Ukraine added $47.3 billion to its public debt in 2025—but slashed its borrowing costs by nearly half. The reason: most of that money came from Russia.

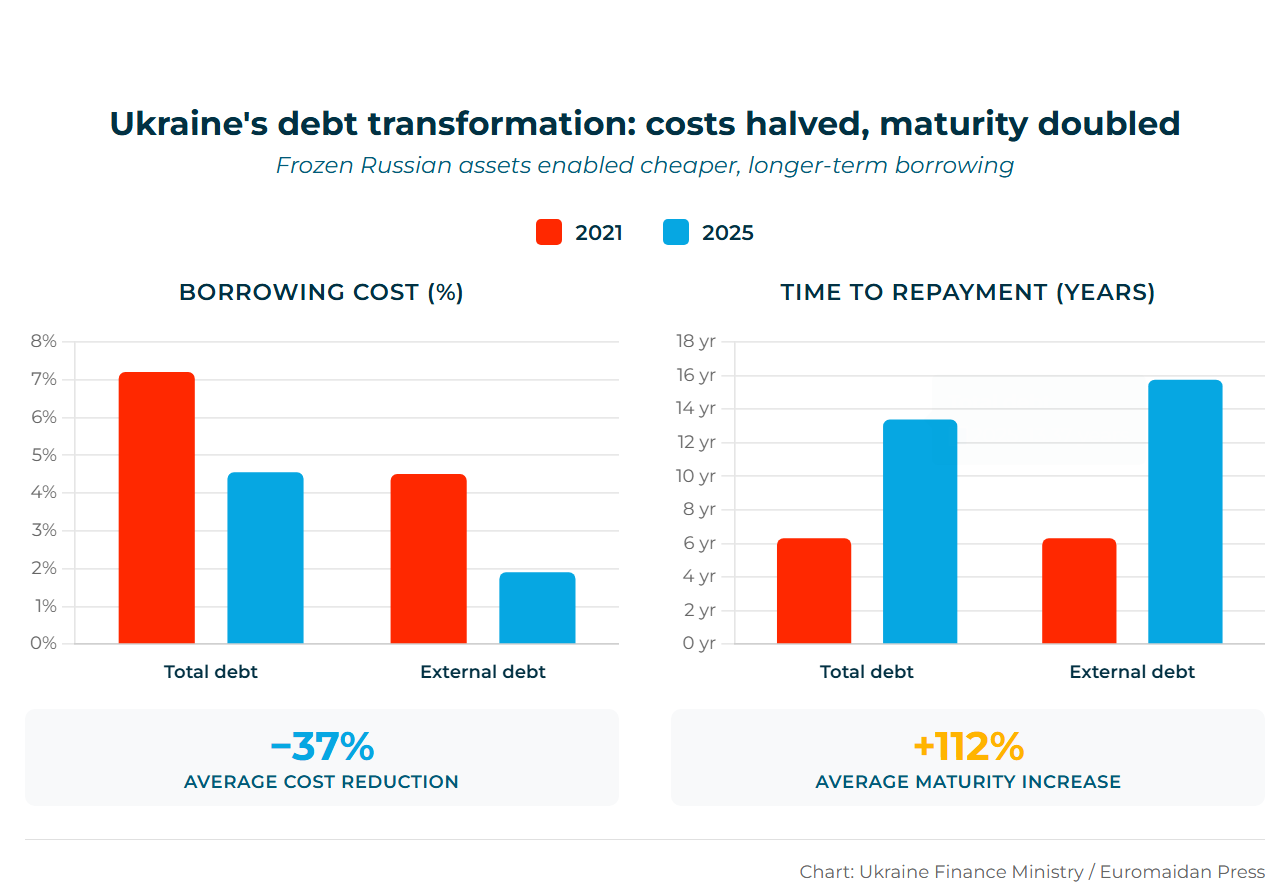

Of the new financing, $37.9 billion arrived as ERA loans from G7 countries, backed by profits from frozen Russian central bank assets. Another $12.1 billion came from EU concessional lending. The ERA loans carry 11-12 year grace periods and will be serviced from Russian asset proceeds—not Ukraine’s budget. Average borrowing costs dropped from 7.2% to 4.55%, while external debt costs fell even further, from 4.5% to 1.9%.

Average time to repayment more than doubled.

The approach could serve other conflicts: fund an ally using the aggressor’s own seized assets, not taxpayer money.

Total debt now stands at $213.3 billion, up 29.5% from 2024. Debt-to-GDP is approaching 100%. Yet the structure changed: commercial external debt shrank to under 10%. Average time to repayment more than doubled, from 6.3 years in 2021 to 13.37 years now. State-guaranteed debt fell to about 3%, continuing a four-year decline.

Breathing room against a demographic ceiling

Cheaper, longer-term debt buys time—but can’t fix Ukraine’s deeper constraints. The population in government-controlled areas has fallen to roughly 31 million, down from 41 million before the full-scale invasion. That 10-million gap includes 6.7 million refugees abroad, around 2.4 million in occupied territories, and tens of thousands of war dead. The birth rate—one child per woman—is among the world’s lowest. Labor shortages have hit an all-time high.

Russia’s energy campaign adds pressure. Moscow has now damaged every Ukrainian power plant, forcing Ukraine to spend $1.9 billion on emergency gas imports while millions endured 12-hour blackouts.

The EU now holds 40% of Ukraine’s debt

About 75% of Ukraine’s public debt is now external, with over half owed to the European Union—roughly 40% of total state debt. EU financing comes on concessional terms; member states may compensate Ukraine Facility repayments.

Trending Now

The €210 billion in frozen Russian assets remains locked as leverage for future negotiations.

In December, EU leaders approved €90 billion in interest-free loans through 2027, repayable only if Russia pays war reparations. The €210 billion in frozen Russian assets remains locked as leverage for future negotiations.

The debt is growing. The burden is shifting to the aggressor.