Ukraine’s energy system just faced its toughest week since the 2022 blackout. After the combined Russian attacks on 20 and 23 January, up to 85% of consumers nationwide lost power simultaneously.

Relief might come by mid-March—not from restored infrastructure, but from a seasonal factor: longer days when solar generation picks up.

As of 26 January, 1,330 Kyiv apartment buildings remained without heat—after many had already been reconnected and disconnected twice following earlier strikes.

There are no quick fixes. Energy expert Serhii Popenko told Euromaidan Press last week that relief might come by mid-March—not from restored infrastructure, but from a seasonal factor: longer days when solar generation picks up.

That seasonal fact points to a longer question: if centralized power plants keep getting destroyed, shouldn’t Ukraine build a more resilient system—one with diversified inputs (nuclear, gas, wind, solar, hydro) and smaller subsystems that can function independently when the main grid fails?

What’s actually being built

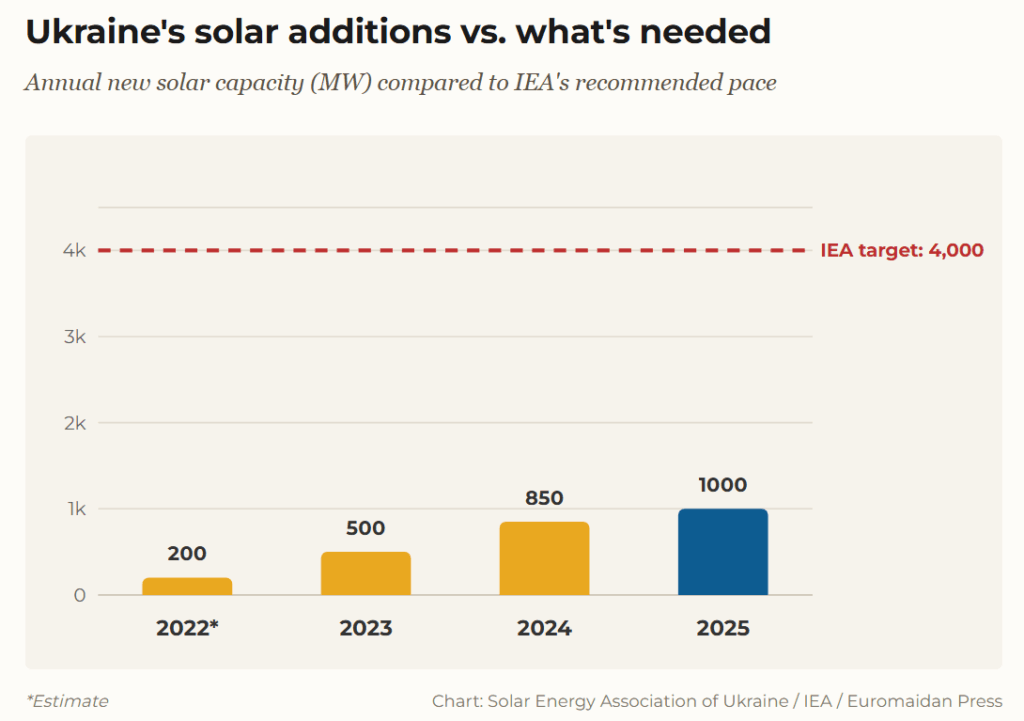

Indeed, Ukraine is doing that—developing wind power, Euromaidan Press has written, and expanding solar. In 2024, Ukraine added 800–850 MW of solar capacity, according to the Solar Energy Association of Ukraine (SEAU), as reported by pv magazine. In 2025, the figure exceeded 1,000 MW, SEAU Chairman Vladyslav Sokolovskyi said in November.

The shift in who’s building matters more than the numbers. Before the war, Ukraine’s solar sector was dominated by large utility-scale farms selling power through government-guaranteed tariffs. Now the fastest-growing segment is rooftop solar paired with batteries—keeping hospitals running and factories operating during outages.

“The demand for energy independence today is stronger than ever.”

“Solar generation combined with storage systems is actively being implemented by businesses, communities, and households,” Sokolovskyi noted. “The demand for energy independence today is stronger than ever.”

In June 2025, Britain’s Octopus Energy Group and Ukraine’s DTEK announced a €100 million ($118 million) initiative called RISE to install solar-and-battery systems at 100 Ukrainian businesses and public institutions over three years.

International donors have also moved: Norway committed $105 million through UNDP for solar panels at Ukrainian schools and hospitals, and Lithuanian company UAB Okata completed solar projects powering five public institutions in Odesa Oblast.

Why the pace is still too slow

The International Energy Agency (IEA) estimates Ukraine needs to add around 4 GW of distributed solar annually—reaching 24 GW by 2030—to build a more decentralized and resilient power system. Even 2025’s improved figure of 1,000 MW is barely a quarter of that pace.

The problem isn’t equipment or sunshine. It’s money flows and market access.

When Ukraine held renewable energy auctions in late 2024 and early 2025, they attracted zero bidders for solar or wind projects.

Ukraine’s Guaranteed Buyer—the state entity that pays renewable producers under the feed-in tariff—still owes generators approximately €335 million ($395 million) for electricity produced from 2022 to 2025.

When Ukraine held renewable energy auctions in late 2024 and early 2025, they attracted zero bidders for solar or wind projects, a July 2025 CSIS analysis found. Only one small hydro project secured a contract. The reasons: “policy instability, payment arrears, and flawed auction design.”

The government’s approved auction quotas for 2025–2029 will cover only 5% of Ukraine’s solar capacity needs by 2030.

The oligarch shadow

Investor wariness has roots. In the early 2010s, Ukraine’s generous feed-in tariffs attracted rapid buildout—but a 2018 Wilson Center analysis noted the tariff “provided a good business for oligarchs at the expense of the state’s coffers.” When the model became financially unsustainable, the government cut tariffs retroactively in 2020, further eroding investor confidence.

“The biggest problem is that Zelenskyy is not fulfilling the promised key energy sector reforms.”

Trending Now

Today’s solar growth is driven by self-consumption, not subsidized exports. But the legacy of unstable rules remains.

“The biggest problem is that Zelenskyy is not fulfilling the promised key energy sector reforms and not opening the market for independent renewable energy project developers,” energy policy expert Oleh Savytskyi of Razom We Stand, a Ukrainian clean energy advocacy group, told Euromaidan Press. “Only the most resilient and politically connected companies are able to survive and continue business.”

What solar can and cannot do

Solar energy offers three things for Ukraine:

First, backup power for buildings and businesses that install rooftop panels with batteries. During outages, these systems keep lights on, refrigerators running, and medical equipment functioning—regardless of what happens to the grid.

Second, seasonal grid relief. Solar generation peaks in spring and summer, exactly when heating demand drops. Popenko noted this is why electricity supply might ease by mid-March—not from repairs, but from longer days.

Third, distributed resilience. Destroying one solar installation leaves thousands operational. The same strike on a thermal plant blacks out entire oblasts.

What solar cannot do: replace baseload power, solve the heating crisis, or generate electricity at night or during winter’s shortest days. It’s one component of a diversified system—alongside nuclear, gas, wind, hydro, and storage—not a standalone solution.

What needs to happen

The IEA’s December 2025 report outlined three policy options to accelerate distributed solar, all requiring government investment between €1.4 billion and €2.7 billion ($1.65 billion to $3.19 billion) through 2030.

But money alone won’t work. Clearing the debt backlog, creating bankable purchase agreements, and opening market access to independent developers would let Ukraine’s solar potential actually get built. Draft Law No. 13219, introduced in April 2025, proposes shifting to feed-in premiums and more flexible auction rules—but implementation remains uncertain.

The question is whether Ukraine will build a power system with diversified inputs and distributed subsystems.

“He [Zelenskyy—Ed.] chose corruption over EU integration reforms and market opening,” Savytskyi told Euromaidan Press. “When we have electricity only 2-3 hours a day in Kyiv... it is vivid, scandalous failure.”

The question isn’t whether solar technology works. It does. The question is whether Ukraine will build a power system with diversified inputs and distributed subsystems, in which solar energy would be a small but strategic part—and whether market reforms will allow independent developers to participate in that buildout, or whether only politically connected companies will survive.

Read also

-

Why does Ukraine’s grid survive missiles that would black out Europe? Ousted energy chief explains

-

From frontlines to frozen pipes: railway & utility workers across Ukraine rush to save Kyiv

-

Collective survival beats post-Soviet authority dependency: Five unexpected consequences of Russian attacks on Kyiv