Russia is making more money from liquefied natural gas (LNG) than it ever did from pipeline exports through Ukraine, exposing a critical flaw in Western sanctions. As Europe celebrates the end of Russian pipeline dominance, the Kremlin's Arctic gas giant Novatek has quietly doubled its share of EU imports, turning supposed energy independence into a mere illusion.

This shift represents not just an energy trade pattern, but a deliberate strategy to maintain Russia's grip on European energy markets despite sanctions.

At the heart of this strategy stands the Russian LNG giant Novatek.

While Novatek operates as a private company, with major shareholders including Gennady Timchenko (a Putin associate) and Leonid Mikhelson, its independence is largely formal. Despite not being state-owned, the company's strategic importance to Russia's energy sector and its leadership's close ties to the Kremlin suggest it operates in alignment with Russian government interests rather than as a truly independent entity.

Novatek and its trading subsidiaries in Switzerland and Singapore now operate as Russia's new energy ambassadors, methodically expanding their presence in global LNG markets while avoiding sanctions that have crippled other parts of Russia's energy sector.

The company's success relies on a sophisticated market strategy. Unlike rigid pipeline contracts, LNG can be traded in two ways: through long-term commitments or on the more flexible "spot market," where gas is bought and sold for immediate delivery at current prices. Novatek has masterfully exploited this system, using competitive spot market prices to undercut American suppliers and maintain its European presence.

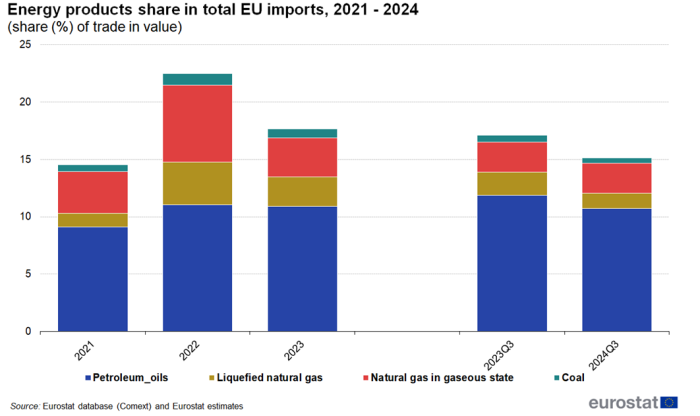

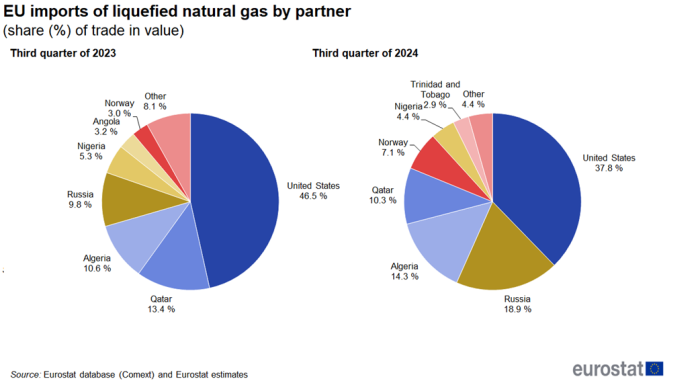

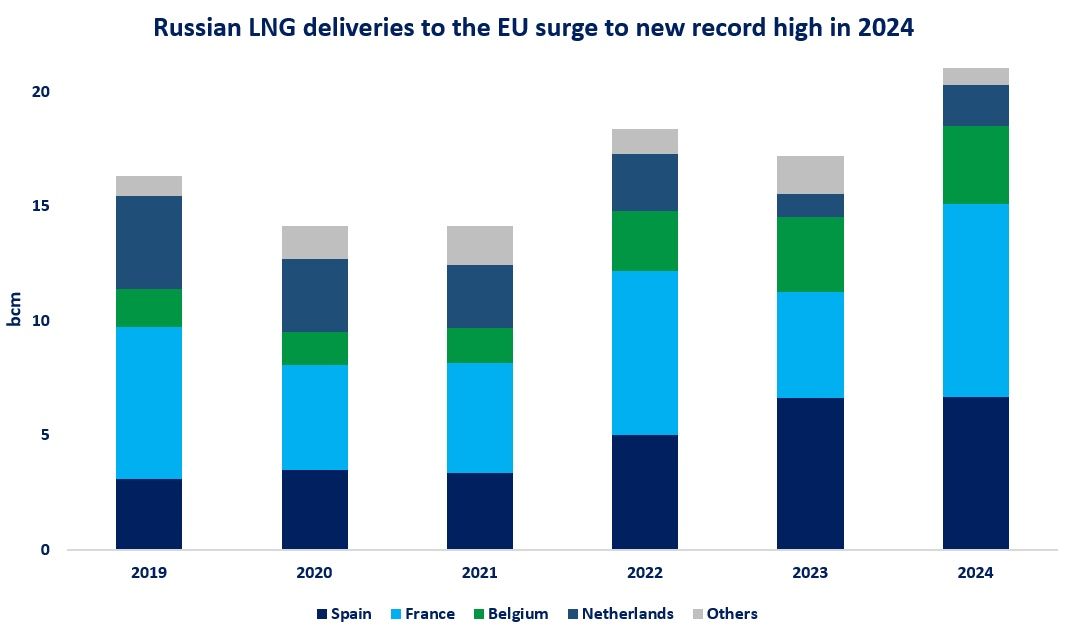

This strategy is working: while total LNG imports to the EU decreased in 2024, Russia's share of these imports has increased to 18.9% in Q3 2024, up from 9.8% in Q3 2023.

This growth occurred not because Europe needs Russian gas -- claims about energy security ring increasingly hollow -- but because Novatek's aggressive pricing on spot markets has pushed out US suppliers.

This shift happened because traders simply chose cheaper Russian LNG over US supplies on the spot market. The pattern exposes a stark contradiction: while Europe can clearly operate with less gas overall, it's allowing market prices to drive increased dependence on Russian supplies.

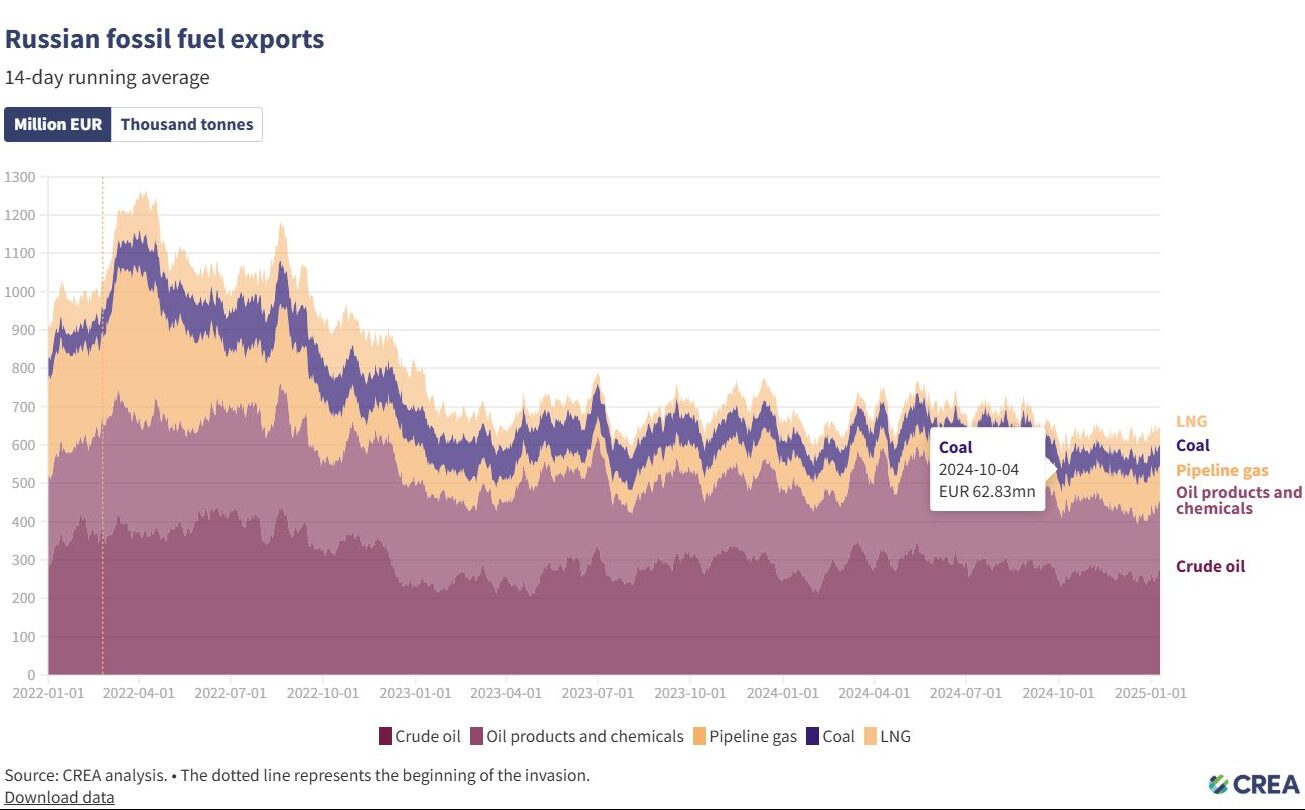

This transformation is no accident. Following Russia's full-scale invasion of Ukraine in February 2022, Gazprom's pipeline exports to Europe collapsed, while Novatek's business and presence in the EU energy market expanded significantly.

The end of pipeline gas transit through Ukraine on 1 January 2025 has only amplified the strategic importance of LNG exports and Novatek's operations for the Kremlin's revenue streams.

The scale of this trade is substantial. According to the Finnish think tank CREA, European ports received 17.5 million tons of Russian LNG in 2024, valued at €7.3 billion. Notably, 20% of these imports were subsequently re-exported to third countries.

In comparison, Gazprom's revenue from pipeline transit through Ukraine amounted to just €5.8 billion during the same period, highlighting LNG's growing dominance in Russia's energy export strategy.

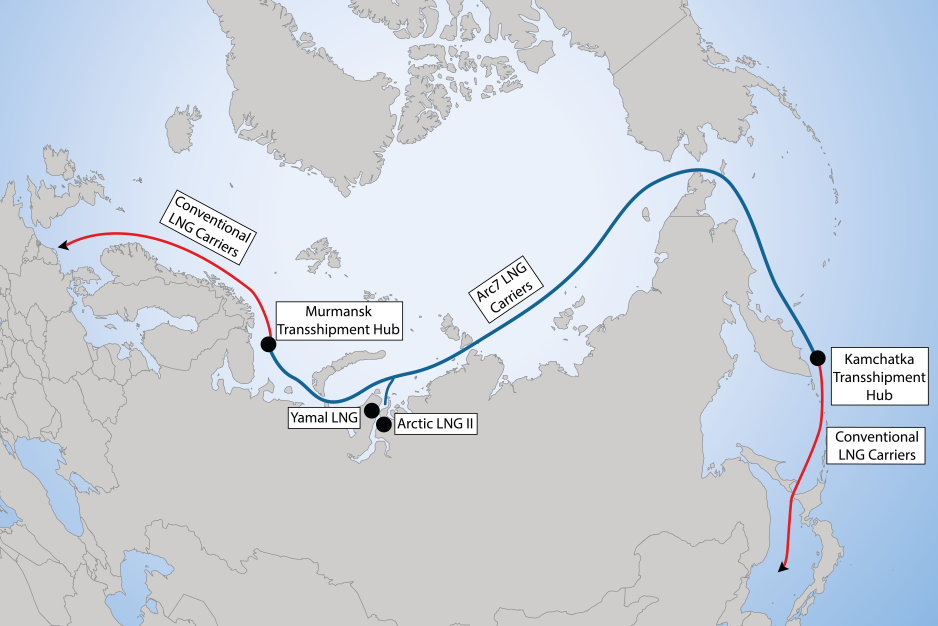

Most of Russia's LNG flows from the Arctic - specifically the Yamal LNG terminal, Novatek's flagship asset. While US sanctions have blocked Novatek's second major project, Arctic LNG 2, the company maintains aggressive expansion plans with Kremlin support. French energy giant TotalEnergies and Chinese investors remain key partners in this Arctic gas empire, their partnerships facilitated directly by Moscow.

Since 2017, when Yamal LNG first began shipping to Europe, the operation has grown dramatically - EU imports hit 16.5 million tonnes in 2024, surpassing previous years' volumes of around 15.2 million tonnes.

This volume significantly exceeds the 15.21 and 15.18 million tonnes recorded in 2022 and 2023, driven by increased spot market purchases.

But this growth reveals a critical weakness in Europe's energy strategy. CREA's analysis of shipping data shows that while half of Russian LNG imports come through fixed long-term contracts, the other half flows through more flexible arrangements. Of these flexible purchases, 27% happen through spot market trades -- one-time deals where gas is bought and sold for immediate delivery at current market prices.

Unlike long-term contracts that bind buyers for years, these spot market purchases could stop tomorrow - if Europe chooses to act.

Recent US sanctions on 10 January targeted two smaller Russian LNG facilities in the Baltics --Gazprom's Portovaya LNG and Novatek's Cryogas Vysotsk -- but left the massive Yamal operation untouched. Russia's response reveals its concerns: Novatek's senior executive Denis Solovyov traveled to Washington seeking relief from sanctions, while company representatives maintained business connections at the Berlin LNG Summit through their Singapore subsidiary.

This dual strategy -- lobbying in Washington while preserving European market access through overseas entities -- shows how Novatek adapts to maintain its energy influence.

With Trump's incoming administration, the responsibility for further action against Russian LNG shifts decisively to the EU and UK.

Europe's first attempt to restrict this trade could backfire. The upcoming March 2025 ban on LNG transshipment through EU ports aims to cut Russia's access to global markets. Currently, when Russian LNG arrives at European ports, about 20% continues to other continents. But stopping this practice might trap more Russian gas in Europe -- exactly the opposite of what sanctions intended.

Recent market data shows concerning early signs of this scenario unfolding.

Market data already shows this shift beginning: Yamal LNG's spot market sales jumped from 23% to 33% from 2023 to 2024. Analysts warn that once the transshipment ban takes effect, even more Russian LNG could flood the spot market, potentially strengthening Russia's presence in EU markets.

Brussels and London hold the tools to end this dependence. The EU's new Energy Commissioner promises a plan by March to sever Russian energy ties. British parliamentarians are questioning why UK firms still manage Russian LNG tankers and provide their insurance, even as Britain bans Russian gas imports.

But promises and questions aren't enough - Europe needs decisive action to close the LNG loophole that keeps its energy markets open to Russian influence. As the Kremlin weaponizes energy supplies and continues its assault on Ukraine, allowing this backdoor to remain open undermines every other sanction in place.

The path forward is clear: complete phase-out of Russian gas imports represents the only credible economic response to Russia's escalating war of aggression, including brutal attacks on civilian energy infrastructure in Ukraine and the Baltic Sea.

Major tests for consistency and credibility now lie before officials in Brussels and London, who possess the necessary means to end Russian gas dominance in European energy markets. The pressing question remains whether they will demonstrate the political will to use these tools effectively.

Related:

- Britain must stop Glasgow firm’s Arctic ships from funding Putin’s war

- US, UK block Russia’s oil giants in largest-ever energy sanctions package, target shadow fleet

- The end of an era: Russia loses its gas grip on Europe

- Senator silenced: how France’s TotalEnergies is allergic to transparency on Russia