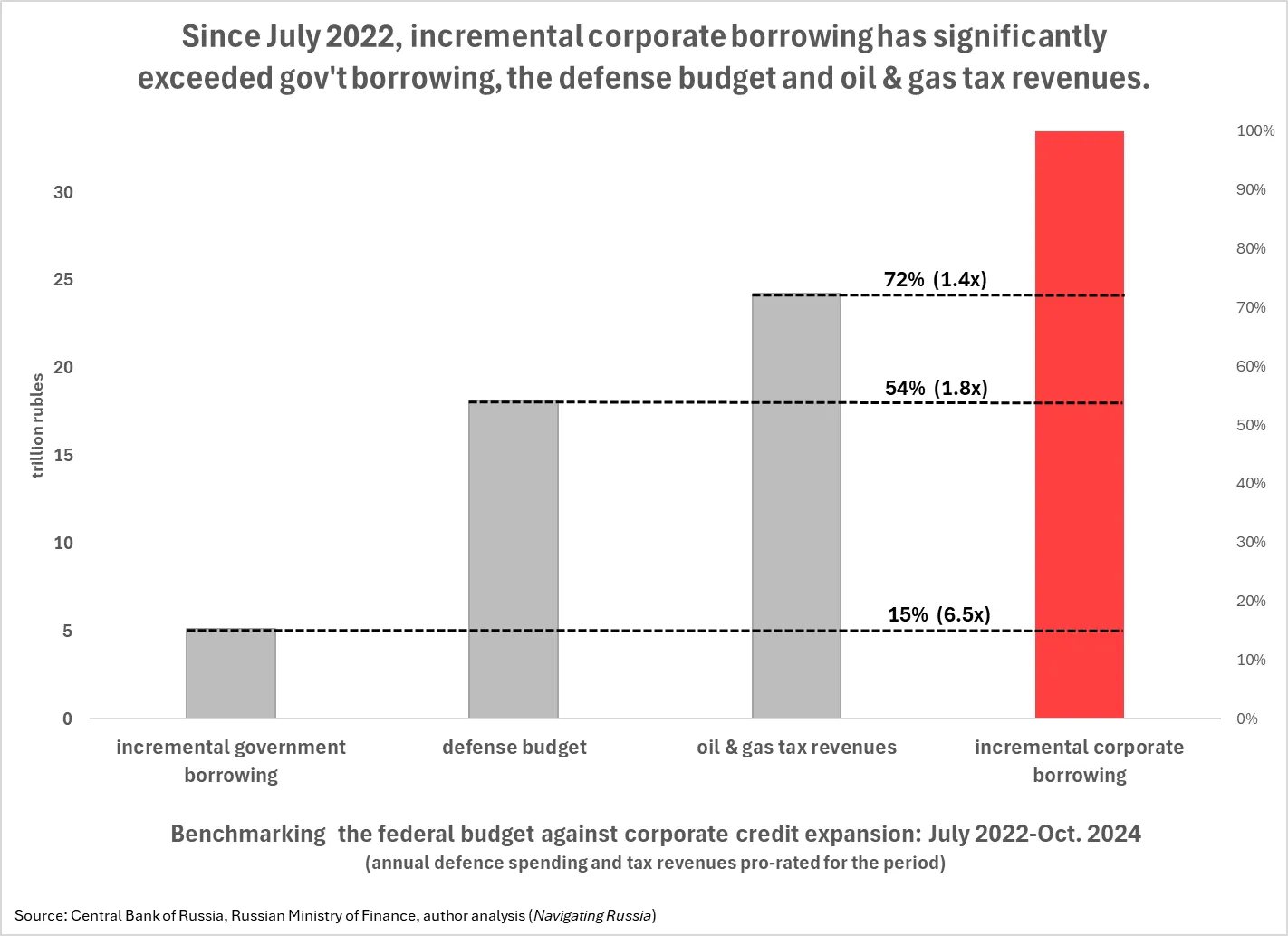

The scale is staggering – this secret spending matches the entire official budget and exceeds Russia’s total oil and gas revenues. The scheme is 6.5 times larger than the government’s own new borrowing, showing how Moscow tried to fund the war without appearing to strain its budget.

How does this secret funding work?

On the second day of the invasion, Russia quietly passed a law forcing banks to give loans to defense companies – even financially unstable ones – at artificially low interest rates.

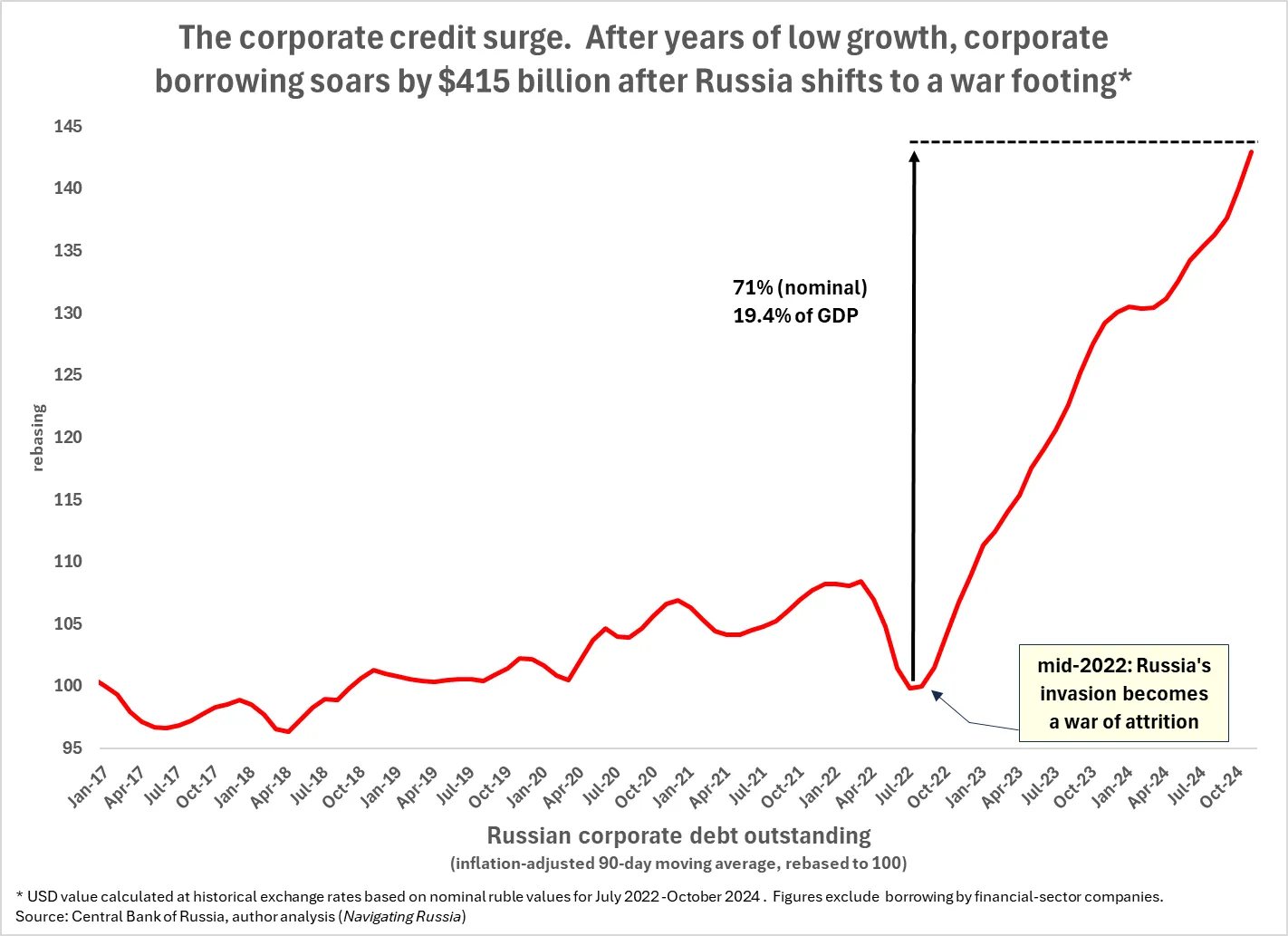

This created an unprecedented $415 billion surge in corporate borrowing, with an extraordinary 71% jump in corporate debt, reaching 19.4% of Russia’s GDP.

Kennedy’s analysis shows that over 70% of this lending went to sectors involved in war-related activities. The state compelled banks to approve these credits regardless of the borrowers’ creditworthiness, creating massive hidden risks in Russia’s banking system.

Why is this hidden funding dangerous for Russia?

Most military contractors who received these forced loans won’t be able to repay them, creating a massive risk for banks.

To fight inflation caused by this hidden lending, Russia’s Central Bank had to raise interest rates dramatically, forcing regular businesses to borrow at over 21%.

The Central Bank has identified this preferential lending scheme as a significant threat to Russia’s economic stability, noting that it has become the main driver of inflation and is largely “insensitive” to interest rate hikes.

Can Russia keep hiding these costs?

Not for long. By late 2024, Russian banks were running low on cash and reserves, with some taking dangerous risks under eased regulatory policies.

This isn’t the first time such schemes have turned toxic – similar but smaller programs in 2016-17 and 2019-20 required state bailouts. But today’s scheme is far larger.

The Central Bank has been publicly calling on the government to curtail this preferential funding since October 2024, but doing so would force Russia to either dramatically increase its official defense budget or reduce war spending.

What does this mean for Moscow?

By late 2024, Russia faced high interest rates and banks were running low on cash and reserves. This isn’t just slowing economic growth – it could lead to widespread bankruptcies of banks and companies.

With dwindling national reserves, a weakening currency, and having spent most of its oil and gas savings called the “National Wealth Fund” on the war, Russia might not be able to handle this growing debt if the war continues.

Moscow faces a tough choice: the longer it waits to seek peace and cut military spending, the greater the risk of having to bail out failing companies and banks, which would weaken its position in any peace talks.

The potential bailout could cost as much as half of Russia’s entire 2024 federal budget. This could limit government spending for years, including its ability to rebuild its military – unless sanctions are lifted.

What does this mean for Ukraine?

This financial weakness gives Ukraine unexpected leverage.

Russia is working hard to maintain an image of financial stability, but this investigation shows it faces serious economic pressure to end the war.

Unlike slow-burning problems like inflation, credit crises can emerge suddenly and unpredictably with massive disruptive force.

In late October, Putin himself convened an urgent meeting with senior officials, including the Central Bank head, to discuss concerning trends in corporate debt. This shows Moscow’s growing anxiety about its hidden financial vulnerability.

Could Russia find other ways to fund the war?

While Russia could theoretically raise taxes or increase state borrowing, it strongly prefers not to because this would reveal its financial struggles.

Moscow wants to maintain the illusion it can fund the war indefinitely to strengthen its negotiating position – a tactic it has used since Soviet times. The Kremlin’s bigger worry isn’t that a financial crisis could stop the war funding entirely, but that it would expose Russia’s economic vulnerabilities and weaken its position in peace talks.

The longer Russia delays seeking peace, the greater the risk that uncontrollable credit events will expose these weaknesses.

What should Ukraine and its allies do?

Kennedy’s report suggests two key actions:

- Western allies should maintain unity and confidently demonstrate they can outmatch Russian resources in a long war. This would pressure Moscow to reconsider its strategy, as Russia knows it cannot prevail against united Western support.

- Sanctions relief should be explicitly tied only to a comprehensive peace settlement – including reparations – not to temporary ceasefires. This would prevent Russia from using sanctions relief to bail out its hidden war debt and maintain pressure for genuine peace negotiations.

With continued resolve and understanding of Russia’s financial vulnerabilities, Ukraine and its allies can avoid making unnecessary concessions.

Putin must end Ukraine war by 2025 or face economic collapse, warns ex-energy chief

Russian propaganda says Russia is invincible and, therefore, cannot lose the war.

Facts show another story. We deliver them to millions worldwide.

Keep this story free for others to read — become our patron right now.