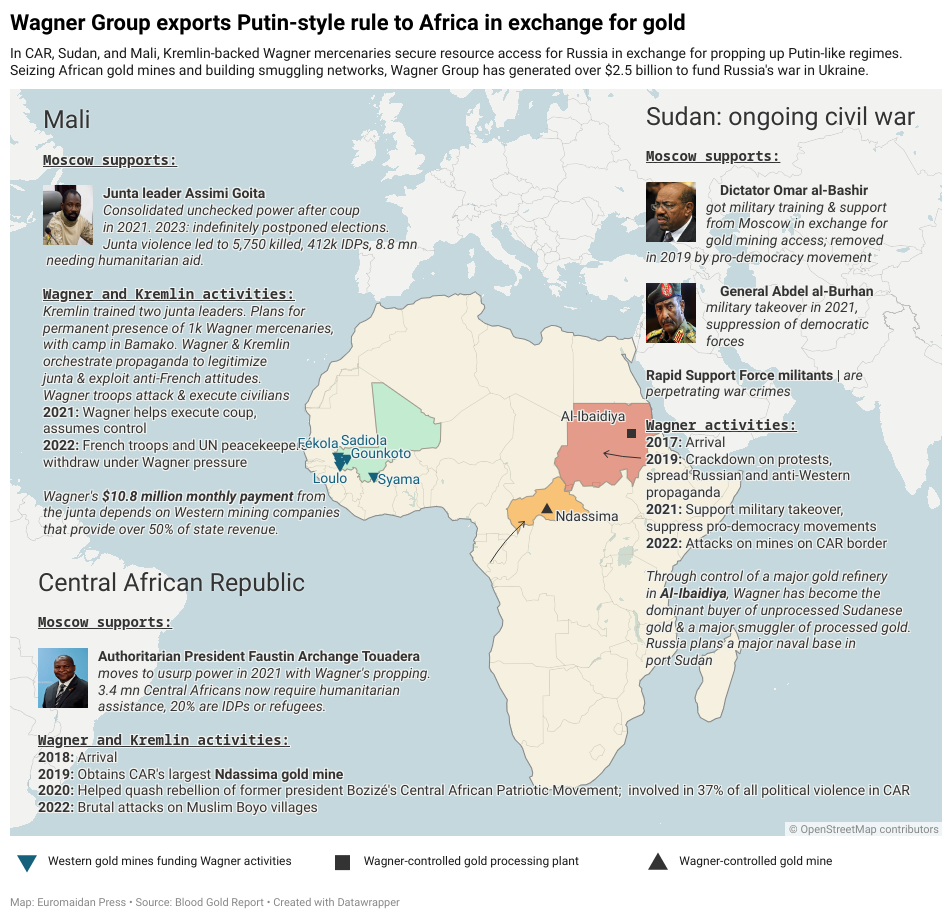

Founded in 2014 to aid pro-Russian forces in Ukrainian Donbas, the Kremlin-backed Wagner Group has grown into a global network advancing Russian interests while generating revenue to sustain Russia's war effort in Ukraine. A key focus is illicit African gold.

The Blood Gold Report, made by the international group of independent analysts, claims that the Kremlin has obtained over $2.5 billion in gold from Africa since Russia's 2022 invasion of Ukraine. Wagner secures control of gold mines and refineries in the Central African Republic (CAR), Sudan, and Mali by propping up regimes and terrorizing civilians.

In CAR, Wagner obtained the country's largest Ndassima gold mine in exchange for backing President Touadera's authoritarian rule. Through control of a major gold refinery in Sudan, Wagner has become the dominant buyer of unprocessed Sudanese gold and a major smuggler of processed gold. In Mali, Wagner's $10.8 million monthly payment from the junta depends on Western mining companies that provide over 50% of state revenue.

Exploiting gold's meltability, Wagner infiltrates unethical sources into legal supply chains via refineries in Russia and the UAE's sanction-free system. This blood gold fuels Russia's war machine with up to $114 million monthly.

With the help of security expert Omar Ashour of the Doha Institute, Euromaidan Press analyzed the key findings of the Blood Gold Report, closely tracking Wagner Group's gold exploitation in Africa and exposing illicit financing of Russia's brutal war in Ukraine. Experts believe there are ways to close off these illegal money channels.

The CAR model: Wagner Group's $2.8 billion mine

Wagner's primary vehicle for managing its blood gold operations in CAR is Midas Resources, established in November 2019. Midas is steered by Wagner operative Dmitry Sytiy, who is personally sanctioned by the US and EU for human rights abuses.

Midas Resources has preferential mining access to CAR's Ndassima gold mine, the country's only industrial-scale mine. Canadian firm Axmin had exclusive rights but was forced out in 2013 and is now pursuing arbitration against CAR's government.

Satellite imagery reveals Midas Resources is expanding production at Ndassima. The concession covers 12 unexploited locations in a 700 sq km radius.

Per the Blood Gold Report, Wagner Group's operations there yield up to $290 million in gold annually. According to the CAR’s Ministry of Mines, the estimated gross value of gold deposits at the site is $2.8 billion. Wagner mercenaries ruthlessly oversee Ndassima, violently suppressing miner revolts.

A web of Wagner front companies also hold interests in the country. One example is the gold and diamond extraction company Lobaye Invest, whose managing director, Yevgeny Khodotov, is also sanctioned.

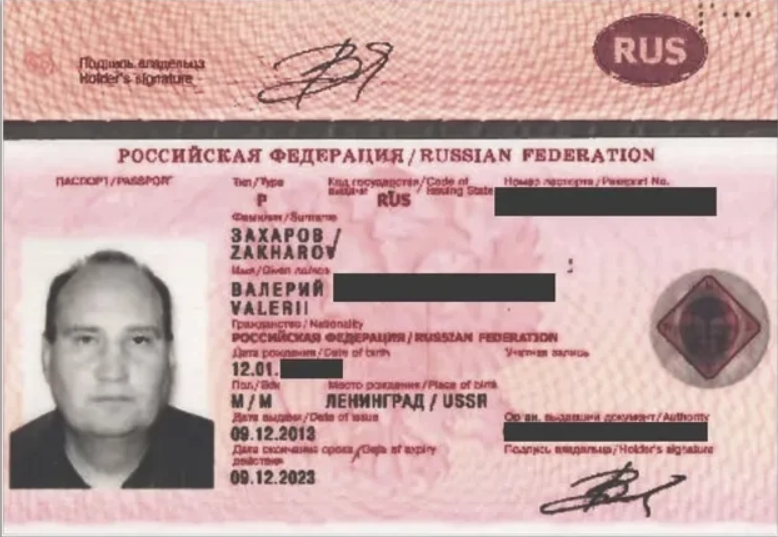

St. Petersburg-based M-Finance is pivotal in linking Wagner Group's operations in CAR to global logistics and financial networks. M-Finance exports equipment for Wagner's African enterprises from Russia to Africa. Initially headed by Valeriy Zakharov until his 2021 removal due to EU sanctions, M-Finance's responsibilities were divided among Wagner operatives Vitalii Perfilev, leading Wagner's CAR mission, Dmitry Sytii, and Alexandr Ivanovis, who directs Wagner spying and sabotage missions on behalf of the Touadera regime.

Diamville SAU, another Wagner-linked company, participated in a gold-selling scheme converting CAR-origin gold into US dollars until facing US sanctions in 2023. After that, participants in the scheme planned to move their operations onto a cash-only basis.

Under heightened scrutiny and sanctions, Wagner resorts to complex means to export resources from CAR. A favored tactic involves transshipping gold via third-party countries, such as the route between CAR and Cameroon. Overland shipment to the Congo market in Douala port facilitates cash-only transfers managed by Wagner-affiliated International Global Logistics.

CAR's border with Sudan is an alternate smuggling route, allowing Wagner Group to carry items to and from “friendly” countries.

When such paths fail, Wagner uses unconventional methods, including registering private jets instead of cargo planes to evade controls. Additionally, the group seeks collaboration with criminal networks and militia groups in CAR to smuggle goods on its behalf.

The Sudan model: a “gold town” for Wagner Group

Sudan's gold sector is rife with factionalism among political elites, military factions, and financial players. The state sees little revenue as up to 90% of gold production is smuggled out illegally. Artisanal mining - done by hand using basic tools - generates 85% of production.

Wagner Group's extensive Sudan interests are managed by M-Invest, led by Andrei Mandel and Mikhail Potepkin.

M-Invest's financial agreement with Sudanese intelligence firm Aswar involves a $200,000 “goodwill fee,” $100,000 monthly covering Aswar staff salaries and taxes, plus $500 per Wagner individual entering Sudan. In exchange, Aswar provides the Russians access to Sudan and its Ministry of Defense weaponry.

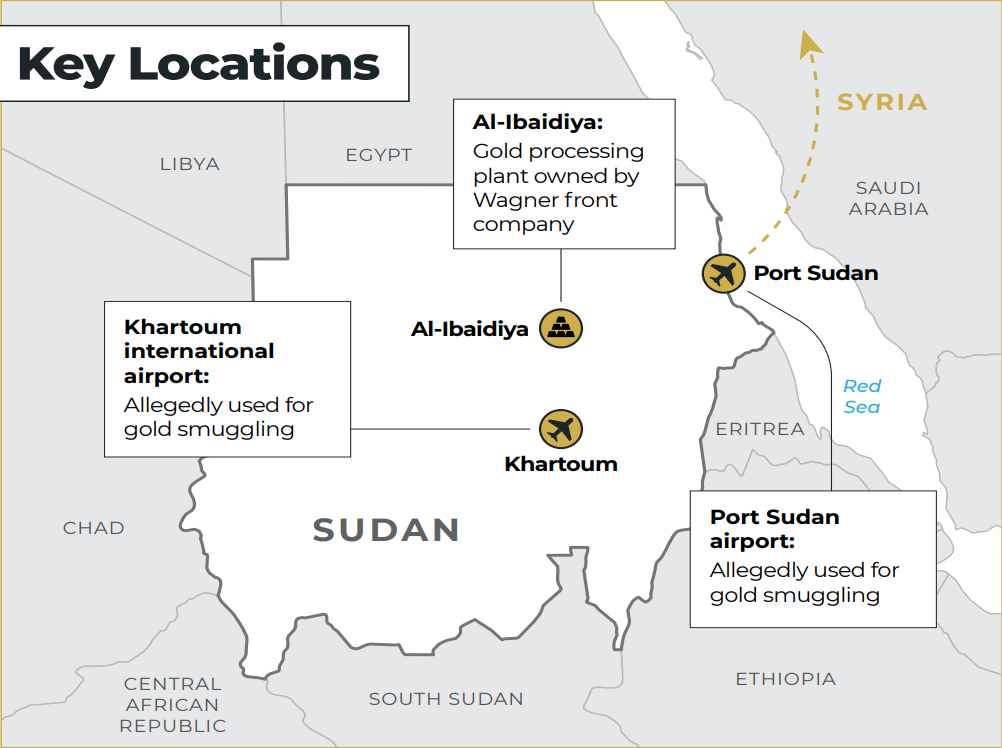

M-Invest's subsidiary, Meroe Gold, served as Wagner's primary front until 2021, exploiting regulatory exemptions granted under al-Bashir's regime. Meroe Gold dominated gold processing, notably through a plant in “gold town” al-Ibaidiya. This area, abundant with artisanal miners and local mining companies, also hosted a major processing facility known locally as “the Russian company,” which was synonymous with Meroe Gold.

By controlling the al-Ibaidiya plant, Meroe, and consequently Wagner Group, became major players in Sudan's gold sector. Facing 2020 US sanctions, Meroe Gold was simply replaced by Al Sawlaj for Mining Ltd.

A 2018 letter revealed M-Invest arrangements with Aswar to utilize military flight codes. In 2022, a Russian plane was found smuggling a ton of gold hidden among cookie boxes, one of at least 16 such flights between Khartoum and Russia's Syrian airbase. Wagner also transports gold overland to CAR through a shared border.

Russians also plan for a new major naval base in Port Sudan. Announced in 2018 under al-Bashir's rule, the al-Burhan junta later approved the project. This may facilitate large-scale Russian smuggling operations if Wagner can navigate Sudan's civil war. The proposed base includes a logistics center, a repair yard, four naval ships, up to 300 personnel, and nuclear-powered ships.

The Mali model: cash instead of gold

Wagner initially tried to replicate its strategy from CAR and Sudan in Mali, Africa's 4th largest gold producer. The group brought in geologists and mining executives and established mining companies. However, displacing international corporations proved difficult.

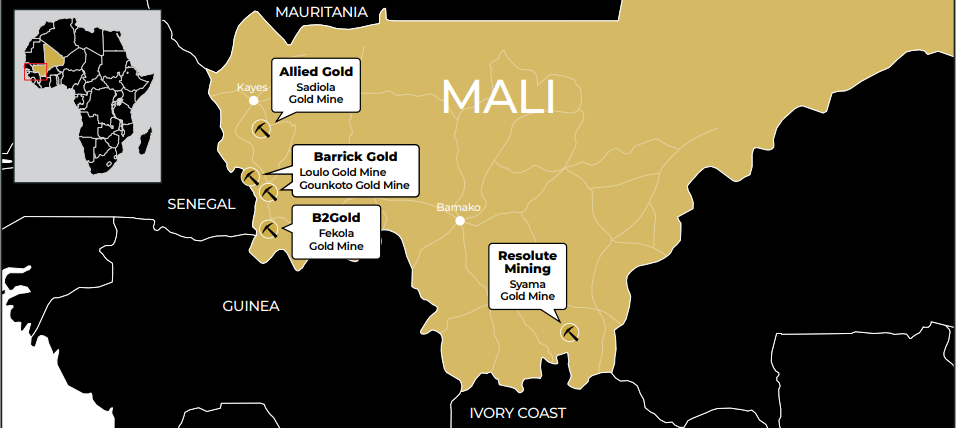

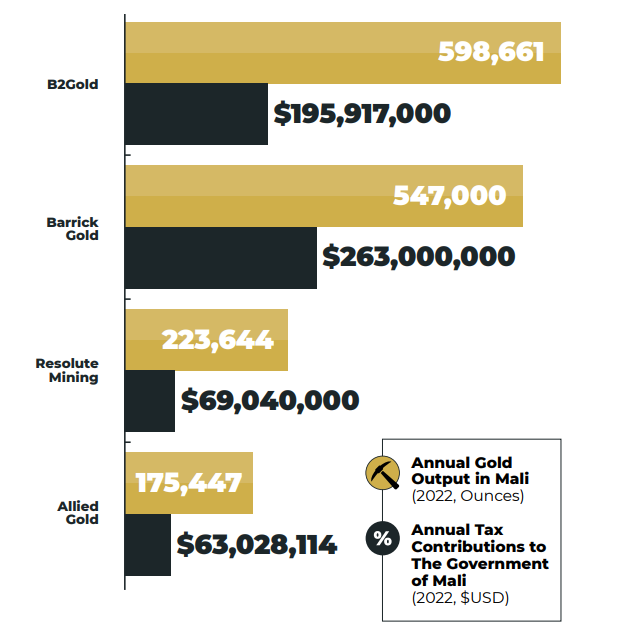

So, Wagner pivoted to a cash-for-security deal with the junta. Mali pays Wagner a reported $10 million monthly, handing over $200 million between late 2021 and mid-2023. This is enabled by taxes from international mining companies, especially the four largest: Barrick Gold, B2Gold, Resolute Mining, and Allied Gold, which paid approximately $588 million in taxes and royalties to the junta in 2022. International mining firms operate with the State of Mali holding a 20% stake in their respective operating companies.

Unlike in CAR and Sudan, Wagner does not need elaborate corporate schemes in Mali to turn blood gold into cash. Major international mining companies certify Malian gold exports as ethical before refining. Then, it enters the legal global market and becomes untraceable.

- Barrick Gold, a Canadian-based mining firm, has operated gold mines in Mali for 26 years. It now owns two active mines there - Loulo and Gounkoto. The company paid $263 million in taxes in 2022, making it the largest contributor.

- B2Gold, the Canadian-based mining company, has operated the Fekola gold mine in Mali since 2014. In 2022, B2Gold paid $196 million in taxes.

- Resolute Mining, the Australia-based gold miner, has run the Syama mine since 2004. Resolute paid $67 million in taxes for 2022.

- Allied Gold, another Canadian headquartered company, bought Mali's Sadiola mine in 2020. Allied has aligned with the junta, getting tax breaks. Sadiola paid over $63 million in taxes and royalties in 2022.

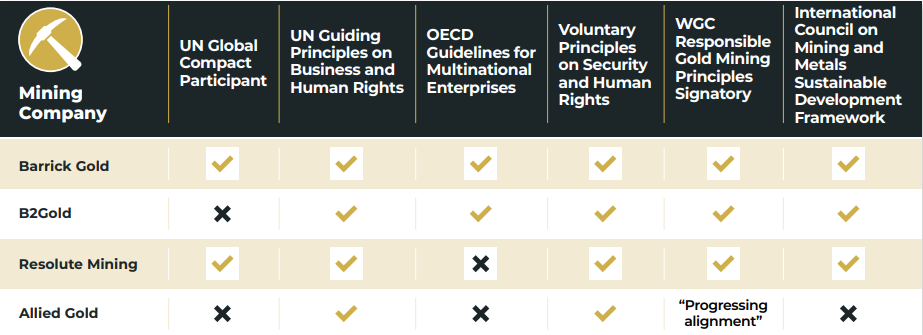

All four companies state human rights commitments but did not respond when the Blood Gold Report authors asked how they reconcile these with the junta's abuses, enabled by Wagner. By continuing operations, companies have reaped revenues despite the coup. The junta also benefits - 2022 revenues from miners rose 35% to $1.3 billion, over 50% of tax income.

Under Russian influence, the junta aims to increase control and revenues. In July 2023, the junta moved to review the mining code, proposing rules allowing the state to take up to 35% of new mining projects, up from 20%. Barrick Gold CEO Mark Bristow stated the junta needs time to “comprehend” as they are “military people.”

Despite the junta's increasing demands and Russia's growing influence, the companies seem intent on maintaining the status quo of operations and investments.

Beyond the $10 million monthly payment, Wagner appears to be considering mining concessions in northern Mali, an area abundant with artisanal mining sites but lacking industrial mining.

This move could further complicate matters for international companies, particularly as the junta has inked a deal for Russia to construct a 200-tonne annual refinery – the largest in West Africa. Given the refinery's significant capacity compared to the 2022 production of 66.2 tonnes, it suggests the junta aims to channel all Malian gold through it, potentially demanding more from its international partners.

Western complicity in Wagner atrocities across Africa

Western companies operating in Africa are indeed to some extent responsible for Wagner Group's abuses in Africa, agrees security expert Omar Ashour of the Doha Institute. However, pinpointing culpability within those private firms is challenging.

"The company paying the largest amount to the Malian government is registered in Canada. But who runs it? You could have a Russian dual citizen register there while living in Moscow," explains Ashour. "Or a Putin loyalist from Brazil registers in Canada but resides in Rio. So untangling ownership is complicated."

While complex, tracing responsibility is possible given Western transparency standards requiring companies to register owners and directors. As Ashour notes, backgrounds of board members and managers can be accessed.

Western governments, particularly former colonial power France which still wields influence, also bear a degree of responsibility for turmoil unfolding across post-colonial Africa, notes the expert. In Mali after 2012, a coalition of insurgents including separatists, Al-Qaeda affiliates and other militants severely challenged government control, occupying significant territory. Though France initially helped Mali's government regain control, their military success gradually declined, leading to stalemate. When a coup occurred in 2020, the new Malian junta expelled French forces then turned to the Wagner Group, paying its mercenaries $10.8 million monthly partly using taxes imposed on Western mining companies.

"Western forces, including the French, British, and Italians, were present in Mali, but they left at the request of the Malian government following a coup. This shift in dynamics resulted in the regime aligning with Russia," explained Ashour.

Western response to Wagner Group's blood gold: effectiveness and limitations

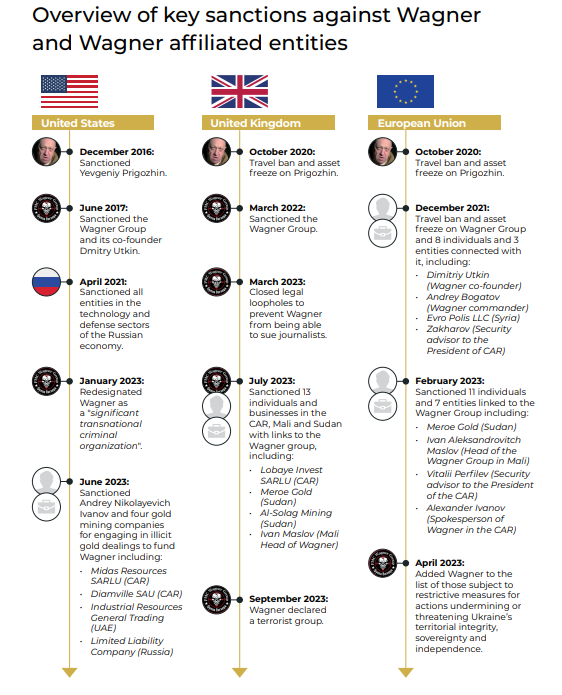

Wagner's blood gold network uses complex corporate and individual intermediaries, remaining largely adaptable. However, sanctions disrupt supply chains and financing. Since Putin's 2022 Ukraine invasion, Western allies imposed asset freezes, trade and travel bans on Wagner and Russia with turbulent impact.

- Over €20 billion in assets belonging to 1,500+ sanctioned entities were frozen by the EU, G7 nations, and Australia. In July 2023, the UK introduced thirteen new sanctions against Wagner leaders and front companies, restricting dealings for UK citizens, companies, and banks.

- Export prohibitions limit Kremlin access to vital technologies, hindering heavy machinery development crucial for industrial gold mining.

- Import restrictions severed Russia's gold sales in the UK, Canada, the US, and Japan, causing a revenue drop. Russian gold exports fell from $17.3 billion in 2021 to $7.1 billion in 2022.

- Travel bans force Russia and Kremlin affiliates to avoid sanctioned territories, potentially restricting access to entire continents.

- Dollar dominance allowed the US to freeze half of Russia's “war chest,” crippling international transactions. The EU's SWIFT system, developed with the US, disconnected a number of Russian banks.

- Secondary sanctions add to the impact, with the London Bullion Market Association prohibiting gold trades with entities violating relevant EU, US, UK, or other economic and trade sanction lists.

However, Western sanctions against Kremlin-linked entities face significant weaknesses.

- Lack of harmonization among EU, UK, and US sanctions leads to inconsistencies and potential evasion opportunities.

- Gaps in the overall scope of sanctions, particularly regarding the use of private jets for transnational travel, allow for continued Russian air travel to non-Western allies despite restrictions on elite access to European airspace.

- The reactive nature of sanctions frameworks, with slow updates, contrasts with the adaptive nature of Wagner's blood gold networks.

- Lack of a unified policy among Western powers to automatically sanction any sovereign or political actor employing Wagner's services.

- Vast areas of global commerce remain unaffected by sanctions, allowing Wagner and Kremlin actors to conduct business uninhibitedly.

The UAE, suspected to be a major destination for Wagner and Kremlin-linked blood gold, increased Russian gold imports from 1.3 to 75.7 tonnes between 2021 and 2022. The UAE gold industry largely avoided Western sanctions, allowing the export of laundered Russian gold to countries that also do not impose sanctions on the Kremlin, such as India, Hong Kong, Saudi Arabia, Switzerland, and Türkiye. Once gold is melted and recast, its origin becomes effectively untraceable.

While some of the above limitations can be amended, others are inherent to the nature of sanctions. Additional private sector support is crucial to counter Wagner's adaptive blood gold system robustly. Corporate social responsibility (CSR) frameworks in mining firms and investors can enhance vigilance. However, for CSR to significantly wind down Wagner's gold revenue, it must be robustly and proactively applied. Evidence suggests this did not happen.

Furthermore, only the UK and France formally designated Wagner a terrorist group. However, public pressure could convince more Western governments, believes Ashour.

"Ukrainian legal experts should file cases against Wagner for crimes, with aid from Western colleagues. Their atrocities could warrant International Criminal Court prosecution," Ashour stated.

Stopping Wagner's blood gold system

The Blood Gold Report authors offer measures to close off avenues for Wagner blood gold profiteering:

- WIDEN sanctions to automatically target any party that employs Wagner's security services.

Sanctioning just Wagner is ineffective since the group readily shifts personnel and assets to new entities. Instead, authorities must also target governments and companies employing Wagner, imposing a binary choice: work with sanctioned mercenaries or access global markets. Where authoritarian regimes still choose Wagner, third parties cannot work with them without penalties, preventing scenarios as in Mali.

- INTRODUCE stringent supply chain controls to prevent blood gold infiltration.

Wagner profits by turning looted African gold into hard currency, targeting upstream supply links. The group ships illicit gold to refining hubs with lax oversight like the UAE. This infiltration polluents downstream supply chains globally. Refineries must face penalties for insufficient due diligence, including potential exclusion from the global gold industry. By targeting upstream links, enhanced diligence standards can sever Wagner's cash flow.

- DEMAND real responsibility from international mining companies.

No company should engage in activity enriching the Wagner Group or regimes using state resources for Wagner-directed brutality. Despite extensive CSR frameworks, mining firms and trade bodies trigger little meaningful withdrawal from risky deals. Where self-regulation fails, institutional investors and governments must force change by penalizing complicit companies.

- DESIGNATE Wagner a terrorist group and set the International Criminal Court on the group's trail.

The UK designated Wagner a terrorist entity in 2023, enabling tighter scrutiny. However the US, EU and allies have not yet done so, missing an opportunity to boost law enforcement cooperation and ICC referral. Despite typically lengthy cases, the ICC demonstrates determined pursuit of justice against rights violators.

- DEEPEN sanctions collaboration between allies and international partners.

Tightening UK/EU/US sanctions coordination via a swift unified mechanism would minimize circumvention risks and patchwork policies, while expanding collaboration through the UN, EU and African institutions like the African Union, ECOWAS and EAC can prioritize addressing Wagner's blood gold.

- INCREASE support to African democratic states, independent media, and civil society groups threatened by Wagner Group operations on the continent.

While the Kremlin bears full responsibility for Wagner Group's damage and displacement of millions in Africa, Western government failure over the past decade to counter Russia's hybrid warfare enabled Wagner’s success. To correct this, Western nations should engage with countries under the Kremlin's influence, strengthen ties with neighboring democratic African states, and offer real support to African democracies facing Russian hybrid warfare and Wagner Group violence.

Read more:

- How Wagner Group exports Putin-style rule to Africa

- Wagner defector exposes Russia’s Donbas ruse, false-flag ops in bombshell interview

- UK intel: Russia officially recognizes Wagner Group veterans

- “They just did it for fun”: Ukrainian survivors detail Wagner group horrors

- UK declares Russian Wagner Group a terrorist organization