Ukrainian businesses borrowed at interest rates above 15% throughout 2025 and increasingly turned down cheap government subsidies to do it—a sign they see returns worth the cost, even in wartime. But the same companies taking on expensive debt now face a harder problem: finding anyone to do the work.

Market-rate loans to businesses grew by more than 40% over the year, while subsidized lending through the government’s “5-7-9%” program grew just 12%, according to the National Bank of Ukraine’s Banking Sector Review published on 19 February.

Companies aren’t just covering cash flow gaps. They’re making multi-year investment bets.

The subsidized share of the business loan portfolio dropped five percentage points to 30%. The NBU called the shift a result of its Credit Development Strategy.

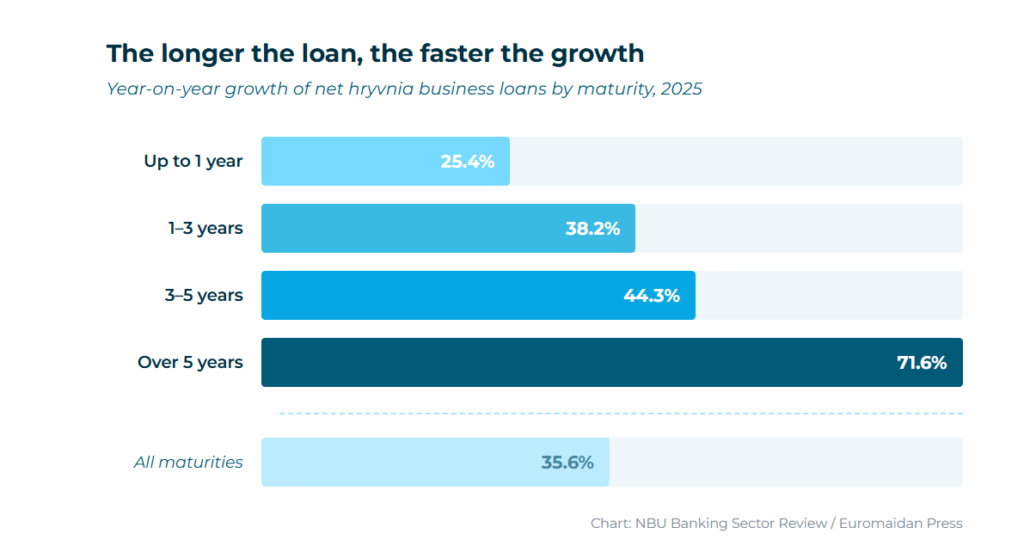

The most striking detail is the maturity profile. Loans with terms over three years grew roughly 50% year-on-year—far outpacing shorter-term borrowing at 31%. Companies aren’t just covering cash flow gaps. They’re making multi-year investment bets in a country that gets bombed daily.

Where the money is going

Wholesale trade, agriculture, food processing, energy, machine-building, and defense industry companies all sharply increased their borrowing. Lending to state-owned energy corporations also grew, pushing their share of the loan portfolio up 2.5 percentage points to 14.8%—reflecting the massive cost of rebuilding power infrastructure after Russian strikes.

State banks still hold 52% of the sector’s net assets and 61.8% of household deposits.

In the second half of the year, large and mid-sized agricultural and energy companies increasingly borrowed in foreign currency—dollars and euros—with net foreign-currency business loans growing 23.2% over the year.

Foreign-owned banks grew their hryvnia loan portfolios fastest, at 45.7% year-on-year, compared with 34% for state-owned banks. But the state bank growth was driven primarily by demand from state corporations, not private enterprise. And state banks still hold 52% of the sector’s net assets and 61.8% of household deposits.

The quality is real

Loan quality improved alongside quantity. The share of non-performing loans fell to 13.9%—the lowest in over 15 years—down from 30.3% a year earlier. The biggest drop came from state banks writing off legacy debts dating to the Privatbank nationalization era. But the NBU noted that the default rate on new corporate loans stayed below 3% throughout the year—better than pre-invasion averages.

Hryvnia household deposits grew 18.6% over the year, and the dollarization of household deposits has been falling for three quarters straight.

Ukrainians are also trusting the hryvnia more. Client fund dollarization fell to 28.6%, down 2.8 percentage points. In wartime, people typically flee to hard currency.

In Ukraine, hryvnia household deposits grew 18.6% over the year, and the dollarization of household deposits has been falling for three quarters straight. The NBU cut its key rate from 15.5% to 15.0% in January 2026, the first easing since March 2025.

Trending Now

The sector earned 126.8 billion hryvnias ($3 billion) in profit in 2025—but that 39.4% year-on-year headline growth is misleading. Pre-tax profit grew only 13.3%.

Most of the gap came from a lower tax rate, not better performance. And that tax advantage reverses in 2026: the NBU’s own Financial Stability Report warned that a new 50% corporate income tax rate for banks “limits banks’ capacities to grow their operations further.”

The ceiling nobody can lend past

All of this exists within an economy that grew just 1.8% in 2025—below most forecasts—as Russian strikes on energy infrastructure constrained industrial output, which fell 2.4%.

The IMF projects Ukraine’s population could fall to around 34 million by 2030.

But the hardest constraint isn’t energy. It’s people. The number of full-time employees in Ukraine fell from 7 million in 2021 to 5.3 million by September 2025. Labor shortages are now the top concern for 60% of Ukrainian businesses, outranking even security risks. The IMF projects Ukraine’s population could fall to around 34 million by 2030—down from an estimated 37 million in 2023.

Ukraine’s economy adapts to war, but hits a ceiling money can’t break (INFOGRAPHICS)

Banks can lend. Businesses want to borrow. The money is there, the confidence is there, and borrowers are even willing to commit to three-year-plus terms at 15% interest. What isn’t there is the workforce to staff the businesses taking on that debt. Capital has found the ceiling that capital alone cannot fix.