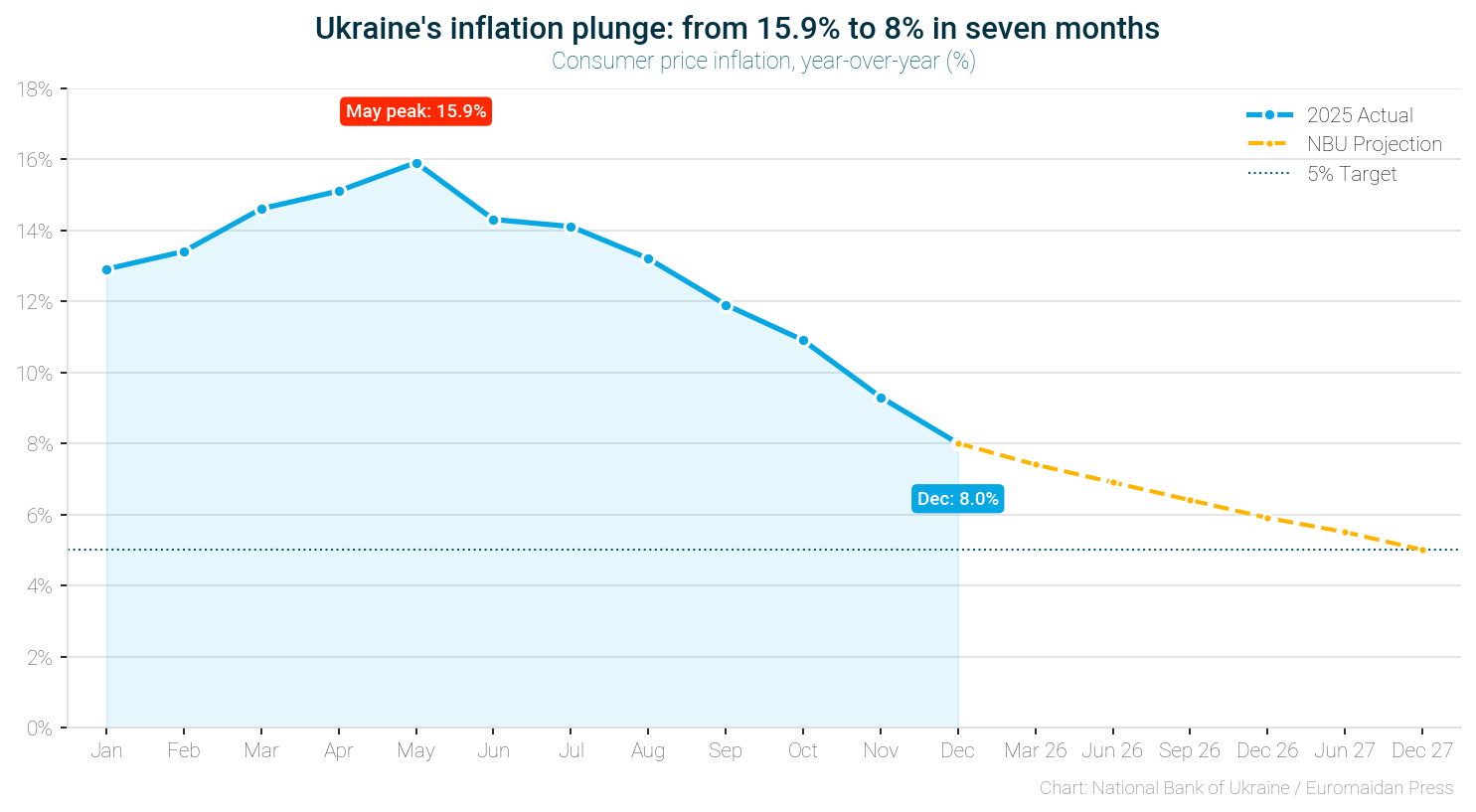

Ukraine’s inflation fell to 8.0% in December, down from 9.3% in November and below the National Bank’s own forecast for the second consecutive month, the NBU reported on 12 January.

Non-food goods recorded zero price growth year-on-year—prices stopped rising entirely. The NBU credits a stable exchange rate for keeping import costs contained.

But the explanation for cooling service-sector inflation is less reassuring.

The ceiling, not the cure

Services inflation slowed to 12.3% in December. The NBU attributes this to “gradual easing of labor market pressure”—less competition for workers means slower wage growth, which means businesses aren’t raising prices as fast.

That sounds like stabilization. It isn’t.

When businesses can’t find workers, they scale back—and reduced activity means less wage competition.

Ukraine’s workforce has shrunk by a quarter since 2021. Some 6-7 million people have left the country. Employers posted 427,000 job openings in 2025; only 63% were filled. A November 2025 survey by the European Business Association found 83% of Ukrainian companies have a staff shortage—74% calling it serious.

So why is “pressure easing”? Because the economy is contracting to fit the workers it has. GDP growth is capped at 2% regardless of Western support levels. Manufacturing is shrinking under Russian strikes and staff shortages. When businesses can’t find workers, they scale back—and reduced activity means less wage competition.

The inflation number looks good. The mechanism producing it reflects an economy hitting a demographic ceiling.

Ukraine’s economy adapts to war, but hits a ceiling money can’t break (INFOGRAPHICS)

Fuel bucks the trend

Not everything is cooling. Fuel prices accelerated in December—gasoline, diesel, and LPG all rose.

The cause is visible across Ukraine: Russian strikes on energy infrastructure, brutal cold, and countless small generators burning fuel to produce heat and light. Logistics problems and supply delays compounded the pressure.

For farmers counting on European market access, friction shows that trade integration doesn’t follow a straight line.

Trending Now

Power outages are driving demand for fuel even as the rest of the economy slows.

The NBU also noted that Ukrainian dairy exports to the EU stopped entirely in December after licensing requirements for quota-based shipments changed. For farmers counting on European market access, even temporary friction shows that trade integration doesn’t follow a straight line.

What comes next

The NBU expects inflation to continue slowing in 2026, helped by easing labor market imbalances, moderate external price pressure, and sustained monetary discipline. An updated forecast is due on 29 January; the full Inflation Report follows on 5 February.

Ukraine held its key interest rate at 15.5% all year, tight by any standard, especially for a wartime economy. Russia’s central bank, by contrast, cut five times from a 21% emergency peak and still struggles with inflation above target.

The institutional discipline required for EU membership is visible in the numbers.

Ukraine is tracking toward the NBU’s 5% target by 2027—matching European Central Bank standards. The institutional discipline required for EU membership is visible in the numbers.

Whether the economy can grow fast enough to use those institutions is another question.