Ukraine has been struggling to revive its upstream sector for a few years already. Back in 2015, the state-owned major Naftogaz (via its subsidiary, Ukrgasvydobuvannya)—the largest natural gas producer in the country, accounting for about 75 percent of Ukraine’s production—announced the “20/20 Strategy.” The goal of said strategy was to increase natural gas output until 2020 by one third, to 20 billion cubic meters (bcm) per annum (Naftogaz.com, December 2015). The ambitious program, however, was not fulfilled. Already in 2019, Naftogaz admitted that the “20/20 Strategy” had failed, as the company’s gas production had not increased significantly. Moreover, three-fourths of the company’s gas fields were found to be depleted by as much as 87 percent (Ugv.com.ua, July 22, 2019). Thus, Naftogaz’s management declared a new strategy for the coming years, focused on, among other objectives, attracting foreign investors to sign production enhancement contracts (PEC) as well as production sharing agreements (PSA) with the firm. Since then, the Ukrainian government has pursued the same approach when it came to developing the domestic gas sector.

Ukraine announced several PSA tenders as early as 2019; but it was not until late 2020 and early 2021 that agreements on the development of eight blocks were finally concluded (Agpu.org.ua, December 31, 2020; Kmu.gov.ua, January 14, 2021). The goal of attracting foreign investors has so far shown meager results. The authorities awarded seven of the eight contracts to Ukrainian companies, and only one went to a foreign firm (Ukrainian Energy, founded by the United States–based Aspect Energy). Half of the PSAs were signed with Naftogaz’s Ukrgasvydobuvannya; however, none of them included partners from abroad. This stands in stark contrast to the company’s strategy and its initial plans—Naftogaz intended to develop two of the four blocks it was awarded with Canadian firm Vermilion Energy, but the latter quit the deal in 2020 due to the prolonged PSA awarding process (Ugv.com.ua, November 27, 2020). To date, Naftogaz’s most significant upstream partnerships with foreign companies remain the $30 million PEC agreement with Romania’s Expert Petroleum (Naftogaz.com, April 21, 2020) and its recent non-binding MoUs signed with Romanian OMV Petrom (Ugv.com.ua, February 15) and Polish PGNiG (Naftogaz.com, March 30).

Independently of seeking investments in gas production, Ukraine is also actively discussing possible options for LNG imports via regasification terminals in the region. Recently, the Gas Transmission System Operator of Ukraine (GTSOU) held consultations with energy decision-makers in Poland (Tsoua.com, March 29) and Croatia (Tsoua.com, March 30), and both meetings were related to, among other topics, possible future LNG shipments to Ukraine. Presumably, the Ukrainian side seeks LNG imports not only to increase its own security of supply but also to foster the development of gas trading using Ukraine’s enormous storage potential (about 31 bcm without the gas storage in occupied Crimea—Esperis.pl, April 2020).

Trending Now

Another hypothetical option may be the development of Ukraine’s own LNG import terminal in the future. Such a project has already been discussed multiple times in the past, but it heretofore always failed due to inter alia Türkiye’s unwillingness to allow LNG-carrying vessels to transit through the narrow and heavily trafficked Bosporus Strait (Aa.com.tr, March 31, 2015). Now, however, the situation could be different, as Türkiye has just given the go-ahead to begin construction on the Istanbul Canal, a mega-project that will provide a new traffic route to divert dangerous cargoes away from the Bosporus (Maritime-Executive.com, March 31, 2021). If the canal is, indeed, built in the coming years, it could also pave the way for possible direct LNG supplies to Ukraine (see Jamestown.org, April 14).

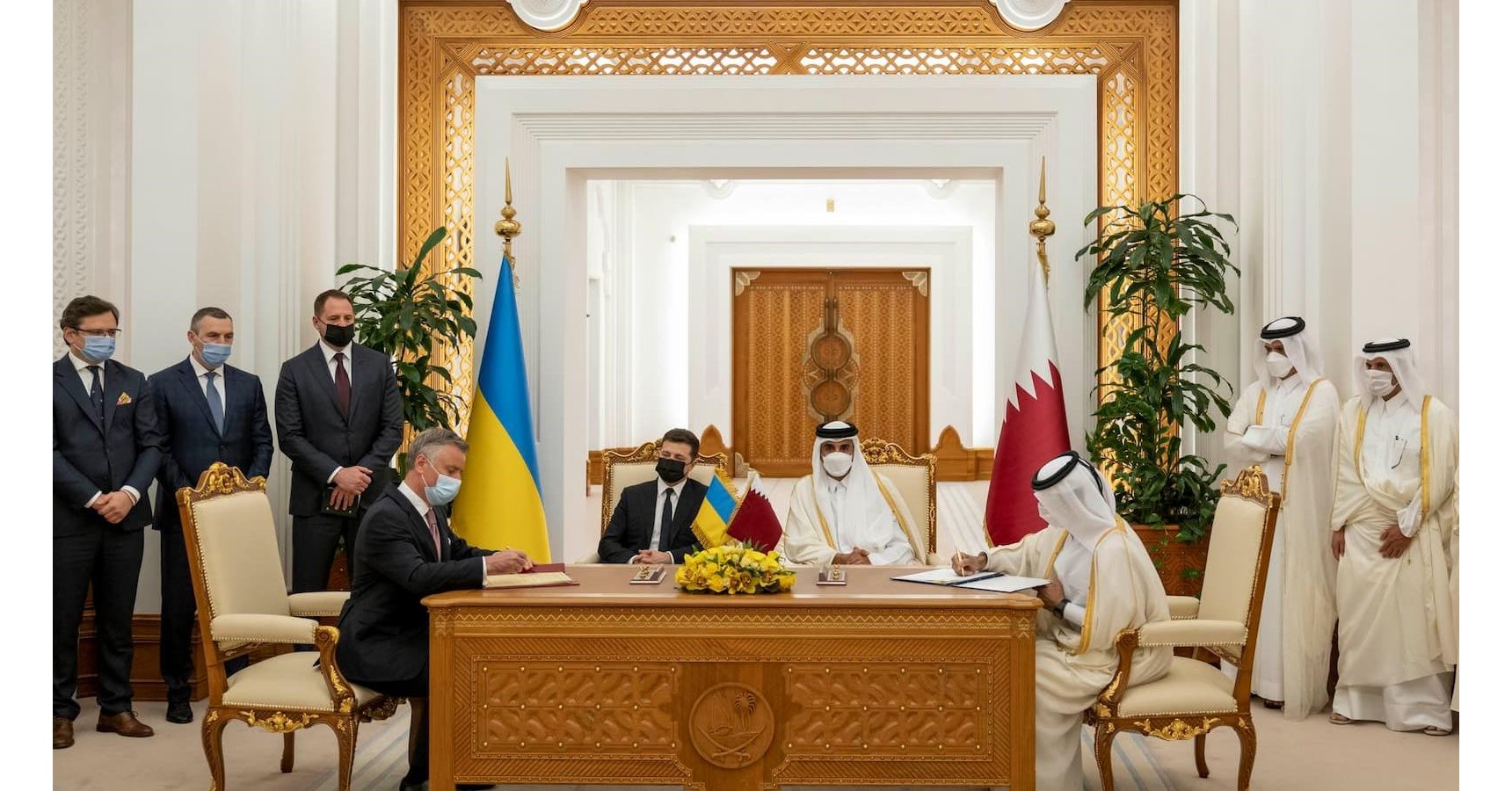

It is still far too early to speculate about what the Ukraine-Qatar MoU may bring. But Kyiv will probably be keen to convince Qatar Petroleum to enter Ukraine’s upstream sector, while Qatar is certainly exploring new market for its LNG exports, particularly since it wants to drastically increase domestic liquefaction capacity in the coming decade (Lngindustry.com, February 2021). All this sounds promising, but it bears remembering that both countries also mulled such energy cooperation three years ago (UNIAN, March 20, 2018), which ultimately came to nothing.

Read More:

- Ukraine to decide whether to buy US liquefied natural gas

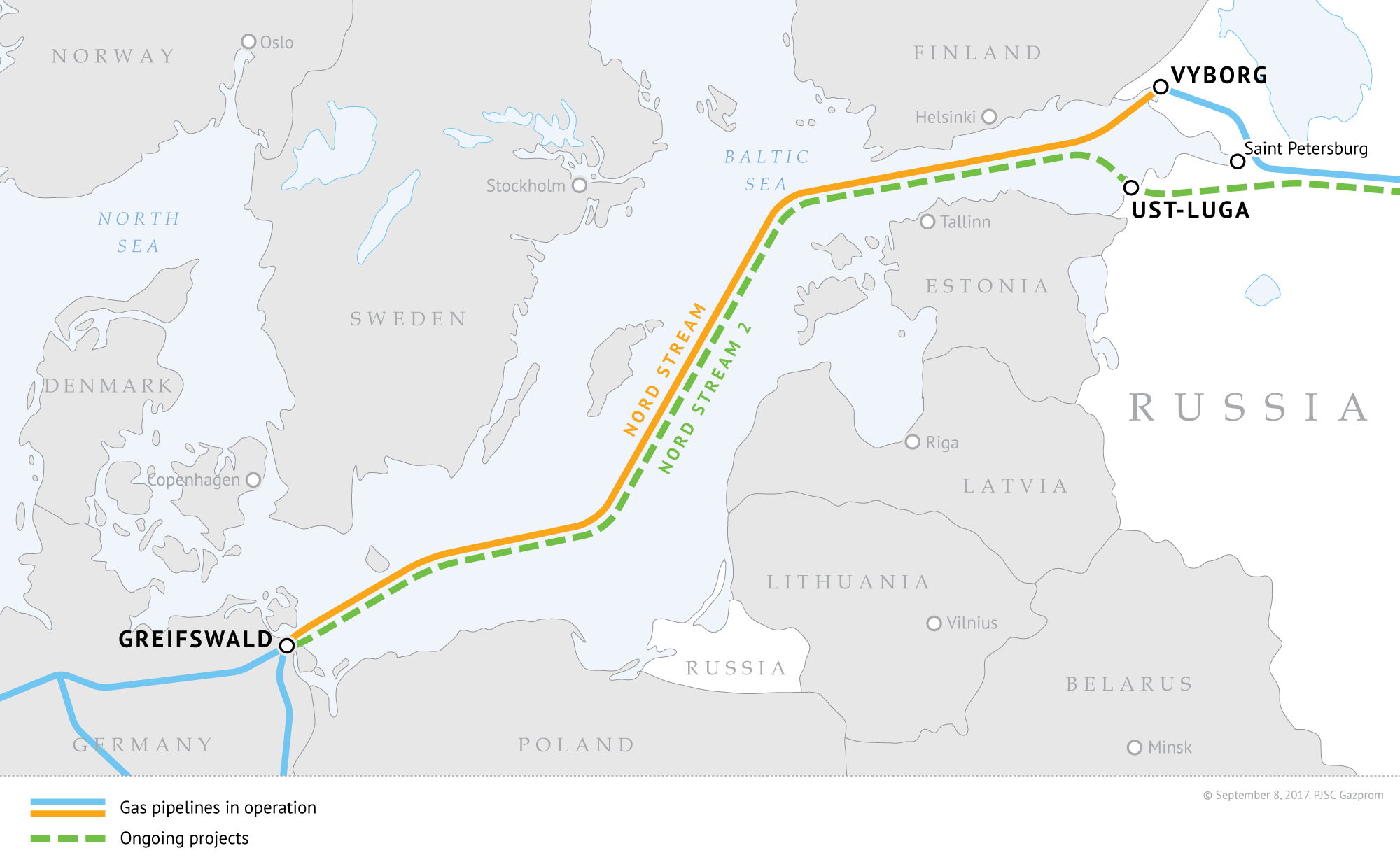

- Portnikov: The break in Putin’s pipe

- The Baltic Pipe case: disinformation at the service of the Kremlin’s energy policy

- Is freedom from the Russian gas needle possible for EU & Ukraine?

- Black Sea gas deposits – an overlooked reason for Russia’s occupation of Crimea

- Ukrainian government sets ambitious goals for privatization of state enterprises

- The secret Soviet council which established the Kremlin’s gas monopoly on Europe

- Turkish Stream or Russian Stream?

- Putin’s gas pipelines and Ukraine

- Why Ukraine needs Norwegian gas