Ukraine’s trade deficit reached $38.5 billion in 2025—up 52% from the previous year—as the cost of shipping goods out of a war zone continued to erode competitiveness, according to newly released government data.

The country’s agricultural exports feed 400 million people in over 100 countries.

Imports totaled $75.4 billion over the first 11 months, while exports reached only $36.8 billion. The gap matters beyond Ukraine’s borders: the country’s agricultural exports feed 400 million people in over 100 countries, much of it in regions with few alternatives.

Agriculture took the biggest hit

Agricultural exports—56% of Ukraine’s total—fell $2.15 billion (8.8%) in 2025, the Ukrainian Club of Agricultural Business reported.

The causes are physical and political. Russian missiles and drones have systematically targeted Black Sea port infrastructure, destroying grain and oil storage facilities. Railways lost 49% of their freight traffic between 2021 and 2025 as exports collapsed—yet specific corridors are now overloaded with cargo that once moved by sea.

The EU, under pressure from its farming lobby, reinstated quotas and emergency brakes on Ukrainian agricultural products after trade preferences expired in June 2025.

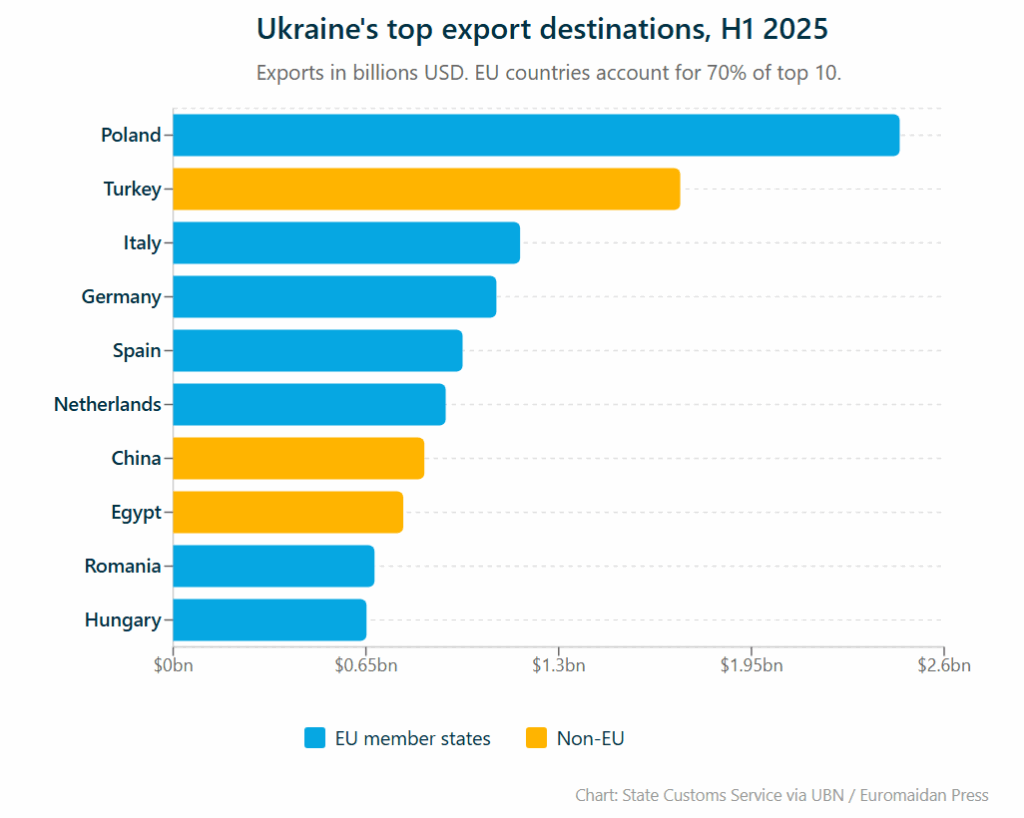

The share of agricultural exports going to EU countries dropped from 50% in 2022-24 to 47.5% last year.

Logistics costs hit hard

Metal delivery costs alone rose by $30-100 per ton, depending on the route, making Ukrainian products significantly more expensive than competitors from Türkiye and Russia.

Ukrainian Railways, posting 7.2 billion hryvnias ($167 million) in losses for the first nine months of 2025, is proposing a 41.5% freight tariff increase in two stages by 2026. Operating costs have exploded: power up 216%, diesel up 57%, wages up 65%. Russian forces attacked railway infrastructure 800 times in 2025, damaging 3,000 facilities.

“If we are forced to cover these costs, we will probably have to stop production.”

ArcelorMittal Kryvyi Rih, Ukraine’s largest steelmaker, warned in September that a 37% tariff hike would cost $26.5 million annually. “If we are forced to cover these costs, we will probably have to stop production,” CEO Mauro Longobardo said. The company called 2025 “a year of survival and constant adaptation”—production remains 50-70% below pre-war levels.

The European Business Association estimates that logistics now account for up to 40% of production costs in some industries.

Some sectors grew

Not all export categories declined. Machinery exports rose $186 million to $3.39 billion, now 9.2% of total exports. Furniture climbed $115 million to $954 million. IT services reached $5.97 billion for the first 11 months of 2025, up $141 million year-on-year. Metallurgical exports increased $145 million overall despite individual companies’ struggles.

Higher-value goods absorb transport premiums more easily than bulk commodities like grain.

Trending Now

These sectors face the same logistics costs as agriculture. The difference: higher-value goods absorb transport premiums more easily than bulk commodities like grain.

China dominates imports

China now supplies 21% of Ukraine’s imports—$17 billion worth—according to State Customs Service data. Poland follows at $7.1 billion, Germany at $5.9 billion.

The China share reflects price reality more than geopolitical drift. A metalworks owner in Lviv who produces industrial lighting systems told Euromaidan Press that when he needed a new CNC precision cutter, German options cost several times more than Chinese equivalents. He bought Chinese.

Government response

Cabinet Resolution No. 1795, issued on 31 December 2025, banned the export of natural gas, gold, silver, and scrap metal, while capping grain and sugar shipments to the EU. The stated goal: prevent domestic shortages and improve the trade balance.

Poland remains Ukraine’s top export destination at $4.6 billion, followed by Türkiye at $2.46 billion and Italy at $1.99 billion.

The full impact of rising logistics costs—and whether growing sectors can offset agricultural decline—will become clearer as 2026 data emerges.