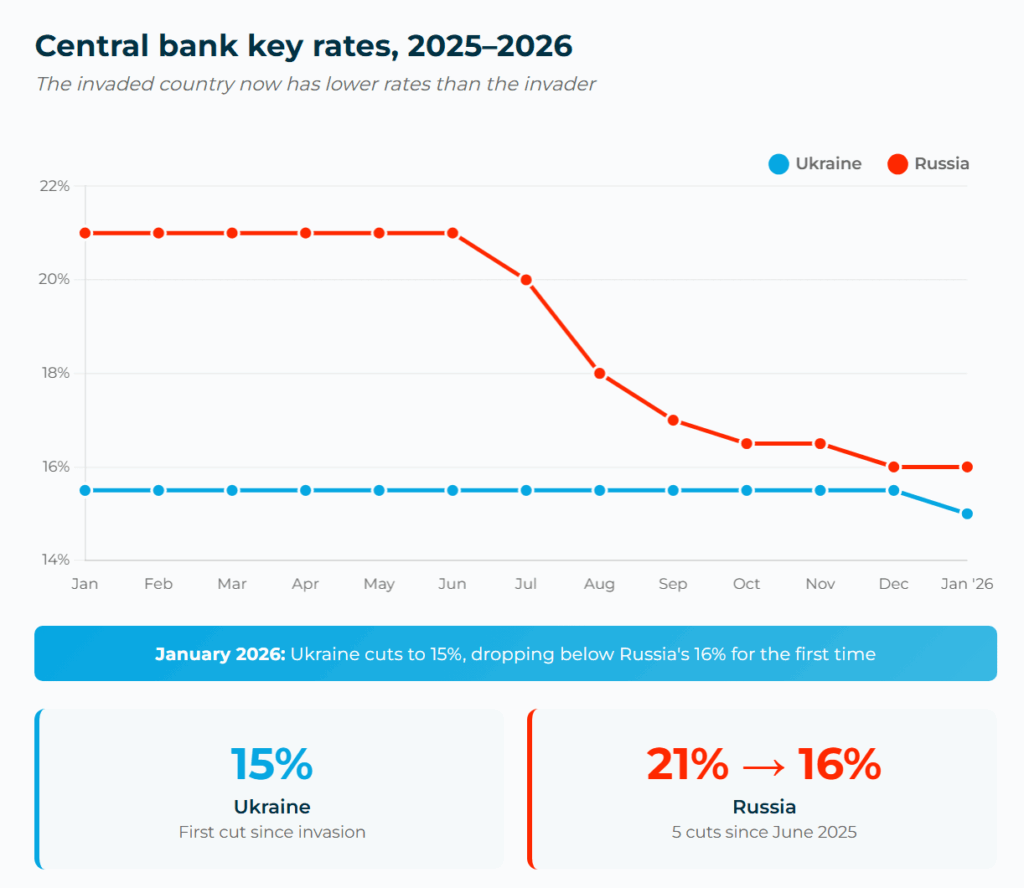

Ukraine’s central bank cut its benchmark interest rate for the first time since Russia’s full-scale invasion began, lowering it from 15.5% to 15% on 29 January. The invaded country now has a lower key rate than the invader.

The new rate cut unlocks cheaper borrowing for Ukrainian businesses.

Russia’s central bank sits at 16% after lurching between emergency hikes to 21% and a series of cuts to contain an economy distorted by war spending. Ukraine held steady throughout 2025 as inflation dropped from nearly 16% to 8%. Moscow projects GDP growth of 0.5-1%. Kyiv expects 1.8%.

The new rate cut unlocks cheaper borrowing for Ukrainian businesses. Credit has grown by more than 30% annually in recent years, NBU Governor Andriy Pyshnyy said. But finding workers to hire is another matter.

Falling inflation, missing workers

December inflation hit 8%—below the NBU’s own forecast for the second consecutive month. Part of the reason is good: a record harvest pushed down food prices. Part is not: service-sector inflation cooled because fewer workers means slower wage growth.

54% of Ukrainian companies want to expand their workforce this year. Most won’t find the people.

According to UN data cited by RBK-Ukraine, 5.3 million Ukrainians remain abroad. Another 700,000 have been mobilized. The shortage has grown so severe that 47% of job postings now require no experience—up from 36% in late 2023.

Kherson Oblast, under near-daily Russian shelling, is the only region where wages fell in 2025. Meanwhile, 54% of Ukrainian companies want to expand their workforce this year. Most won’t find the people.

Defense production has filled part of the gap, growing from $1 billion in 2022 to roughly $12 billion in 2025.

The €90 billion elephant

The EU’s December approval of €90 billion in support for 2026-2027 removed what NBU board members had called “the elephant in the china shop”—financing uncertainty that had blocked earlier cuts. An $8.1 billion IMF program is also under negotiation.

“Russian aggression keeps creating threats to price dynamics and economic activity.”

Trending Now

International reserves should reach $65 billion by year’s end and grow to $71 billion by 2028, the NBU projects. That buffer lets Ukraine continue liberalizing currency controls while keeping the hryvnia stable.

“The war continues,” Pyshnyy said. “Russian aggression keeps creating threats to price dynamics and economic activity.” He named energy destruction, mounting defense costs, and labor migration as key risks.

EU membership: not by 2027

Ukraine held rates steady for a year while bringing inflation from 16% to 8%—the kind of monetary discipline Brussels expects from candidates. Whether it can join the EU anytime soon is another question.

German Chancellor Friedrich Merz said on 28 January that Ukrainian membership by 2027—President Zelenskyy’s goal—is “impossible.”

Inflation should hit the central bank’s 5% target by mid-2028.

“Every country that wants to belong to the EU must first meet the Copenhagen criteria,” Merz said. “This process usually takes several years.”

Ukraine can be “gradually brought closer” to the bloc, he added. Just not quickly.

The NBU expects GDP to grow 1.8% in both 2025 and 2026, accelerating to 3-4% in 2027-2028 as energy shortages ease. Inflation should hit the central bank’s 5% target by mid-2028. But that assumes the workers come back—or that the economy learns to function without them.