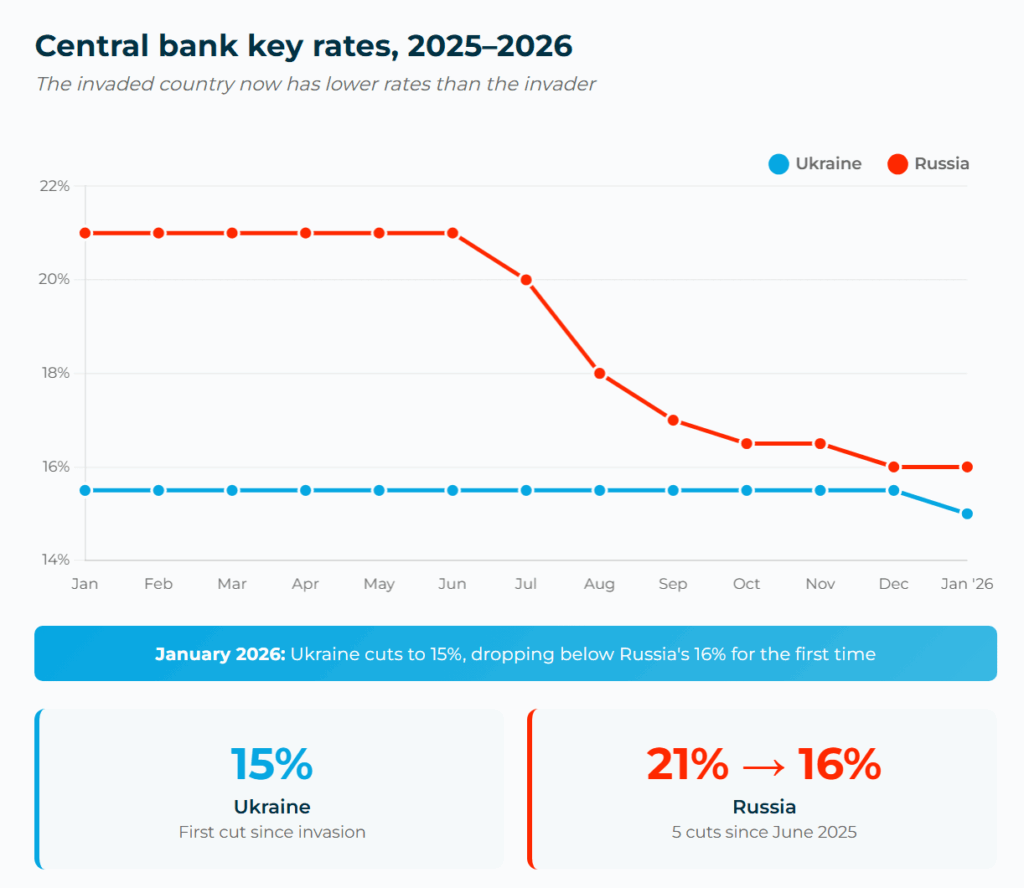

Ukraine’s central bank cut its key interest rate for the first time since April 2024—lowering it from 15.5% to 15% on 28 January—but the decision split the monetary policy committee three ways, according to National Bank of Ukraine minutes published on 9 February.

Ukraine is now running a looser monetary policy than Russia.

Eight of eleven members voted for the 0.5 percentage point cut, two wanted to go deeper to 14.5%, and one argued for no cut at all. The result: Ukraine’s key rate now sits a percentage point below Russia’s 16%.

Ukraine is now running a looser monetary policy than Russia. In December, the same committee voted 10-1 to hold rates steady. The EU’s €90 billion ($107 billion) loan for 2026–2027 removed the funding uncertainty that had paralyzed the committee. But Russia’s bombing campaign against energy infrastructure, which the NBU now treats as the primary threat to prices, kept the cut modest.

Ukraine cuts rates for the first time since invasion—now lower than Russia’s (INFOGRAPHIC)

Bombing as an inflation weapon

Both consumer and core inflation fell to 8% year-on-year in December—down from 9.3% in November and well ahead of the NBU’s own forecasts. Record harvests and tight monetary policy did the work. But the NBU’s early January data already shows the trend reversing: monthly price growth is accelerating again as energy destruction feeds through to costs.

Energy costs hit consumers through market prices and government-mandated tariff increases.

The NBU revised its electricity deficit forecast from 3% to 6% for 2026, after Russia’s winter strikes broke Kyiv’s energy ring and damaged every power plant in the country. Energy costs hit consumers through market prices and government-mandated tariff increases.

One committee member warned that the budget deficit—set at 19% of GDP for 2026, already lower than previous years—will likely widen as defense and reconstruction spending grows. Migration has also worsened in recent months, deepening labor shortages that keep wages and prices elevated.

Three visions, one bank

The three-way split maps three different readings of how much room Ukraine has.

The majority (eight members) see limited space—perhaps reaching 14.5% by year’s end if risks don’t improve. Ukrainians piled into hryvnia savings accounts and government bonds late in 2025, locking in yields before the expected cut. Some banks had already started lowering deposit rates in January. The majority wants to avoid a rush into dollars by keeping hryvnia savings attractive. International reserves stand at historic highs, but the majority argues that the cushion exists precisely because the NBU has been cautious.

Trending Now

The doves (two members) pushed for a full percentage-point cut to 14.5%. Their case: inflation will keep falling through mid-2026 thanks to the lingering effects of last year’s record harvests, and hryvnia savings would remain attractive even with lower yields. Some banks already offer below-market rates and still attract deposits. A bolder cut, they argued, would send a clearer signal to businesses trying to borrow while energy infrastructure crumbles around them.

The lone hawk wanted no cut at all. The NBU’s own 2026 inflation forecast worsened since October, and expectations remain stubbornly high. Starting a series of cuts you might have to reverse, he argued, would damage credibility more than waiting.

Two paths to the same rate

Ukraine got to 15% by holding steady for a year while inflation dropped from nearly 16% to 8%, then cutting once. Russia reached 16% by slashing from a 21% record peak through five consecutive cuts since June 2025, chasing an economy overheated by war spending. The numbers converged. The paths did not.

If bombing intensifies or prices accelerate, the NBU stops cutting.

All eleven NBU committee members expect further cuts in 2026. They disagree on how many. If bombing intensifies or prices accelerate, the committee agreed, the NBU stops cutting. If risks ease, it moves faster. For a central bank that raised rates three times between December 2024 and March 2025, reversals are not hypothetical.