Oil prices fell on Wednesday as US sanctions forced Russia’s Lukoil into a $22 billion global fire sale—yet markets focused on rising inventories rather than the dismantling of one of Russia’s largest international empires.

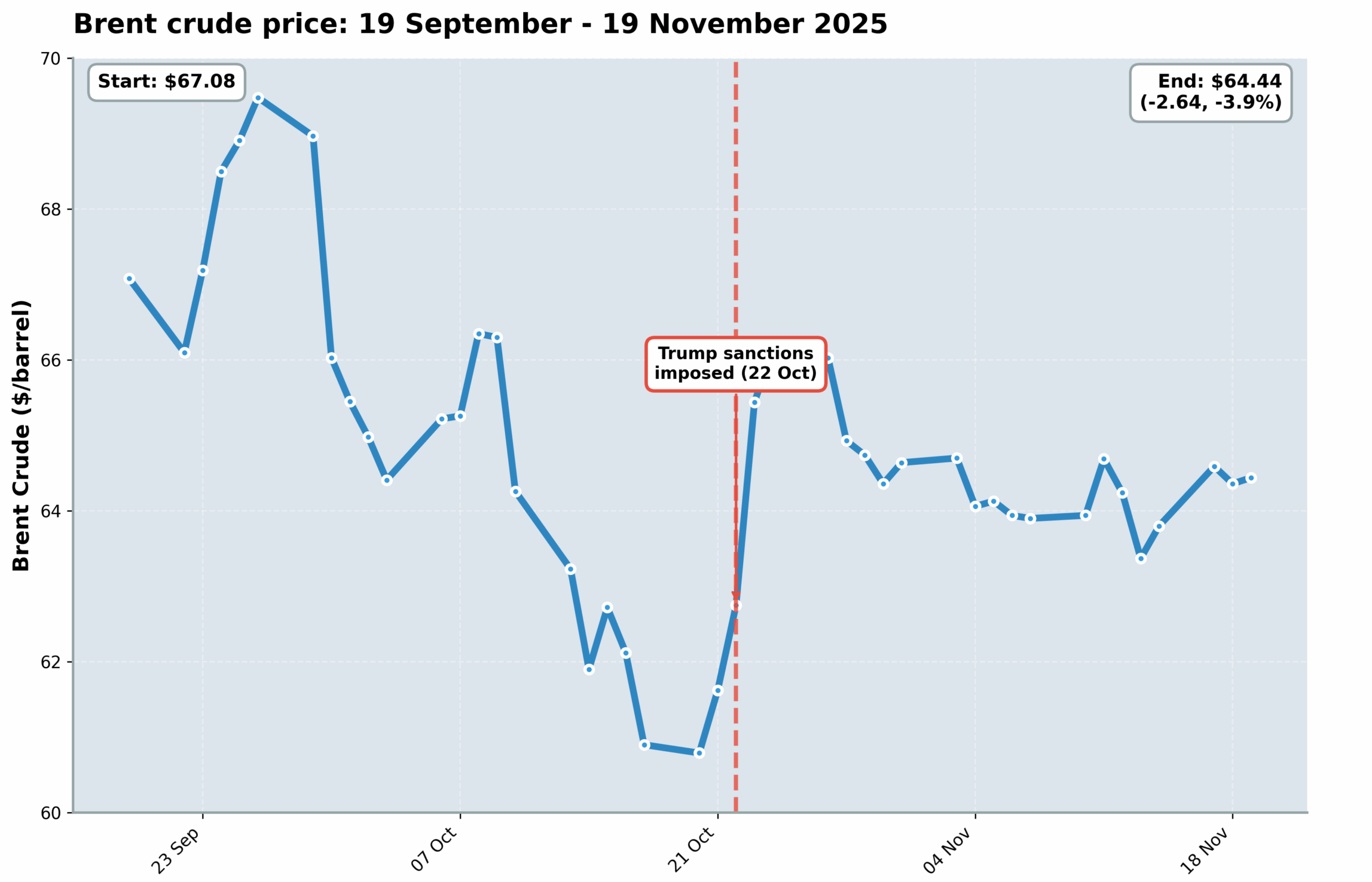

Brent crude dropped 0.3% to $64.67 per barrel by midday, with traders watching weekly supply reports while missing the strategic story: Russia permanently losing three decades of international expansion.

Markets missed the bigger story.

Trump’s sanctions, imposed on 22 October after nine months of unsuccessful negotiations with Putin, are forcing Russia’s second-largest oil producer to abandon assets from Iraq to Europe. Iraq already stopped all payments on Lukoil’s biggest foreign asset. European nations are seizing refineries outright.

American oil majors circle for acquisitions at sanctions-forced discounts. Yet prices reflect supply concerns rather than Moscow’s permanent loss of strategic positioning—an irony intensified by China’s earlier stockpiling, which now suppresses prices precisely as Russia bleeds.

Iraq is bleeding Russia’s largest foreign asset

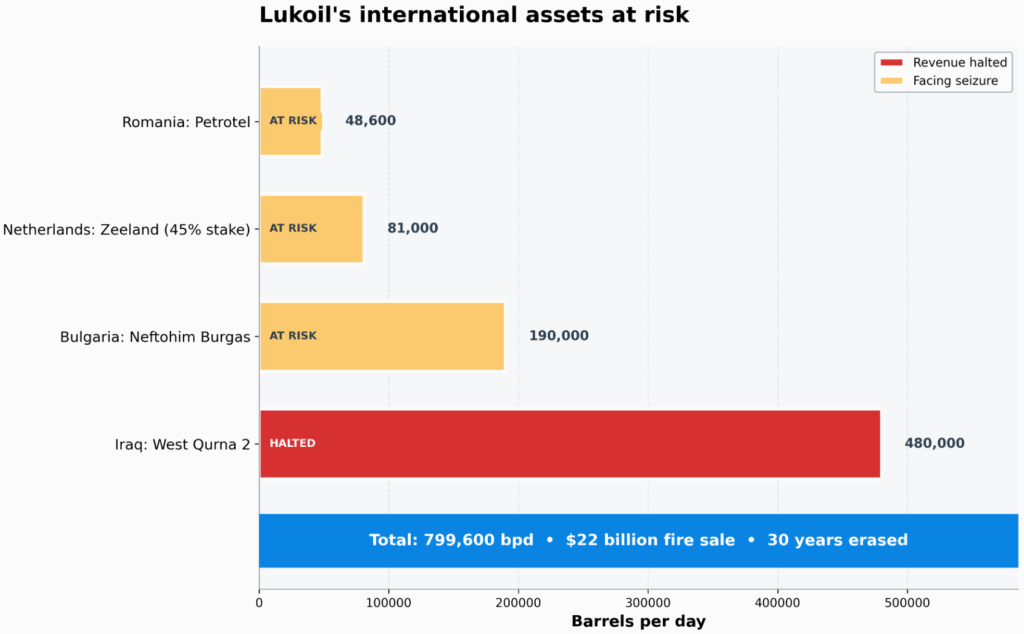

Lukoil’s crown jewel—a 75% stake in Iraq’s West Qurna 2 oilfield producing over 480,000 barrels daily—stopped generating revenue for Moscow in early November. Iraq suspended all cash and crude payments to Lukoil immediately after US sanctions hit, with the state oil company SOMO canceling shipments.

By 10 November, Lukoil declared force majeure—a legal notification that it cannot fulfill its contractual obligations due to circumstances beyond its control, thereby protecting the company from penalties while signaling that operations have effectively stopped. Iraqi officials confirmed two Western firms and one Chinese company are now negotiating to acquire the Russian stake.

This immediate revenue cutoff shows sanctions working in real-time, even before asset sales complete.

Russian oil prices hit multi-year lows following the sanctions, with nearly a dozen prominent Indian and Chinese purchasers pausing December deliveries.

American majors position for spoils

Exxon Mobil has joined Chevron in pursuing parts of Lukoil’s international portfolio, according to Investing.com. Both US oil giants are eyeing stakes in Kazakhstan’s Karachaganak and Tengiz fields, where they already operate alongside Lukoil—positioning themselves to acquire strategic assets at what amounts to a sanctions-forced discount.

Exxon is also studying a potential bid for West Qurna 2 north of Basra in southern Iraq, where it previously operated the neighboring West Qurna 1 project before exiting last year. US private equity firm Carlyle and Abu Dhabi National Oil Company are also exploring options.

The scramble converts sanctions pressure into Western strategic positioning: Moscow loses leverage, American companies gain footholds.

The US Treasury cleared potential buyers to negotiate with Lukoil until 13 December, with a 21 November deadline for companies to cease all dealings with the sanctioned Russian firm or face secondary sanctions cutting them off from the dollar-based financial system.

European seizures add pressure

Bulgaria and Romania are moving to seize rather than purchase Lukoil refineries on their territory. Bulgaria’s government made legal changes to expropriate the 190,000-barrel-per-day Neftohim Burgas refinery, the largest in the Balkans.

Romania’s president indicated the country could take over the 48,600 bpd Petrotel refinery. These seizures mean Russia may receive nothing for some of Europe's most valuable energy infrastructure assets.

Lukoil spent decades building them to gain political leverage and hard-currency revenue. The Netherlands facility, which holds a 45% stake in the 180,000 bpd Zeeland refinery, operated in conjunction with France’s TotalEnergies, faces similar pressures.

Lukoil’s international portfolio spans refineries, over 2,000 filling stations, and oil field stakes across Europe, Central Asia, the Middle East, Africa, and the Americas. The company produces 500,000 barrels of oil daily outside Russia—0.5% of global output—generating an estimated $4-5 billion annually in revenue from its foreign operations.

Ukrainian strikes compound Russian woes

While sanctions force asset sales, Ukrainian long-range strikes have systematically targeted Russian refining capacity. Ukrainian forces struck the Novokuybyshevsk refinery in Samara Oblast on 16 November—the sixth attack on that facility alone this year. The plant, which processes 5.74 million tons of crude annually, had just resumed operations in early November after an 18 October strike forced a complete shutdown.

Ukraine’s General Staff reported hitting the Ryazan refinery on 15 November and the Saratov plant on 11 November (its seventh strike this year).

Trending Now

Ukraine’s Main Directorate of Intelligence struck the Moscow region’s Koltsevoye pipeline on 1 November, destroying all three lines of the 400-kilometer system. The pipeline transports 3 million tonnes of jet fuel, 2.8 million tonnes of diesel, and 1.6 million tonnes of petrol annually from refineries across multiple regions.

Ukrainian attacks have struck more than 50% of Russia’s 38 major refineries since early 2025, according to Russian sources. The campaign aims to disrupt military fuel logistics and undermine export revenues funding the war.

The oversupply paradox

Despite this coordinated military and economic pressure, oil prices fell on Wednesday, 19 November, as the American Petroleum Institute reported US crude stocks rose 4.45 million barrels in the week ended 14 November, while gasoline inventories climbed 1.55 million barrels.

“Overall, the report was relatively bearish,” said ING commodities strategists, signaling expectations for continued price declines. But they cautioned that “market participants appear more concerned about supply risks than the odds of a surplus going forward.”

The price decline creates a puzzle: sanctions and Ukrainian strikes should tighten supply and drive prices higher, yet markets focus on short-term inventory builds.

Commerzbank analyst Barbara Lambrecht explained that oversupply hasn’t materialized yet because “large quantities of crude oil have flowed into building oil reserves, especially in China.” She warned that this cushion is diminishing, and if recent sanctions on Russian oil producers take full effect, “oversupply on the world market should increase.”

The irony: China’s earlier stockpiling—which gave Russia a crucial buyer as Western sanctions intensified—now suppresses global prices precisely as Moscow’s energy empire crumbles. Beijing bought heavily when Russia needed sales, building reserves that now flood the market and keep prices low even as Russia loses revenue-generating assets permanently.

China’s Yulong refinery lifts Russian crude imports to 400,000 barrels a day after EU, UK sanctions

Late pressure finally working

The Trump administration’s October sanctions on Rosneft and Lukoil marked the first significant US restrictions on Russia’s energy sector since the president took office in January. The timing came nine months into Trump’s presidency, following his unsuccessful attempt to negotiate directly with Putin.

US Treasury Secretary Scott Bessent said the measures aim to change Moscow’s behavior after Putin’s “refusal to end this senseless war.” The two companies together account for roughly 55% of Russia’s oil output.

For Lukoil, the sanctions mark the end of three decades of global expansion.

What was once Russia’s most internationally integrated energy firm is retreating into a smaller, regionally constrained operator dependent on state backing at home. The company retains five major domestic refineries processing tens of millions of barrels annually to supply Russia’s wartime logistics, but loses the external cushion that provided financial resilience.

The fire sale shows economic warfare at the structural level—Russia permanently losing strategic footholds in Kazakhstan, Iraq, and Europe, with Western companies positioned to acquire key assets at discounts.

Iraq’s West Qurna 2 alone represents 480,000 barrels daily, shifting from Moscow’s control. European refineries change hands. Kazakhstan’s partnerships dissolve. Within months, assets Moscow spent thirty years acquiring will operate under new ownership.

The paradox reveals competing timeframes: traders watching weekly inventory reports while Lukoil loses revenue streams, refineries, and international leverage built over decades. The structural shift is permanent. The price movement is noise.

Read also

-

Reuters: US firm Carlyle seeks to buy Russia’s Lukoil foreign assets

-

Leak exposes Kremlin-funded “legal aid” network as new front in Russian hybrid warfare in Ukraine

-

Russia kills 26 civilians in Ternopil, wounds more than a hundred across Ukraine in massive air assault on power grid (PICTURES, UPDATED)