Ukrainian drone strikes and Western sanctions have pushed Russia’s oil revenues to their lowest level since the full-scale invasion began—weakening Moscow’s hand in peace negotiations just as a global supply glut ensures no relief is coming.

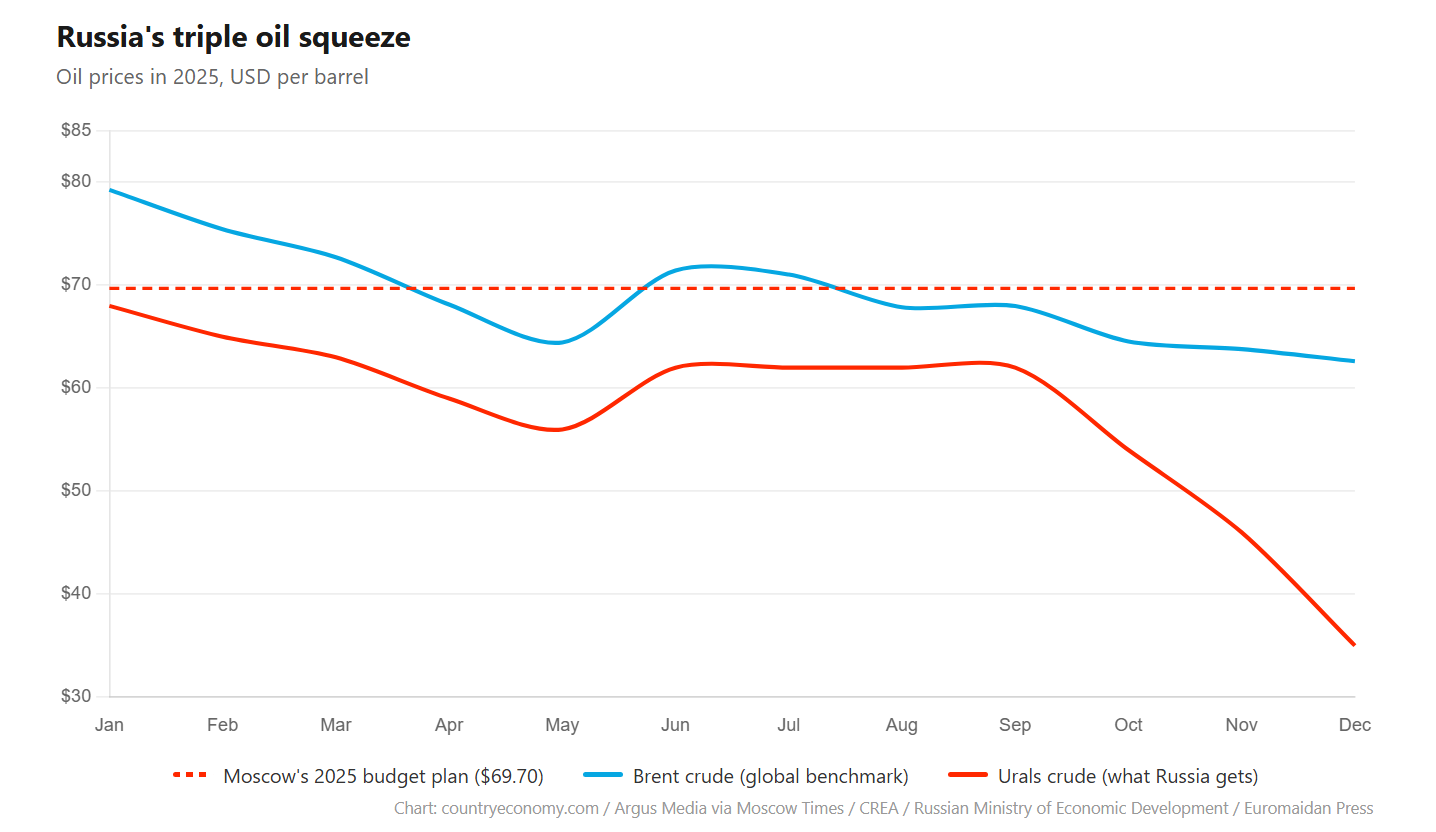

The IEA reported that Russian oil export revenues fell to $11 billion in November, $3.6 billion less than in the same month a year earlier. The Kremlin built its 2025 budget assuming oil would sell at $69.70 per barrel.

By mid-December, Urals crude from the Black Sea port of Novorossiysk had dropped to $34.52—roughly half that price, according to Argus Media data cited by The Moscow Times.

Budget math turns brutal

The result? Russia’s budget deficit has quintupled—from the planned 1.2 trillion rubles to nearly 6 trillion ($76.8 billion), think tank Re:Russia calculated. The National Wealth Fund, Moscow’s emergency piggy bank, has shrunk from $185 billion in 2021 to just $35.7 billion.

Overnight on 31 December, Ukrainian forces sent their own year-end message. Defence Intelligence of Ukraine, working with the State Border Guard Service, struck the oil terminal and refinery in Russia’s Black Sea port of Tuapse, Ukrainska Pravda reported.

The hit damaged the AVT-12 primary oil processing unit, transport pipelines, and loading equipment. The refinery handles around 12 million tonnes of crude annually.

“The team at Defence Intelligence of Ukraine sincerely congratulate Russia’s serfs on the upcoming holidays and present this New Year fireworks display from the bottom of their hearts,” the intelligence source told Ukrainska Pravda.

Ukrainian drones pound Russian oil infrastructure in Tuapse and Yaroslavl (VIDEOS, MAP)

Strikes hit as discounts widen

Global oil prices crashed nearly 18% in 2025—Brent’s steepest fall since 2020 and its third consecutive annual loss, a losing streak unprecedented in the benchmark’s history, Reuters reported. Cheap oil hurts any producer.

For Russia, it’s catastrophic—because Moscow isn’t just fighting a bad market. It’s fighting Ukrainian drones and Western sanctions at the same time.

Russian oil exports fell by 420,000 barrels per day in November as buyers weighed the risks of new sanctions, the IEA reported. US sanctions on Rosneft and Lukoil, imposed in October and November, made the remaining barrels toxic.

Buyers now demand discounts of $23 to $35 per barrel to take the risk. Some China-bound cargoes sold below $30, The Moscow Times reported.

Cheap oil hurts any producer. For Russia, it’s catastrophic.

“Russia is losing billions of dollars each month because of oil sanctions,” Janis Kluge of the German Institute for International and Security Affairs told the Moscow Times. “Discounts on Russian oil have risen to 30% and in some cases over 50% relative to Brent.”

The bleeding accelerated through 2025. Russia’s oil and gas revenues were down 14% by May, 20% by August, and 34% by November—when they hit €489 million per day, the lowest since the full-scale invasion began, the Centre for Research on Energy and Clean Air calculated.

For the first eleven months, total revenues declined 22% year-over-year to approximately $103 billion, as The Moscow Times noted.

Buyers are fleeing. Indian refiners slashed December orders to half of October’s levels. Saudi and Omani suppliers are filling the gap, CREA reported.

Geopolitics couldn’t save prices

On paper, 2025 should have been a good year for high oil prices. A 12-day Iran-Israel conflict in June threatened shipping through the Strait of Hormuz. Trump ordered a blockade of Venezuelan exports. Saudi Arabia and the UAE clashed over Yemen.

On paper, 2025 should have been a good year for high oil prices.

Trending Now

None of it lasted. German industry analysts noted that despite constant geopolitical tension, 2025 saw no sustained supply disruptions—risk premiums were priced out as quickly as they appeared.

Structural forces prevailed: US shale production reached new records, OPEC+ added 2.9 million barrels per day to the market since April, and Chinese demand stagnated.

No relief in sight

The IEA projects global supply will exceed demand by 3.84 million barrels per day in 2026. Goldman Sachs expects Brent to average $56 next year, calling 2026 “the last year of the current big supply wave.”

OPEC+ meets on 4 January to decide whether to resume output increases after pausing hikes for the first quarter. Morgan Stanley’s Martijn Rats told Reuters the cartel would likely continue unwinding production cuts unless prices fall into the low $50s.

For Russia, the revenue collapse undermines its position in ongoing peace negotiations.

For Russia, the revenue collapse undermines its position in ongoing peace negotiations. Re:Russia analysts note that the oil data “exposes Moscow’s weakest point in the ongoing haggling over the terms of a peace settlement.”

Three years into its invasion of Ukraine, Moscow is selling fewer barrels at steeper discounts than at any point since the war began—while Ukrainian drones ensure the New Year starts with another refinery burning.