France’s TotalEnergies has taken full ownership of the Zeeland refinery in the Netherlands, re-acquiring the 45% stake held by Russia’s sanctioned oil giant Lukoil.

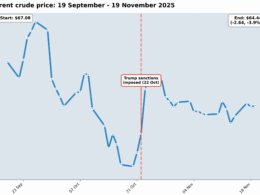

US sanctions imposed on Lukoil are now forcing Russia’s second-largest oil producer to sell off an international empire.

Lukoil bought that stake for about $725 million in 2009, during a state visit by then-president Dmitry Medvedev—a deal that expanded Moscow’s influence in northwest Europe.

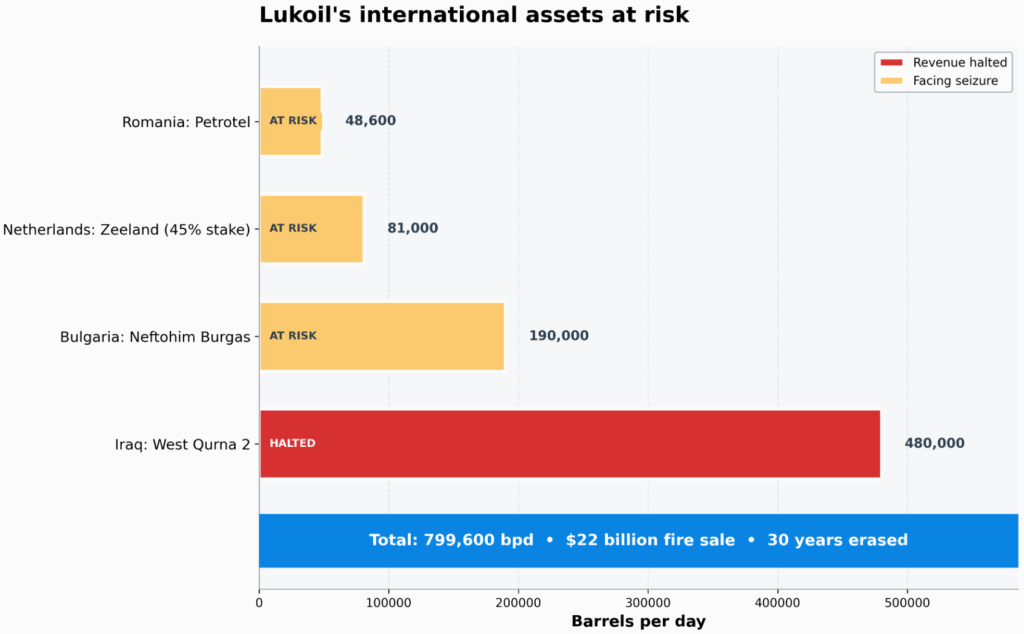

US sanctions imposed on Lukoil last October are now forcing Russia’s second-largest oil producer to sell off an international empire valued at $22 billion, and the Zeeland refinery is among the first assets to change hands.

TotalEnergies moves in

The 180,000-barrel-per-day plant was not formally subject to US sanctions because Lukoil held only a minority stake. But concerns that oil suppliers would refuse to do business with a Lukoil-linked facility pushed TotalEnergies to act.

“I think the market is fundamentally underestimating what it means when you have US sanctions on two large companies which are at the core of trading Russian oil.”

TotalEnergies’ European refining margin indicator rose 231% year-on-year in Q4 2025 to $85.7 per metric ton, according to a trading update published on 20 January. CEO Patrick Pouyanne has credited the sanctions directly.

“I think the market is fundamentally underestimating what it means when you have US sanctions on two large companies which are at the core of trading Russian oil,” he told investors during an October earnings call.

The Dutch government said no approval was required because the refinery was never formally sanctioned.

Neither company disclosed whether money changed hands or whether the deal involved an asset swap with TotalEnergies’ remaining projects in Russia. The Dutch government said no approval was required because the refinery was never formally sanctioned.

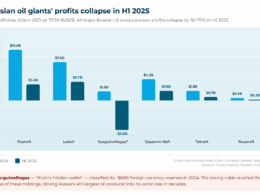

Russia’s oil revenues crater

The Zeeland deal comes as Russia’s oil revenues crater. In January 2026, Russian state income from oil and gas taxation fell to 393 billion rubles ($5.1 billion)—down from 1.12 trillion rubles ($14.5 billion) a year earlier, a 65% year-on-year collapse and the lowest since the COVID-19 pandemic, according to Janis Kluge of the German Institute for International and Security Affairs.

“Give it six months or a year, and it could also affect their thinking about the war.”

Trending Now

The discount on Russia’s Urals crude has widened to roughly $25 per barrel, with prices dipping below $38. The Kremlin has responded by raising VAT from 20% to 22% and borrowing from domestic banks.

“Give it six months or a year, and it could also affect their thinking about the war,” Kluge told Euronews, “they might want to lower the intensity of the fighting, focus on certain areas of the front and slow the war down.”

Sanctions abroad, strikes at home

Zeeland is one piece of a broader unraveling. US private equity firm Carlyle agreed in January to buy most of Lukoil’s foreign assets—a portfolio spanning Iraq’s West Qurna 2 oilfield, refineries in Bulgaria and Romania, and over 2,000 filling stations worldwide.

On the same night the Zeeland story broke, Ukrainian drones struck the Lukoil refinery in Volgograd.

Bulgaria has placed Lukoil’s Burgas refinery, the largest in the Balkans, under a state-appointed administrator. Iraq has taken operational control of West Qurna 2 after Lukoil declared force majeure.

On the same night the Zeeland story broke, Ukrainian drones struck the Lukoil refinery in Volgograd, setting the site ablaze in the first attack on the facility this year. Sanctions force Lukoil to sell assets abroad, while Ukrainian strikes destroy capacity at home.