Over 600 Chinese car dealerships closed in Russia in 2025—triple the number from two years ago—as Moscow’s own policies made the cars unaffordable and Chinese automakers began retreating from the market they once flooded.

Sales of Chinese trucks in Russia fell 39%.

The exodus marks an ironic reversal for Russia’s “pivot to Asia.” When Western brands fled after the 2022 invasion of Ukraine, Chinese automakers rushed in, capturing over half the Russian market by 2023. Now they’re pulling back—not because of Western pressure, but because Russia made their business unprofitable.

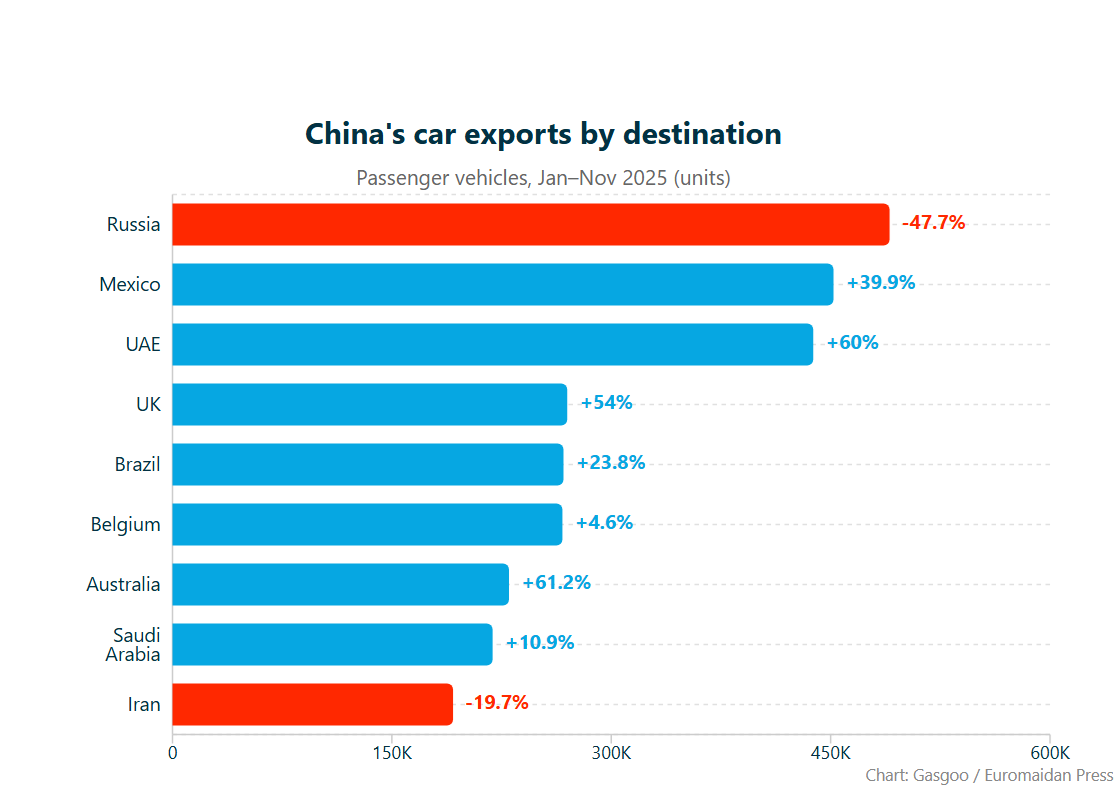

China-Russia trade fell for the first time in five years in 2025, with passenger vehicle exports dropping 42% to 632,300 units, according to Chinese customs data cited by TASS. Sales of Chinese trucks in Russia fell 39%, according to The Moscow Times.

Moscow’s self-inflicted wound

The damage began in October 2024, when Russia raised “recycling fees” on imported vehicles by 70% to 85%—effectively import tariffs meant to protect domestic automakers like AvtoVAZ. Combined with the Central Bank’s then-record 21% interest rate, which pushed car loan rates to around 30%, the average car price in Russia hit 3.35 million rubles ($41,400), reported CarNewsChina.

Consumer demand collapsed. And Chinese companies noticed.

Chery, which held over 20% of Russia’s market in 2024, stated in its 2025 Hong Kong IPO prospectus that it plans to reduce its operational scale in Russia through 2027, citing lower gross profit margins due to higher recycling fees. The company had already completed the sale of some Russian assets and sales channels in April 2025.

About a quarter of all dealerships selling Chinese cars were either closed or rebranded last year.

Over 100 Russian auto retailers stopped purchasing vehicles from China entirely, opting instead to work with domestic assemblers producing locally built versions of Chinese models, the Russian Automobile Dealers Association (ROAD) told Kommersant, as reported by The Moscow Times. About a quarter of all dealerships selling Chinese cars were either closed or rebranded last year.

The bleeding is widespread. Chinese brands sold 672,431 vehicles in Russia in 2025—down 26% from the previous year, according to Avtostat data cited by Za Rulem. Chery and Geely both lost 37% of their sales. Changan dropped 38%. Only Jetour grew—up 4%—by capturing demand shifting away from saturated models.

Political pressure meets reality

The car market collapse reflects a broader pattern: Russia’s war-distorted economy is forcing policymakers into contradictory decisions.

“There are our shortcomings. We should have made these timely decisions.”

The Central Bank cut rates five times from a record 21% peak under political pressure from business leaders and the Kremlin itself. Governor Elvira Nabiullina—who in October 2024 defended high rates as necessary to weed out over-leveraged businesses—reversed course after Putin publicly acknowledged “shortcomings” in monetary policy at his December 2024 press conference.

“There are our shortcomings. We should have made these timely decisions,” he said, in a rare implicit criticism of the Central Bank.

Trending Now

The Moscow Times reported that the Finance Ministry drafted amendments allowing Putin to unilaterally control currency transactions—effectively tightening the “leash” on Central Bank independence.

The partner who exploits

China has not rescued Russia’s economy—it has exploited it. Russian LNG sells to China at 30-40% discounts. Rosneft CEO Igor Sechin even admitted China has saved $20 billion on Russian oil purchases since 2022. And a source close to the Russian government told Reuters: “China does not behave like an ally.”

Ukraine’s chief negotiator tells Davos: China is “absorbing” desperate Russia (INFOGRAPHIC)

Russia remains China’s largest auto export market by value—barely. At $8.46 billion versus the UAE’s $8.06 billion, the gap is just $400 million, according to TASS.

Russia’s overall car market contracted 16% in 2025 to around 1.3 million vehicles, according to Avtostat data cited by Izvestia. Only 459 new Chinese-brand dealerships opened—roughly one-third the number launched a year earlier.

Russia’s war economy creates distortions that even “friendly” partners cannot profitably navigate. Beijing will sell to Moscow—but not at prices Moscow can afford nor under conditions Moscow can control.