While many large UK companies have withdrawn from Russia under consumer pressure, a network of 2,370 Russian companies with nominal British owners continues to work unabated. Their UK nominal owners often act as a front for foreign money transfers to their Russian beneficiaries and allow international capital to keep feeding Russia's war machine. Meanwhile, several large real UK companies keep operating in Russia, namely HSBC Holdings, Unilever, GlaxoSmithKline, AstraZeneca, Linde, Legal & General Group, and LyondellBasell Industries.

British boycott of Russian business

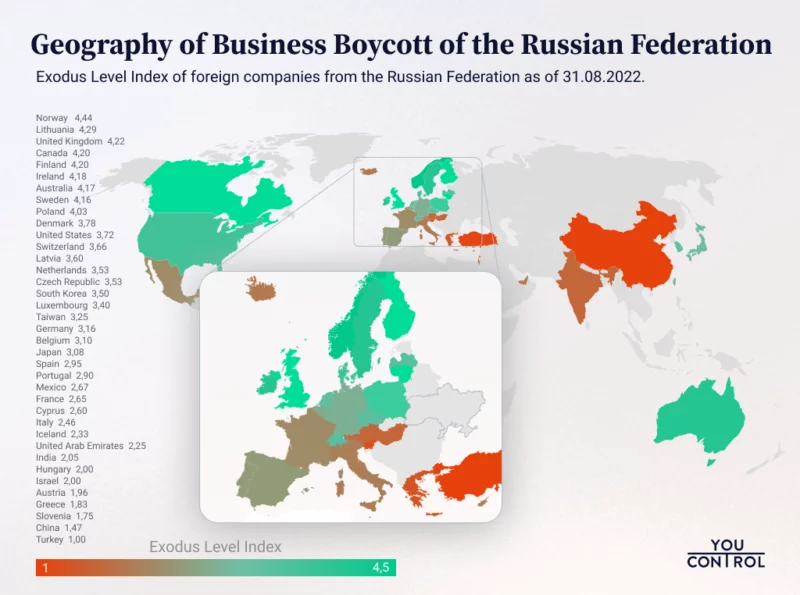

In response to the Russian invasion of Ukraine in February 2022, pressure mounted on Western companies to withdraw from the market in order to stop funding the Russian budget that funds the invading army. Companies withdrew, others not so much. An Exodus Level Index created by YouControl allows measuring various countries' levels of business withdrawal from Russia. Developed with recommendations from Yale University researchers, who monitor the business status of over 1,200 western companies in Russia, it considers five categories of corporate reaction to the Russo-Ukrainian war.

Britain is among the top three countries with the highest withdrawal rate, based on Yale's list. The average withdrawal rate of the 96 British companies in the list, according to YouControl's ELI index, is 4.3, with 5 being the highest.

By sector, companies that withdrew the most, suspending or stopping business with Russia are:

- Business Services

- Finance

- Retail trade

- Food manufacturing

- Heavy industry

- Light industry

- Engineering

- Construction

However, some companies from the following sectors continue to operate:

- Healthcare

- Chemical industry

- Finance.

State of the UK's largest companies' business boycott of Russia

Many of the ones that are still operating are among the world's largest companies. Particularly, seven companies from the American Forbes Global 2000, which compiles a list of the world's largest companies, have their headquarters in the UK and still cooperate with Russia.

These UK companies continue operations without making new investments:

- HSBC Holdings (Finance)

- Unilever (Chemical industry, Food manufacturing)

- GlaxoSmithKline (Healthcare)

- AstraZeneca (Healthcare)

These have reduced activity to some degree:

- Linde (Logistics)

- Legal & General Group (Finance)

- LyondellBasell Industries (Chemical industry)

But many other UK companies from the Forbes Global 200 list have shown more responsibility by suspending operations in Russia:

- Diageo

- M&G

- CNH Industrial

- Rolls-Royce Holdings

- JD Sports Fashion

And many well-known brands have entirely ceased business or withdrawn from the Russian market:

- Vodafone

- Reckitt Benckiser Group

- BP

- Imperial Brands

- Willis Towers Watson

- London Stock Exchange

- Compass Group, WPP

- J Sainsbury

- Mondi

- Centrica

- Wm Morrison Supermarkets.

UK capital in the Russian market

According to the Russian Unified State Register of Legal Entities, 2,370 business companies whose founders are British residents operate in Russia. However, YouControl has analyzed it and found that most of them have only nominal British owners while being ultimately controlled by Russian or non-British nationals.

Most companies with nominal British ownership are concentrated in Russia's capital, Moscow (41%). More than 100 British-owned companies are registered in the Novosibirsk region, St. Petersburg, and Moscow regions, where most economic growth is concentrated.

How do British companies make money in Russia?

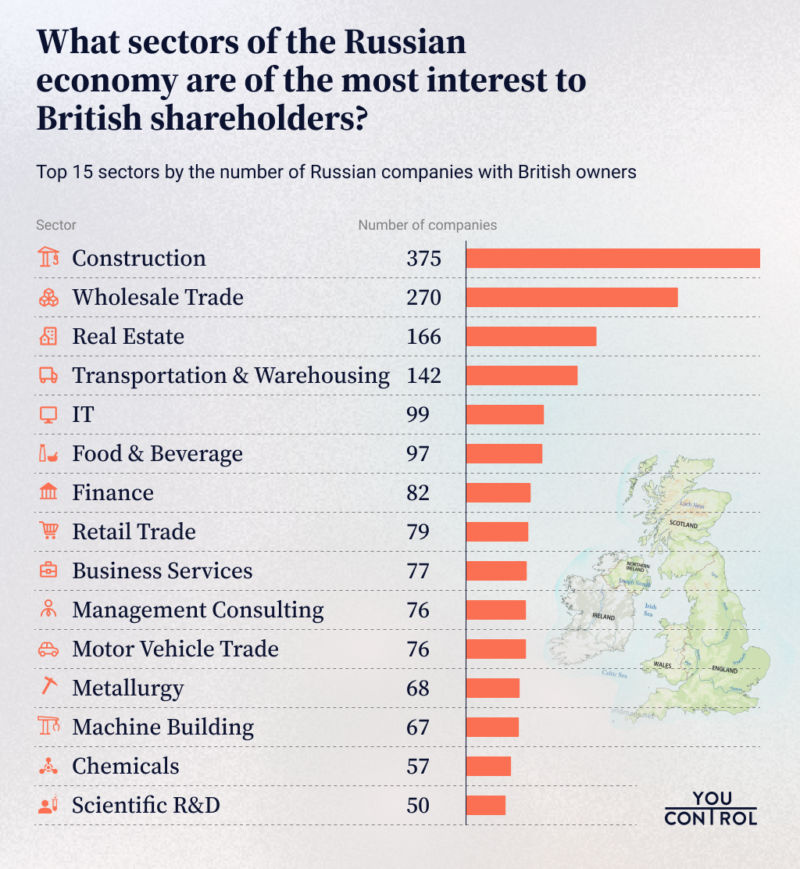

As the following graph demonstrates, companies with nominal British ownership are most active in Russia's construction industry (15.8% of all UK-owned enterprises in Russia), followed by Wholesale trade (11.4%) and Real estate transactions (7%). Transport and logistics (6%), information technology (4%), the food industry (4.1%), and finance (3.5%) are also prominent industries. Retail trade, Business services, and Management consulting complete the Top 10.

Notably, industrial sectors of the economy, such as Metallurgy, Mechanical engineering, the Chemical industry, or Oil and gas, have a smaller proportion of companies with British shareholders. This may be due to historically high barriers to non-residents' access to strategic and also highly profitable industries controlled by the pro-Kremlin oligarchic elite. The ultimate beneficiaries of industrial enterprises with a British façade are often Russians who use British law to structure their business operations within international financial-industrial groups.

The Top 20 largest Russian companies with nominal UK ownership

Upon further analyzing the companies, YouControl found that most of the UK companies in Russia are British only de jure. The UK residency of their owners is just being used as a cover for the profits of their actual owners.

Three nominally British companies from the Top 20 are under Russian control: Investment Company DENMAR-FINANCE LLC, LADOGA Group LLC, and BERKSHIRE LLC.

Further analyzing the companies, YouControl delved into the shareholders using its RuAssets international platform that allows establishing Russian business connections to any company and found two major categories.

1. Many British shareholding corporations exhibit characteristics of so-called "shell companies"

Some of the beneficiaries are companies.

For instance, three British companies (under Russian control, according to YouControl analysis of the board of directors and historical data) are nominal owners of Russian assets in the Top 20. Other are companies from South Africa, the US, Ireland, Austria, Italy, and Switzerland.

Other beneficiaries are individuals with citizenship in Latvia, Sweden, or the United Kingdom.

2. Many nominal British shareholders are startups with founders of Russian origin who have acquired foreign citizenship. The illustrative case is Wheely, a London-based car rental company, which allows users to reserve rides with a chauffeur in luxury vehicles. Its founder is Anton Chirkunov, the son of the former governor of Russia's Perm Oblast, who holds a Swiss passport and resides in the UK. Capital for Wheely was raised by billionaires of Russian origin, including the founder of Russian social media giants Vkontakte and Telegram, Pavel Durov, and other investors. Such investments by Russian billionaires are typical for these startups.

For this analysis, YouControl analyzed the state of Russian-British interdependence in the equity market based on the number of subsidiaries of companies, the most common registration places, and the scope of their activities using its RuAssets international platform, developed at the beginning of Russia's full-scale invasion of Ukraine, which is free to use for media professionals.

Read more:

- 70% of Russian war machine CEOs are still not under sanctions

- 24 Russian arms producers are still not on Western sanctions lists — report

- Meet the activists who forced Australian companies Atlassian and Canva to finally leave Russia

- This Belgian firm saved Russian financial system from collapse (and keeps doing it now)

- EU must end dependence on Russia & China, secure own security – EU top diplomat

- EU's 8th Russia sanctions package has oil price cap, falls beneath Kyiv's expectations

- Candy companies financing Russia’s war in Ukraine

- Russia's milk sector was crippled by sanctions. Then British packaging company Mondi came to the rescue

- To fight oligarchs, Britain to require foreign companies holding UK property to register ownership – UK government