Western sanctions have left Russia's flagship Arctic LNG-2 project out in the cold, suspending production and threatening the country's bid to dominate a fifth of the global LNG market. But experts say more must be done to permanently sink the Kremlin's gas export plans and its war chest. Ukrainian NGO Razom We Stand reveals the key pressure points to target next.

What is Arctic LNG-2?

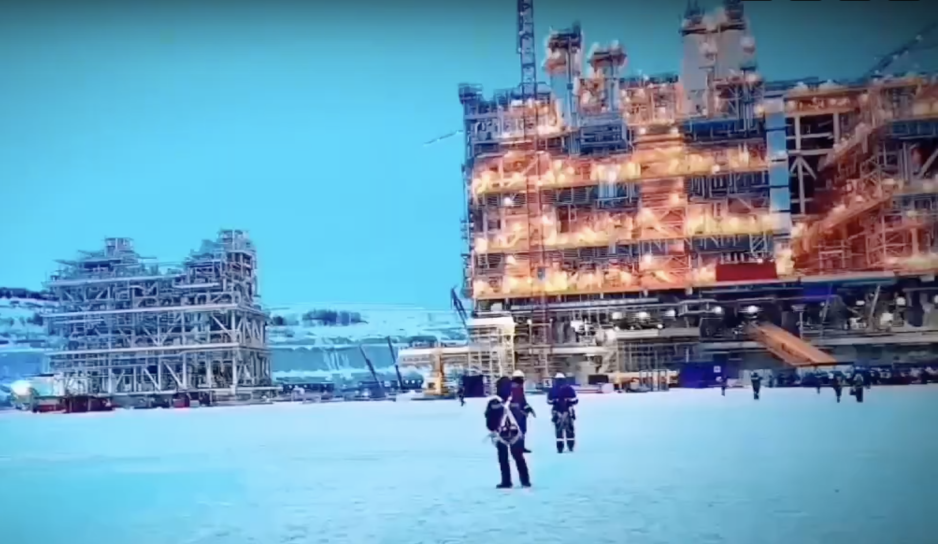

The Arctic LNG-2 project, located on the Gyda Peninsula above the Arctic Circle in Siberia, was envisioned as a major expansion of Russia's LNG export capacity, with a projected 19.8 million tons per year.

If fully completed, the three-phase project could have doubled the export volumes of Novatek, the main owner company belonging to Russian oligarch Gennady Timchenko, making it the largest LNG project in Russia.

Other shareholders include state-owned Chinese companies (20%), a Japanese consortium led by Mitsui (10%), and France's Total (10%).

If fully completed, Arctic-2 can double the export volumes of Novatek, the main owner company belonging to Russian oligarch Gennady Timchenko.

However, the sanctions imposed due to Russia's invasion of Ukraine have severely disrupted the project.

The foreign shareholders have frozen their participation, and Novatek itself has declared force majeure. As a result, LNG production has been suspended, with the first production line shut down until the end of June.

The suspension of LNG production has also forced the shutdown of gas extraction at the adjacent fields, jeopardizing Russia's plans to increase its seaborne gas exports.

Effect of sanctions: Russia has a tanker problem

The US sanctions are aimed at hindering Moscow's ability to obtain specialized Arc7 ice-class tankers , which are essential for transporting liquefied natural gas (LNG) through the icy waters of the Northern Sea Route. These vessels have a unique double-hull design and reinforced features that allow them to operate in the extreme Arctic conditions required for the Arctic LNG 2 project.

Novatek planned to build 15 Arc7 ice-class tankers capable of breaking through 2-meter ice at the Russian shipyard Zvezda, with the involvement of South Korean companies. However, only three such vessels have been completed: "Alexey Kosygin," "Pyotr Stolypin," and "Sergey Vitte."

Three more were manufactured by South Korean Hanwha Ocean on order of the Russian company Sovcomflot, but the contracts for their sale were canceled due to the sanctions. Japanese Mitsui O.S.K. Lines also withdrew its previous plan to charter 3 carriers.

This tanker shortage has already caused delays in Arctic LNG 2 commercial deliveries, negatively impacting Novatek's financial and strategic plans.

Russian Deputy Prime Minister Aleksandr Novak acknowledged the lack of tankers as the main issue, emphasizing the need to resolve it for project success. Analysts, such as Ronald Smith from BCS, have expressed concerns that the uncertainty around tanker availability calls the entire future of the Arctic LNG 2 project into question.

Furthermore, the sanctions have limited the alternatives available for LNG transportation in Arctic conditions, as the company only owns three new LNG tankers registered under the Russian flag, which are barred from entering EU ports. This raises doubts about both the short-term and long-term prospects of the Arctic LNG 2 project.

How US sanctions undermined Arctic LNG-2

In September 2023, the United States announced the first targeted sanctions against Arctic LNG 2, covering the Russian companies involved and their subsidiaries, as well as firms from third countries, including the UAE, that tried to circumvent the restrictions. These actions were aimed at reducing Russia's future energy capabilities.

On 14 September 2023, the US imposed sanctions, and on 2 November 2023, it banned the activities of the Arctic LNG-2 company itself.

This constant US pressure led to significant changes in the project:

- August 2022: Novatek signed an agreement with a Turkish company to build a floating power plant, as American energy company Baker Hughes stopped servicing Russian LNG projects.

- March 2023: Russia's Deputy PM announced plans to increase LNG production to 100 million tons despite a tanker fleet shortage.

- April 2023: South Korea expanded sanctions to include critical components for Arctic gas carriers.

- June 2023: Japan said it would continue gas sector cooperation with Russia to ensure its own energy security.

- 14 September 2023: for the first time, the US imposed sanctions aimed at limiting the development of Russia's energy projects, including Arctic LNG 2.

- October 2023: $400 million in equipment from UK, US, and Italian firms allowed the first Arctic LNG-2 phase to launch.

- 2 November 2023: the US Department of State and the Office of Foreign Assets Control (OFAC) announce sanctions against Arctic LNG-2 LLC as the direct operator of the project.

- November 2023: The United States imposes comprehensive sanctions against the project, including a ban on the purchase of LNG produced from it.

- January 2024: France's Total declares force majeure, refusing to ship gas from Arctic LNG 2 to comply with sanctions.

- February 2024: First gas shipments were postponed, and Novatek received $180 million in new equipment but faced a tanker shortage.

- April 2024: Russia confirmed suspending LNG production at the project's first stage due to logistics issues and lack of new ice-class tankers.

In February 2024, natural gas production at the fields developed for the Arctic LNG 2 project decreased significantly to 83 million cubic meters. This was a sharp drop from 425 million cubic meters in December 2023 and 250 million cubic meters in January 2024.

Russia's sanctions struggle: supported by China, assisted by Norway

Despite the significant challenges, the ongoing activity at the Arctic LNG 2 construction site in Belokamenka village, Murmansk Oblast, demonstrates Novatek's determination to continue the project. A key development is the support from China, which is helping overcome sanctions restrictions on equipment supplies.

In late March, the last module for the second production line arrived at Novatek's northern Russian shipyard, delivered by the Chinese heavy lift vessel Hunter Star. This was made possible despite sanctions, as Norway allowed the use of its territorial waters to transport the critical cargo.

Trending Now

Hunter Star arriving at the Belokamenka shipyard with module TMS-005 on 31 March 2024. Source: Belokamenka Yard

Interestingly, the Hunter Star listed the Norwegian port of Kirkenes as its final destination in the international vessel tracking system, suggesting potential circumvention of sanctions.

This raises questions, as Russian LNG tankers have previously stopped in Norway, indicating gaps in the enforcement of restrictions against Russia.

Hundreds of Chinese specialists have also arrived to install 20 CGT30 gas turbines with a capacity of 300 kW each in the module delivered by Hunter Star.

These turbines, supplied by Harbin Guanghan Gas Turbine, will play a key role in powering the second LNG production line, whose compressors will be fully electric, using Chinese technology. This technical solution can compensate for the absence of American-made turbines.

Two other modules, TMS-003 and TMS-004, were delivered to Belokamenka aboard the ice-class ships Audax and Pugnax, escorted by nuclear-powered icebreakers, through the icy waters of the Northern Sea Route. They covered 2,500 nautical miles over sea ice in about six weeks.

So, Novatek appears to be exploring alternative options, potentially taking advantage of the Northern Sea Route Administration's recent permission for non-ice-class vessels to pass through the region during the summer months.

The terminal was planned to reach full capacity of 20 million tons of LNG annually by 2026 as part of Russia's strategy to strengthen its presence in the global LNG market.

Logistics remain the main problem: they have resulted in a temporary suspension of LNG production and a decline in natural gas output.

Stopping Arctic LNG 2

Further sanctions against Russia's shipbuilding and energy sectors are crucial to halt the Kremlin's ambitions. Currently, dependence on Russian liquefied natural gas (LNG) poses a grave risk to the geopolitical balance in the EU.

The termination of the Arctic LNG 2 project due to sanctions could be a devastating blow to Russia's ambitions to gain a fifth share of the global LNG market by 2030-2035. Currently, the country ranks fourth among global producers, with annual exports of 32.6 million metric tons of liquefied natural gas.

The EU and the US face complex challenges related to energy security and price stability. To address these, they must develop a common strategy to reduce dependence on fossil fuels and counteract the Kremlin's plans.

The termination of the Arctic LNG 2 project due to sanctions could be a devastating blow to Russia's ambitions to gain a fifth share of the global LNG market by 2030-2035.

To counter these challenges, Ukraine's partners should:

- Impose additional sanctions to completely stop Arctic LNG 2, including against any vessels involved in the project's logistics.

- Restrict LNG imports from Novatek's existing Yamal LNG terminal to the EU and completely abandon Russian LNG by 2025.

- Impose sanctions on services supporting Russian LNG exports, including transportation, insurance, and financial transactions.

- Impose targeted sanctions on all tankers used to transport Russian LNG.

These measures aim to ensure Europe's energy security and reduce dependence on Russian energy resources, which is key to deterring Russian aggression and restoring stability in the region.