Lower oil prices are usually good news for consumers. For Russia’s war budget, yesterday’s 4-5% plunge—the sharpest since June—lands at the worst possible moment.

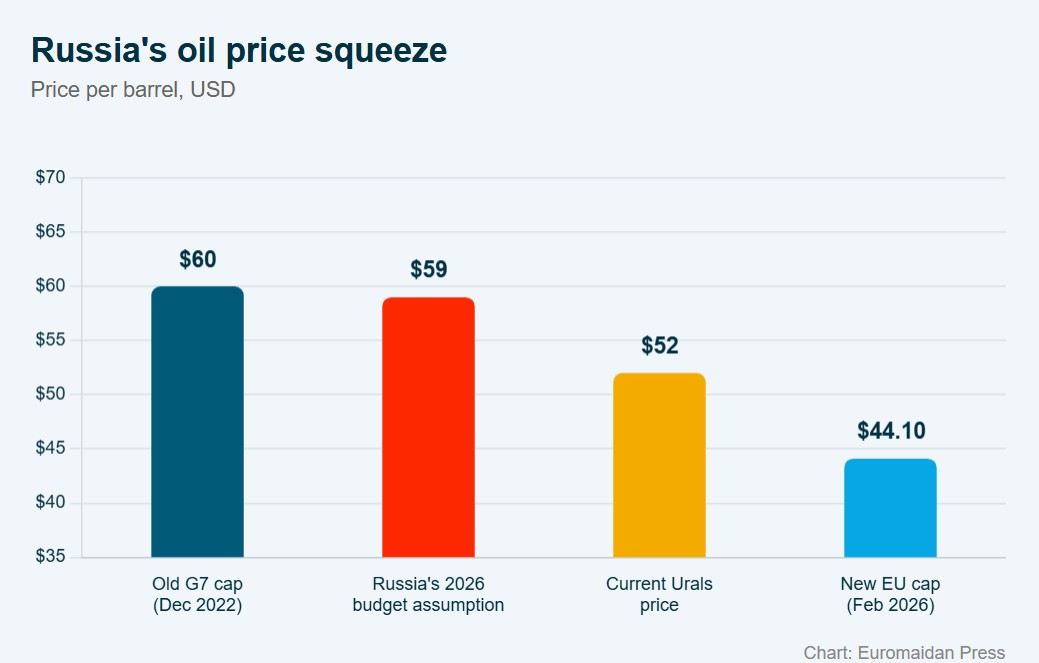

Brent crude settled near $64 a barrel on Thursday while West Texas Intermediate fell to $59, after the US signaled it would hold off on striking Iran. The same day, the EU activated a new mechanism that automatically lowers the price cap on Russian oil to $44.10 per barrel starting 1 February.

The timing compounds Russia’s problems. Moscow’s 2026 budget assumes Urals crude at $59 per barrel. Urals is trading around $50-54. January oil tax revenues could fall to approximately 380 billion rubles ($4.7 billion)—the lowest monthly take since late 2022 and roughly half what Moscow collected a year ago. Oil and gas revenues fund roughly a quarter of Russia’s federal budget, which dedicates 38% to defense and security—the highest share since Soviet times.

EU’s dynamic cap closes a loophole

The original G7 price cap, set at $60 in December 2022, remained static even as market conditions shifted. Under it, a global price collapse could have allowed Russia to regain access to Western shipping and insurance services at lower prices.

“Constraining Russia’s energy revenues has consistently been, and will remain, a top priority for the EU.”

The new EU mechanism closes that possibility. It automatically adjusts the ceiling to stay 15% below Urals crude’s 22-week average, ensuring the cap tracks downward as prices fall.

“Constraining Russia’s energy revenues has consistently been, and will remain, a top priority for the EU, with the view of weakening Moscow’s ability to wage its illegal war of aggression against Ukraine,” the European Commission stated.

Whether the new cap adds meaningful pressure remains to be seen.

Russia has used a shadow fleet of aging tankers to evade the cap, shipping crude to India and China without Western services. But shadow shipping comes with costs—discounts have widened to $27 or more below Brent since November, when the US blacklisted major producers Rosneft and Lukoil.

The Biden administration’s January 2025 sanctions targeted 183 shadow fleet tankers. Ukrainian drone strikes have added pressure, damaging refineries and disrupting exports throughout 2025. Whether the new cap adds meaningful pressure beyond what markets, sanctions, and Ukrainian strikes have already imposed remains to be seen.

Trending Now

Russia’s reserves drain faster

The gap between what the Kremlin budgeted and what it’s receiving could reach 3 trillion rubles ($38 billion) by year’s end if current prices persist, Russian analysts told Charter97.

Every dollar Brent falls pulls Urals down with it.

To cover the shortfall, the Finance Ministry is drawing on Russia’s National Welfare Fund—selling foreign currency and gold at a rate of 12.8 billion rubles per day starting 16 January. But that cushion is already thin. The fund held 4.1 trillion rubles in liquid assets as of 1 December, down from the equivalent of $185 billion in 2021 to just $35.7 billion—a decline of more than 80% since Russia launched its full-scale invasion.

Thursday’s oil crash and the EU’s tightening of the price cap add pressure to a budget already stretched. Every dollar Brent falls pulls Urals down with it. Every week the fund is tapped, depletion draws closer.