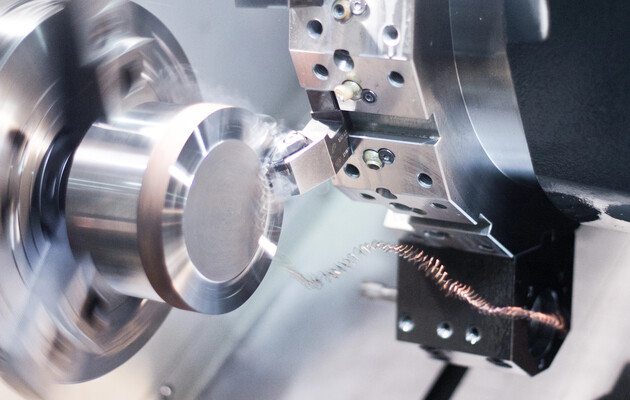

Chinese shipments of advanced machine tools to Russia have increased tenfold since the full-scale invasion of Ukraine, with a significant rise in the trade of high-precision "computer numerical control" (CNC) devices, Financial Times reported.

These tools, crucial for metal milling with extreme precision, are now predominantly supplied by China as Moscow faces tightened restrictions on imports from the European Union.

July's Russian customs returns revealed a significant increase in CNC tool imports from China, amounting to $68 million, compared to $6.5 million in February 2022. This surge in imports coincides with a notable decline in CNC tools from the EU, Russia's historical main source. The data indicates that Chinese-origin CNC devices constituted 57% of Russian imports by value in July, a stark rise from 12% before the war.

The US responded to this situation in November by imposing sweeping sanctions on major Russian importers of CNC tools. This move potentially jeopardizes the ability of Chinese companies to trade in other markets if they continue their transactions with these Russian importers.

Despite Beijing's assertion of non-involvement in Moscow's military aggression and its rejection of the use of sanctions, Chinese exports to Russia, including oil, machinery, and consumer goods, have bolstered Russia’s economy under sanctions. President Xi Jinping remarked on the historic high in annual trade between China and Russia, nearly reaching $200 billion.

The Financial Times analysis also highlighted that some major beneficiaries of the Russian demand have strong connections with China’s People’s Liberation Army. For instance, Wuhan Huazhong Numerical Control, known for its collaboration with Chinese military industries, has seen increased exports to Russia. The company, which faced US sanctions in the past, did not respond to requests for comment.

Emily Kilcrease, a former deputy assistant US trade representative, shed light on Washington's cautious approach towards targeting Chinese companies aiding Russia. The administration is focused on ensuring that Russia receives inferior goods, thus increasing the cost and difficulty for Russia to obtain such machine tools.

The Bank of Finland Institute for Emerging Economies reported a 78% increase in the median price of a basket of Chinese goods supporting Russia's war effort from 2021 to 2023. In contrast, prices for the same exports to other countries rose by only 12%.

Alexander Gabuev, director of the Carnegie Russia Eurasia Center, noted many Chinese companies' indifference to potential US sanctions risks, considering the existing sanctions against Beijing's military contractors.

Read also:

- Russia likely plans to modify Kh-32 missiles with cluster munitions

- IStories: Russia imports Western-made rifle scopes

- Upgraded Russian guided bombs suggest ongoing access to foreign electronics

- Insider: Western companies supply spare parts for Russian tanks