Ukrainian businesses entered 2026 more confident than they were a year ago—yet every major forecaster agrees that the economy will grow no faster than 2%.

The National Bank of Ukraine’s (NBU) December business survey, published on 1 January, recorded a business activity expectations index of 49.2. On this scale, 50 is neutral; above signals expected growth, below signals expected contraction.

December 2025’s reading is the highest on record for December, beating last year’s 45.9, despite Russian attacks on energy infrastructure resuming in October after a seven-month pause.

The paradox points to a shift in what constrains Ukraine’s economy. Three years of adaptation raised the floor. But the ceiling is now fixed by something Western aid cannot buy: workers.

Financing secured, ceiling fixed

Ukraine’s financing for 2026 is largely secured. The EU approved €90 billion ($105 billion) through 2027 on 19 December—roughly €45 billion ($52 billion) per year, close to the $45 billion the NBU estimates Ukraine needs annually.

Yet growth forecasts remain stuck. The NBU projects 2% GDP growth for 2026, down from an earlier 2.3% estimate. The World Bank forecasts the same. The Ukrainian research NGO Centre for Economic Strategy’s December survey found a 2.4% median among private analysts. Ukrainian investment group ICU offered 1.2%, citing infrastructure damage and export difficulties.

The pattern suggests aid prevents collapse but cannot unlock growth. Peace scenarios allow 5% or higher. Under current conditions, money isn’t the binding constraint.

The labor ceiling

Half of Ukrainian companies now say workforce shortages block their business development, according to the NBU’s quarterly enterprise survey. The figure rose steadily since 2023, though it stabilized in late 2025—construction and trade companies are now optimistic about staffing, while the industry and services remain constrained.

“The shortage of people with technical skills and education is catastrophic.”

Some 6-7 million Ukrainians have left the country since the full-scale invasion began, an RFE/RL investigation found in December. The workforce aged 15-70 shrank by over a quarter compared to pre-war levels. Mobilization continues draining the civilian economy.

Ukraine’s State Employment Service received 427,000 job requests from employers in the first 11 months of 2025, while only 338,000 people were registered as unemployed. Yet just 63% of positions were filled.

“The shortage of people with technical skills and education is catastrophic,” Ukrainian economist Oleh Penzin told RFE/RL.

A split economy

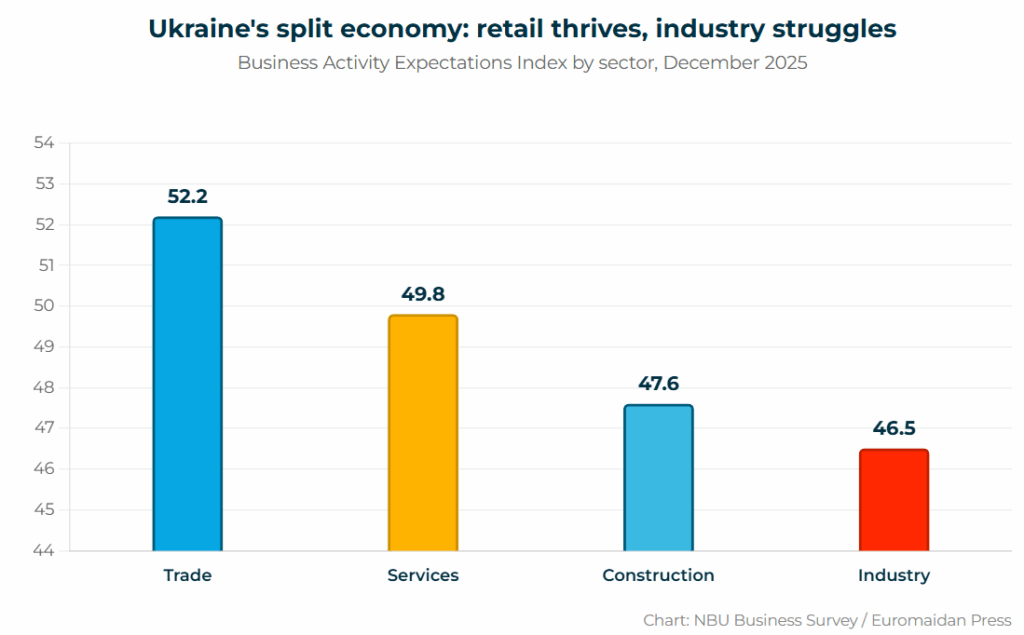

The split Euromaidan Press identified in November’s data persisted through December.

Trading companies recorded their tenth consecutive month of positive expectations, with a sectoral index of 52.2—the highest among all sectors. The NBU attributed this to sustained consumer demand and decelerating inflation.

Industrial companies told a different story. Their index fell to 46.5, the most pessimistic reading for the second month running. Manufacturers expect to cut both output and workforce, citing power outages, rising costs, and the worker shortage.

“War-related losses weigh heavily.”

“On one hand, internal consumer demand is gradually growing and remains quite stable,” said Olena Bilan, chief economist at Dragon Capital, Ukraine’s largest investment firm. “On the other hand, war-related losses weigh heavily.”

Those losses accumulated through 2025: coal production in Pokrovsk halted completely as fighting approached, gas extraction suffered serious damage in February, and Russian gas transit ended. A brief energy respite from March through September helped—but attacks resumed in October.

Signs that adaptation works

The constraints are real, but so is the adaptation.

As Bilan points out, bank lending to businesses grew 25% in 2025—the first significant expansion since the invasion began, and notably outside state-subsidized programs.

Trending Now

“It looks like businesses understood they can not only work within existing resources but develop through additional financing,” Bilan said. “It’s not yet strong enough for a tangible effect on growth. But it’s a very positive signal.”

Construction companies held steady at the neutral threshold, supported by reconstruction demand. The composite business confidence index, while below neutral at 49.2, remains substantially higher than last December’s 45.9.

Inflation slowed to 9.3% in November, beating the NBU’s forecast. With the EU’s financing decision resolved, the central bank is expected to begin cutting interest rates at its 29 January meeting.

What 2026 brings

The energy sector faces what The Kyiv Independent’s business reporter Dominic Culverwell called “the biggest test” of the war. Late 2025 brought some of the worst attacks yet, and Ukraine’s stocks of replacement equipment are dwindling.

The NBU estimates electricity shortages will average 5-6% in the first quarter, improving to 3% by mid-year if attacks moderate.

The US-Ukraine minerals deal, signed in April 2025, is supposed to go live in early 2026. But “the exact investment mechanism remains fuzzy,” Culverwell noted, “and investors are unlikely to line up until something more tangible is presented.”

The government is considering VAT requirements for individual entrepreneurs.

Tax pressure will intensify. Banks face a 50% profit tax for 2026. Fuel excise duties rise. The government is considering VAT requirements for individual entrepreneurs earning over one million hryvnias annually—critics warn this could push activity into the shadow economy.

The cost of war

Bilan estimated total war costs—including Western military aid—at approximately $90 billion in 2025, up from $80 billion in the first two years. With Ukraine’s GDP estimated at around $200 billion, the country spends roughly half of its economic output on the war.

The larger question of confiscating the €210 billion in frozen Russian assets remains unresolved.

The EU’s €90 billion decision resolved the immediate financing uncertainty. Without it, Bilan noted, budget funds could have run out by the end of the first quarter. The package does not create an additional debt burden for Ukraine—repayment comes from Russian asset revenues and eventual reparations.

But the larger question of confiscating the €210 billion in frozen Russian assets, rather than just their interest income, remains unresolved. Belgium, where most assets are held, resisted more aggressive measures.

Two economies under strain

Russia enters 2026 under its own constraints. The World Bank forecasts just 0.8% growth. Urals crude traded around $35 per barrel in December, half the $70 Moscow budgeted.

On 1 January, Russia raised VAT from 20% to 22%, eliminating exemptions for roughly 450,000 small businesses. A senior Russian official warned the Washington Post that “a banking crisis is possible” in 2026.

Ukraine has secured financing through 2027 and maintains credibility with international lenders. The question is which economy’s limits bind first.

For Ukraine, 2026 offers stability without a breakthrough. The floor rose. The ceiling holds. And the workers needed to raise it are building lives in Warsaw and Berlin that become harder to reverse with each passing year.