Europe’s reliance on Russia’s flagship Arctic gas facility increased in 2025—even as Brussels promised to ban imports by 2027.

New data from German environmental NGO Urgewald and Ukrainian campaign group Razom We Stand, reported by The Kyiv Independent on 8 January, show the EU received 76.1% of all exports from Russia’s Yamal LNG terminal last year, up from 75.4% in 2024—totaling €7.2 billion ($8.4 billion).

For comparison, Greenpeace calculated that $9.5 billion in Yamal taxes between 2022 and 2024 could fund 271,000 Shahed drones—suggesting that the 2025 revenue alone could cover roughly 240,000 more.

Belgium’s Zeebrugge terminal alone received 58 ships carrying 4.2 million tonnes of Russian gas. China, supposedly Russia’s new energy partner, received less: just 51 ships delivering 3.6 million tonnes. Three years into Moscow’s “pivot to Asia,” the EU remains Russia’s most reliable customer.

“Our ports continue serving as the logistics lung for Russia’s largest LNG terminal.”

France led all importers, taking in 87 tanker deliveries totaling 6.3 million tonnes—41.7% of all Yamal LNG shipped to Europe, The Independent reported. Behind those numbers sits a name: TotalEnergies, the French energy giant that owns 20% of Yamal, purchases 4 million tonnes annually, and holds contracts running until 2041.

“While Brussels celebrates the latest deal to phase out Russian gas, our ports continue serving as the logistics lung for Russia’s largest LNG terminal,” said Sebastian Rötters, sanctions campaigner at Urgewald.

The lever Europe won’t pull

The EU could shut down Yamal’s exports tomorrow. It chooses not to.

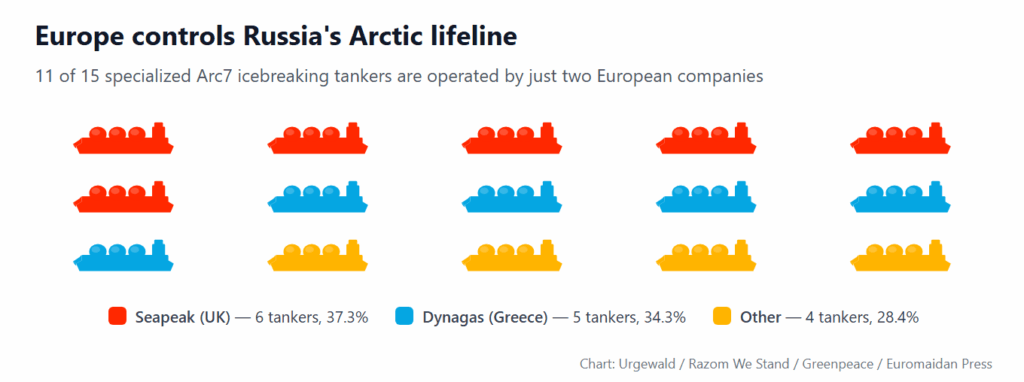

Russia’s Arctic LNG operations depend on 15 specialized Arc7 icebreaking tankers—the only vessels capable of navigating frozen Arctic waters year-round. Eleven of them are controlled by just two European companies: the UK-based Seapeak (six ships, accounting for 37.3% of 2025 shipments) and the Greek-owned Dynagas (five ships, accounting for 34.3%).

Russia cannot replace them. The first Arc7 tanker built at Russia’s Zvezda shipyard, the Alexey Kosygin, has not progressed beyond short test runs. US sanctions block further construction.

“There are credible reports that the Russian secret service FSB has infiltrated agents into the crews.”

A coalition of over 40 civil society groups—including Urgewald, Razom We Stand, Greenpeace, and Deutsche Umwelthilfe—calls this dependency “Russia’s Achilles’ heel.”

“If at least these ships can be removed from Russian influence, it will be impossible to continue operating the Arctic LNG business at its current level for years to come,” the coalition wrote in a December 2025 open letter to EU and UK leaders.

The letter also flagged a security concern: “There are credible reports that the Russian secret service FSB has infiltrated agents into the crews.”

The UK acted. The EU hasn’t.

Britain announced in November 2025 it would ban UK companies from providing maritime services—shipping, insurance, maintenance—for Russian LNG, with the ban phased in throughout 2026. Glasgow-based Seapeak, which operates six of the critical Arc7 tankers, falls directly under the new restrictions.

The EU has taken no equivalent action against the tanker fleet.

Instead, Brussels set a January 2027 deadline for banning Russian LNG imports—a timeline the coalition calls “too late.”

LNG that would have been re-exported to Asia now stays in Europe, partly explaining why EU imports rose despite the ban.

“The recently agreed exit date of 1 January 2027 gives Russia valuable time to build the necessary infrastructure for increased exports to Asia,” the open letter warns.

Russia is already adapting. When the EU banned transshipment of Russian LNG through European ports in March 2025, Moscow shifted the operation to its own waters near Murmansk. An unintended consequence: some LNG that would have been re-exported to Asia now stays in Europe, partly explaining why EU imports rose despite the ban.

Trump’s pressure

President Donald Trump has repeatedly pressed European allies to cut Russian energy ties faster. The EU’s decision to accelerate its LNG ban by one year—from 2028 to 2027—was “likely introduced in response to pressure” from Trump, who has “singled out Europe for continuing to buy Russian fossil fuels,” the Atlantic Council noted.

In October 2025, Trump imposed sanctions on Russia’s two largest oil companies, Rosneft and Lukoil—the first time his administration directly targeted Russian energy since taking office.

“EU will continue to funnel billions of euros to Moscow for at least another year.”

Some EU members have moved faster than others. Spain cut Yamal imports from 58 tankers in 2024 to 38 in 2025. But France and Belgium increased their intake, and the bloc’s overall dependency deepened.

Trending Now

“This trajectory suggests the EU will continue to funnel billions of euros to Moscow for at least another year,” Urgewald researchers said.

Arctic logistics under strain

Russia’s ability to keep Yamal running faces mounting pressure. In December, Moscow deployed all eight nuclear-powered icebreakers simultaneously for the first time in history to keep Arctic shipping lanes open. Even that unprecedented effort failed: a sanctioned LNG carrier made four attempts to reach the Arctic LNG 2 terminal and turned back each time, blocked by early, thick ice.

But Yamal itself continues uninterrupted. The facility operates at full capacity, exporting over 19 million tonnes annually. No Western sanctions target it directly.

“Currently, there is no viable alternative to the short-distance routes leading to EU ports,” Urgewald notes. “Without these vessels, Yamal’s operations would reach a total standstill, particularly during the impenetrable winter months.”

“The Arc7 fleet is not merely a logistical detail—it is a strategic weapon of economic warfare.”

The coalition’s demands are specific: ban EU/UK shipping companies from transporting Russian gas; deny port access to LNG carriers; prohibit all maritime services, including insurance, flagging, and repairs; block the sale of Arc7 tankers to shadow fleet operators; and impose secondary sanctions on companies that continue facilitating the trade.

“The Arc7 fleet is not merely a logistical detail—it is a strategic weapon of economic warfare,” the letter concludes. “Sanctioning these vessels would send an unequivocal message that there is no safe harbour for fossil fuel revenues that sustain aggression, war crimes, and environmental destruction.”

The cost, counted

Between 2022 and 2024, Yamal LNG paid $9.5 billion in taxes to Russia’s federal budget, a September 2025 Greenpeace report found. That sum could buy 9.5 million artillery shells, or 271,000 Shahed drones, or 2,686 modern battle tanks.

The 2025 data adds another €7.2 billion to the ledger.

“There is no doubt that Russia’s LNG business is of vital importance to Putin’s regime.”

Dr. Svitlana Romanko, founder of Razom We Stand, warned in November that sanctions must extend beyond Arctic LNG 2—which the EU targeted in 2023—to Yamal itself.

“There is no doubt that Russia’s LNG business is of vital importance to Putin’s regime,” she wrote. “It represents a key source of revenue for his brutal war against Ukraine.”

Eleven European-controlled tankers keep that revenue flowing. The EU has the power to stop them. So far, it has chosen not to.