Estonian fintech group Iute Group announced Tuesday it will establish its first fully digital bank in Ukraine—marking the first foreign banking investment in the country since Russia’s full-scale invasion began.

“We should learn from Ukraine’s decision-making experience.”

The deal comes with a striking admission. Estonia built its reputation as Europe’s “digital tiger”—the country that invented e-residency and put its government online. But CEO Tarmo Sild says that edge is gone. “Estonia is no longer a digital tiger,” he told Estonian Public Broadcasting. “We should learn from Ukraine’s decision-making experience.”

First foreign bank since invasion began

The transaction is the first entry of a foreign investor into Ukraine’s banking sector since 2021, when Czech investors acquired Unex Bank, according to Ukrainian media. Since then, 23 international insurers have fled Ukraine. Major Western banks have reduced exposure, not increased it.

Iute is moving the other way—with calculated limits. The company capped its investment at €15 million and expects a net loss of up to €3 million in 2026. The new IuteBank will start with a balance sheet under €10 million, inheriting roughly 13,000 clients and €4 million in deposits from the failed RwS Bank.

“We acquire a transitional structure with a banking license and carefully selected assets.”

“We are building from zero,” Sild said. “We acquire a transitional structure with a banking license and carefully selected assets—no legacy systems, no inherited practices.”

RwS Bank was declared insolvent by Ukraine’s central bank in November after repeated regulatory violations. Iute won the tender in December. Final approval from the National Bank of Ukraine is expected this month.

“They have been driven by pain”

In a radio interview on Tuesday, Sild offered a concrete example of what Ukraine built while under attack.

“In Tallinn, every parking company has its own app. In Kyiv, there is one municipal app that lets you park everywhere and do much more,” he said. “They are very advanced—and they have been driven by pain.”

That pain—war, blackouts, cyberattacks—forced innovation that peacetime complacency prevented elsewhere. More than 99% of Ukrainian bank clients now use digital identification.

Fourteen competing banks built a shared infrastructure called Power Banking, with 2,396 branches sharing backup generators and ATM networks. When Russian missiles knocked out power across Chernihiv in October 2025, all 33 Power Banking branches kept running.

“We already have something which even the European Union doesn’t have with digitalisation,” Olena Sotnyk, policy adviser to Ukraine’s deputy prime minister, told a London conference. “When you can’t physically get services or documents, you look for more efficient ways.”

Trending Now

Ukraine’s banks now share customer data with apps through open banking systems, which the EU mandated, but many members still haven’t fully implemented.

Tallinn headquarters, Balkan markets

Iute Group is headquartered in Tallinn with 130 employees and Estonian investors, but the company has never operated in its home country. Its markets are in Southeastern Europe—Albania (with over 100,000 clients), Bulgaria, Moldova, and North Macedonia.

“We support Estonian culture, but we haven’t developed much deeper connection there,” Sild commented.

Ukraine will become Iute’s sixth market—and its first fully digital bank anywhere.

In the Balkans, the company offers buy-now-pay-later services, consumer loans, and processes international payments. Its model relies on raising funds through bonds on the Frankfurt Stock Exchange and lending to consumers. At the end of September 2025, the group’s total assets stood at €486.6 million.

Ukraine will become Iute’s sixth market—and its first fully digital bank anywhere. The company holds a banking license only in Moldova, where it acquired Energbank in 2022.

Betting on Ukraine since day one

Sild’s interest in Ukraine predates the current deal. On day four of Russia’s full-scale invasion, Iute donated €100,000 to Ukraine’s central bank. “The border of freedom is in Ukraine,” Sild said at the time.

Now he sees that bet paying off. “I believe that thanks to the bravery of the Ukrainian people, their country will become one of Europe’s growth engines within five years,” he said.

IuteBank will be led by Arthur Muravitsky, a Ukrainian banker with 22 years of experience at TAScombank, Finance Bank, and other institutions.

Capital returns to Ukraine

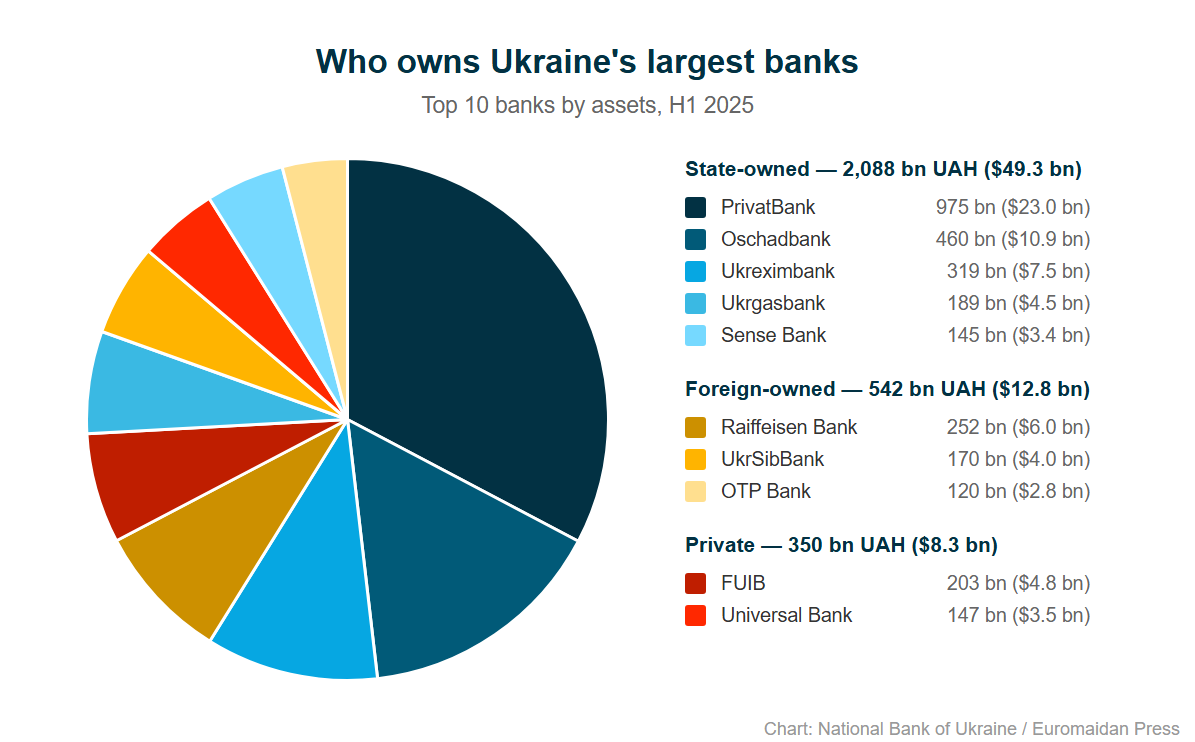

Ukraine’s financial sector has held up better than anyone predicted. Banks posted $2.4 billion in pre-tax profits in the first half of 2025. Deposits reached a historic high of 1.36 trillion hryvnias ($32.1 billion) in November. In March 2025, Lloyd’s reinsurer MS Amlin launched a €1 billion annual war-risk scheme—the first major reinsurer to return.

Iute’s entry is another signal: foreign capital is beginning to flow toward Ukraine, not just away. The country being bombed is now attracting investors because of what it has built while under attack.