S&P Global Ratings raised Ukraine’s foreign currency credit rating from “selective default” to CCC+ on 22 January, after Ukraine completed a $2.6 billion debt swap that pushed major payments years into the future. The upgrade marks the first time since August 2024 that Ukraine is no longer classified as defaulting on its foreign debt.

How the debt swap worked

Ukraine’s “selective default” status came from missing a $670 million payment in June 2025 on unusual bonds called GDP warrants, S&P reported. Issued in 2015 during a previous debt crisis, these bonds paid investors more when Ukraine’s economy grew—creditors would share the upside if the country recovered.

The solution: investors agreed to exchange their GDP warrants for new, simpler bonds.

Russia’s full-scale invasion ended that bet. With GDP growth crushed and war costs mounting, Ukraine couldn’t pay.

The solution: investors agreed to exchange their GDP warrants for new, simpler bonds maturing between 2030 and 2032 with fixed payments. For every $1 of old warrants, investors received $1.34 in new bonds—compensation for giving up the growth-linked upside and waiting longer for repayment.

Four years without major payments

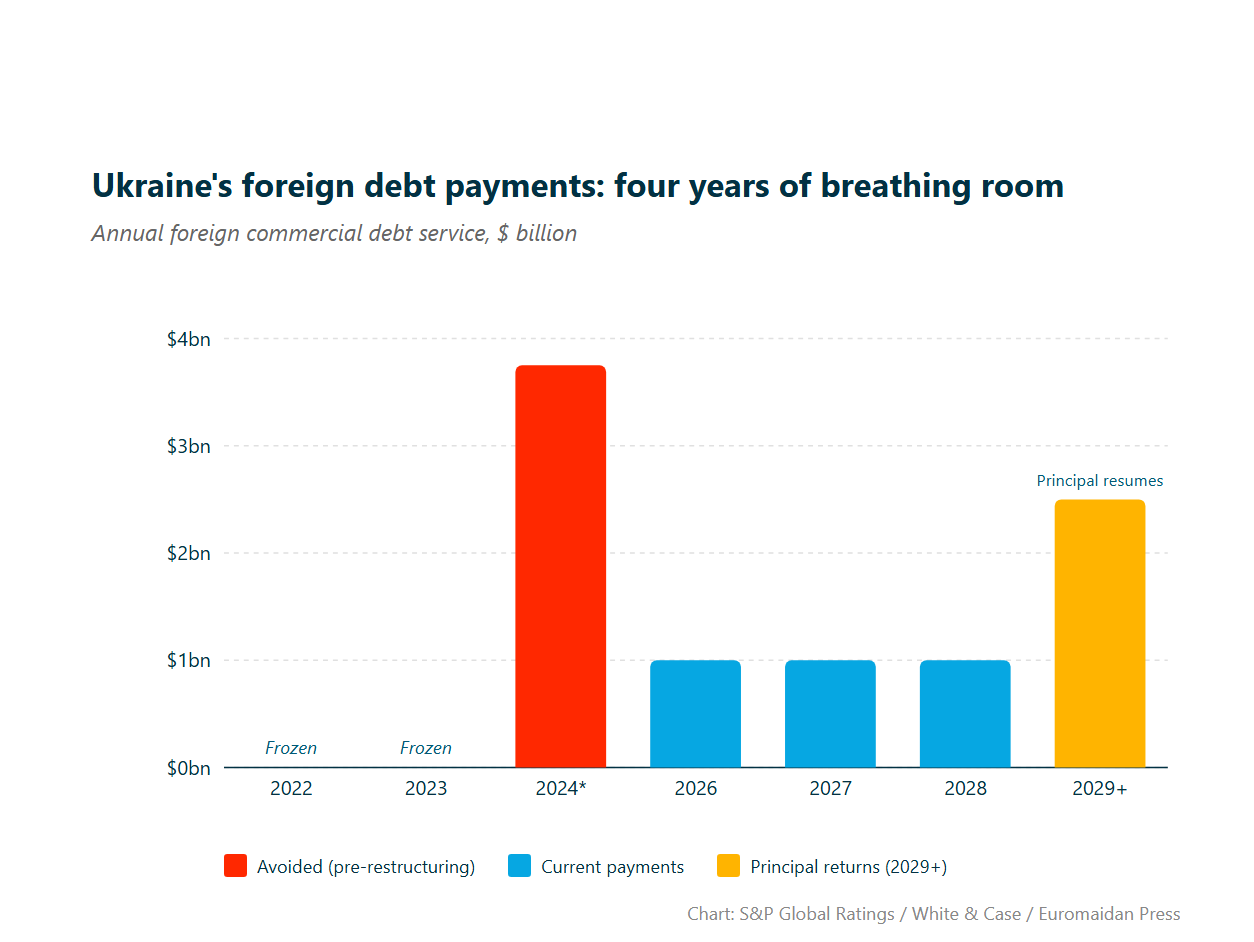

The practical change: Ukraine’s foreign debt payments dropped from billions annually to roughly $1 billion per year for the next three years. The first principal repayment on foreign bonds isn’t due until 2029.

That’s four years during which Ukraine can direct money toward defense rather than creditors.

Combined with 2024’s larger restructuring that wrote off $9 billion in Eurobond debt, Ukraine has pushed its debt cliff back by half a decade.

Ukraine’s foreign currency reserves hit a record $57.3 billion by end-2025—a cushion that supports the country’s ability to meet obligations.

What the rating means

Credit ratings measure how likely a country is to pay back what it borrows. “Selective default” meant Ukraine had stopped paying some creditors. CCC+ means “vulnerable”—still risky, but no longer failing to pay.

The upgrade doesn’t mean Ukraine’s finances are healthy.

For comparison, the United States holds AAA, the highest rating. Russia was downgraded to junk by all major agencies after invading Ukraine in 2022; they later withdrew their ratings entirely and no longer assess Russia.

The upgrade doesn’t mean Ukraine’s finances are healthy. S&P called Ukraine’s capacity to meet its commitments “vulnerable and dependent on favorable financial and economic conditions, including the evolution of the war.”

Trending Now

What keeps Ukraine vulnerable

Russian forces occupy roughly 20% of Ukraine’s territory, accounting for 8-9% of pre-war GDP. Almost one-third of Ukrainians have been displaced. Reconstruction costs are estimated at $500 billion, two and a half times Ukraine’s annual economic output.

The rating depends on continued Western support. The €90 billion EU loan approved in December covers Ukraine’s estimated needs through 2027, with first disbursements expected in April. Ukraine would only repay this loan if the war ends and Russia pays reparations.

The agency said it could downgrade Ukraine if the security situation deteriorates or if commercial debt needs another restructuring.

S&P’s outlook is stable for now. The agency said it could downgrade Ukraine if the security situation deteriorates or if commercial debt needs another restructuring. An upgrade would require significant improvement in the security environment and medium-term economic outlook.

A small portion of Ukraine’s commercial debt remains unpaid—a bond issued by a state power utility that the government guaranteed, plus a foreign bank loan. Together, these represent less than 1% of total debt. Restructuring talks continue, but these won’t trigger problems for Ukraine’s other obligations.