Ukraine now has digital banking capabilities that even the European Union lacks. Banks securely share customer data with apps—a system the EU mandated, but many members still haven’t fully implemented.

More than 99% of bank clients use digital identification. After three years of repelling Russian cyberattacks, Ukrainian banks have developed what experts call “some of the most robust systems in the world” for cyber defense.

“When you can’t physically get services or documents, you look for more efficient ways.”

“We already have something which even the European Union doesn’t have with digitalisation,” Olena Sotnyk, policy adviser to Ukraine’s deputy prime minister for European integration, told a London conference. “When you can’t physically get services or documents, you look for more efficient ways.”

This wasn’t the plan. War made it necessary. And now Ukraine’s crisis-forged financial system offers a blueprint for any nation worried about infrastructure resilience—from cyberattacks to power grid failures to the kind of hybrid warfare Russia has pioneered.

The laboratory nobody wanted

When bombs started falling on 24 February 2022, Ukrainian businesses discovered which ones would survive—the answer: those that had gone paperless.

Alina Golubieva, CEO of Kyiv-based financial advisor Karpatia Benefits, described the test: “On February 24, 2022 we regrouped quickly. We didn’t store any paper-based agreements or anything like that. So we closed the office for two months and it didn’t affect our work at all.”

“Currently, the Ukrainian banking IT infrastructure is one of the most reliable in the world.”

Her firm had clients in Kharkiv, Kherson, Mykolaiv, and Mariupol—cities that would face occupation or constant shelling. “We were expecting to lose about 80 percent of our portfolio, but we lost only 30 percent because we haven’t stopped working and we are a digital business.”

That pattern scaled across the sector. Monobank, Ukraine’s largest mobile-only bank, deployed IT systems to Amazon’s cloud servers, eliminating dependence on physical infrastructure. “Currently, the Ukrainian banking IT infrastructure is one of the most reliable in the world,” co-owner Mykhailo Rogalskyi told The Kyiv Independent.

Competitors became partners

The most radical innovation wasn’t technological—it was organizational. Ukraine’s 14 largest banks, usually competitors, built a shared infrastructure called Power Banking.

Branches share backup generators. ATM networks offer roaming across institutions. Staff train together for crisis response. What started in late 2022 with 100 branches has grown to 2,396—nearly 55% of all Ukrainian bank branches, integrated into the government’s Diia app, allowing citizens to locate functioning branches during power outages.

“Nothing comparable has ever been implemented anywhere in the world.”

“Nothing comparable has ever been implemented anywhere in the world,” National Bank of Ukraine Governor Andriy Pyshnyy told the International Monetary Fund.

The system faced its biggest test in October 2025. Russian missiles knocked out power across Chernihiv. All 33 Power Banking branches in the city kept running—generators humming, backup communications active, customers withdrawing cash while the grid stayed dark.

“The intensity and the depth of the destruction of the energy system are the scenarios for which we were preparing,” Pyshnyy said. “And, in fact, the unified Power Banking network was created for this.”

Defensive by design

Ukrainian banks didn’t just digitize—they restructured for survival. Loans as a share of bank assets dropped from 36% before the invasion to 23.6% by 2024. Liquid instruments—cash and central bank deposits—rose from 27.1% to 43%.

Trending Now

That defensive posture paid off. In November 2025, deposits reached 1.36 trillion hryvnias ($32.1 billion)—a historic high. The sector posted $2.4 billion in pre-tax profits in the first half of 2025.

“We are sending a clear signal: Ukraine is actively looking for ways to reduce risks for business.”

“The banking sector is operationally sound, liquid, and profitable,” Pyshnyy said at the NBU’s annual conference.

International insurers had fled—23 withdrew from the market after the invasion. In March 2025, Lloyd’s reinsurer MS Amlin launched a €1 billion annual war-risk scheme for Ukrainian businesses—the first major reinsurer to return.

By August, Marsh McLennan, Aon, and Fairfax had signed a memorandum to further develop Ukraine’s insurance market. “We are sending a clear signal: Ukraine is actively looking for ways to reduce risks for business,” then First Deputy Prime Minister Yulia Svyrydenko said.

What remains to fix

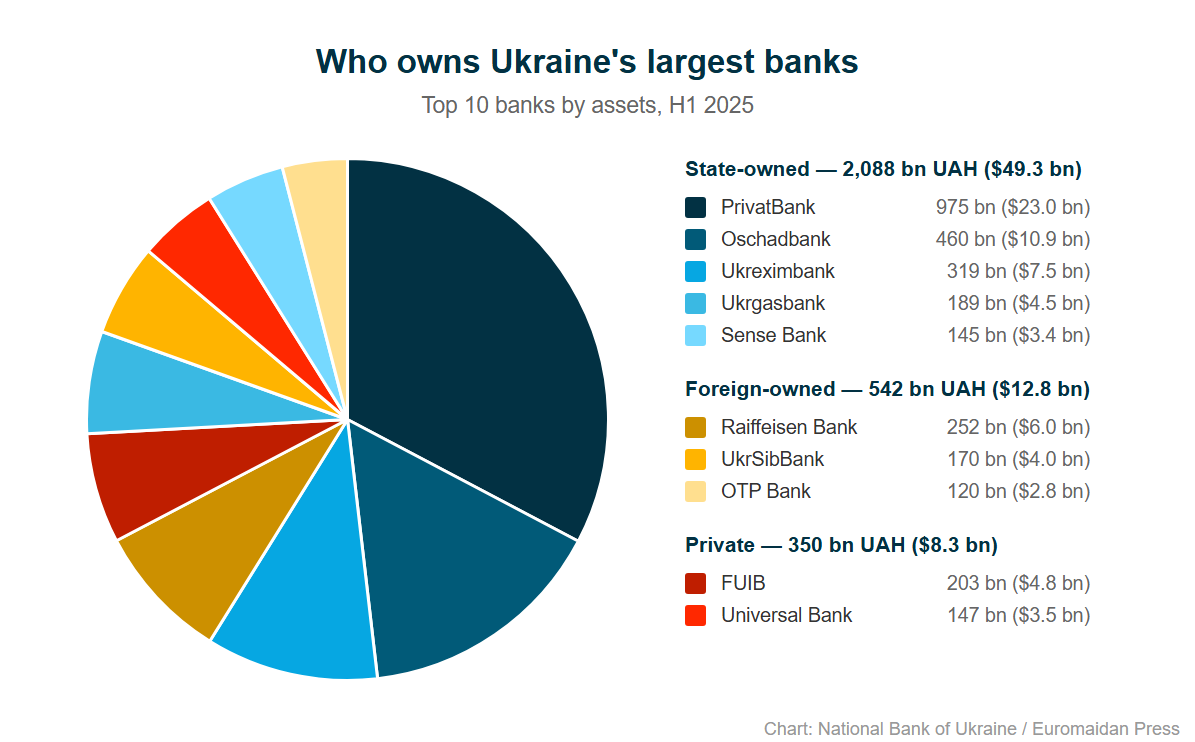

Not everything is resolved, though. State banks, which expanded during the crisis to provide stability, now pose a postwar challenge. EBRD researchers Alexander Pivovarsky and Ralph De Haas warned that state lenders “will account for an even greater majority of all banking assets after the war”—and remain reluctant to restructure bad debts for fear of prosecution.

For frontline regions where normal banking can’t operate, the NBU is developing “financially inclusive banks”—limited-license institutions that postal services and retail chains can operate using existing infrastructure.

The $486 billion question

Ukraine’s financial resilience isn’t just about survival. The country needs an estimated $486 billion for reconstruction—nearly three times its 2023 GDP. The system absorbing that investment is the one being stress-tested by Russian missiles right now.

Other countries don’t have to wait for missiles to learn the lesson.

But the implications reach beyond Ukraine. Any nation facing infrastructure threats—whether from state adversaries, terrorists, or natural disasters—now has a working model to study. A banking system that coordinates instead of competes. Digital infrastructure that doesn’t depend on physical locations. Cyber defenses hardened by constant attack.

Fourteen banks that used to compete now share generators, train staff together, and keep each other’s customers served. War forced them to. Other countries don’t have to wait for missiles to learn the lesson.