Ukrainian households held a record 1.355 trillion hryvnias ($32.1 billion) in bank deposits at the end of November, up 11.8% year-over-year, the National Bank of Ukraine reported on 17 December. Real deposit returns have turned modestly positive—a sharp contrast with Russia, where high rates are increasingly straining the civilian economy even as inflation risks persist.

The surge reflects a quiet victory for Ukraine’s central bank: for the first time since inflation spiked earlier this year, savers can actually beat rising prices.

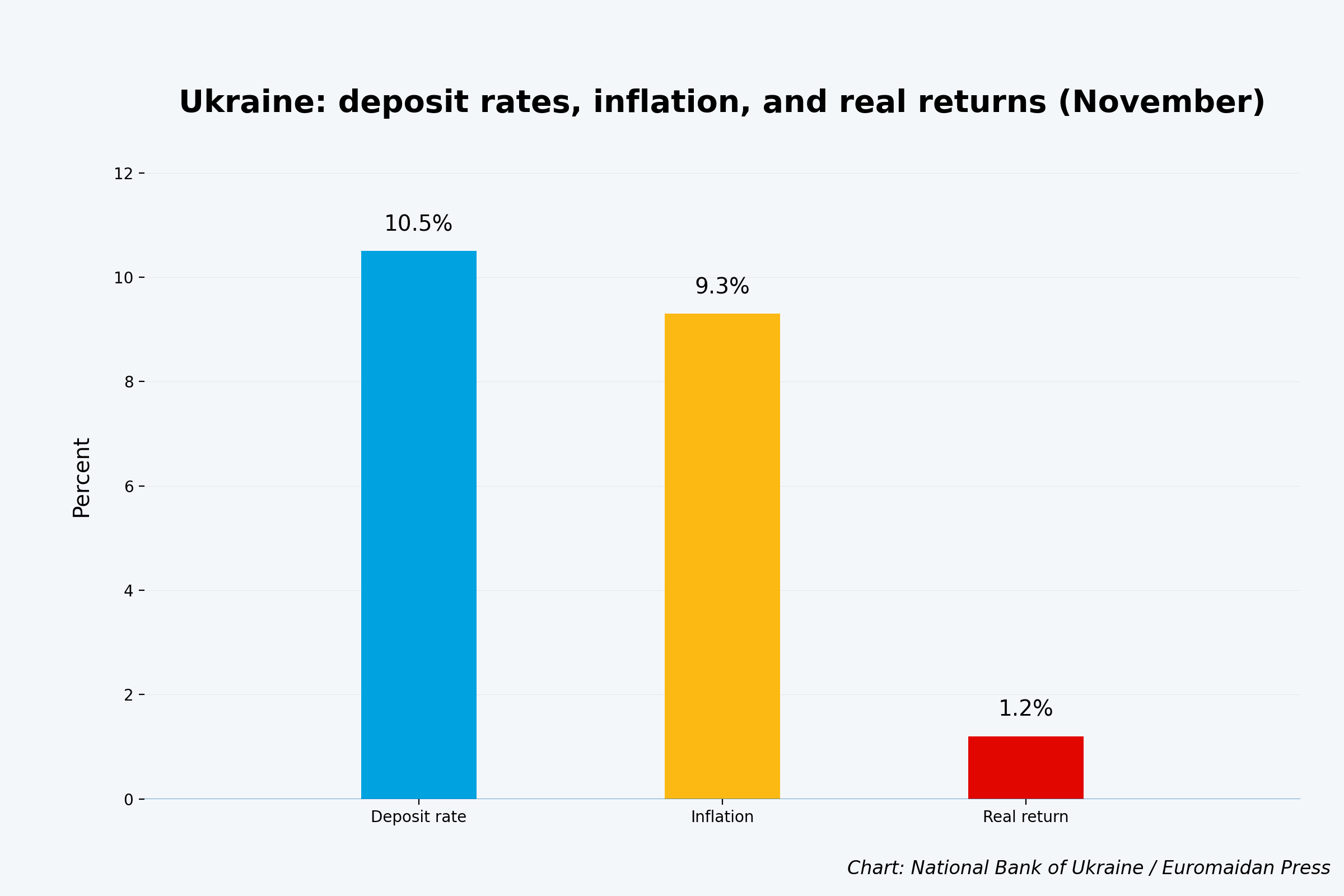

With deposit rates averaging 10.5% and inflation falling to 9.3% in November, Ukrainians now earn roughly 1.2% in real terms—modest, but positive. They’re responding rationally.

Hryvnia deposits are growing faster than foreign currency ones — 14% versus 7.5% year-on-year, according to NBU data. That’s significant. It suggests Ukrainians are gaining confidence in the national currency, or at least in the returns it offers.

Hedging both ways

But Ukrainians aren’t putting all eggs in one basket. The same NBU data show that households bought $6.1 billion in cash foreign currency over the first eleven months of 2025, with the euro increasingly preferred over the dollar.

This reflects how Ukrainians have long treated foreign currency as a stability anchor.

Real estate prices and rent contracts are typically denominated in dollars or euros, even when paid in hryvnias. Earning 10.5% on hryvnia deposits while holding cash foreign currency isn’t a hedge fund strategy. It’s practical wartime finance.

Two central banks, two stories

The contrast with Russia is striking. Both central banks maintain double-digit rates—Ukraine at 15.5%, Russia at 16.5%. But the economies are responding differently.

Russia’s Central Bank is expected to cut rates again on 19 December, under pressure from businesses struggling with borrowing costs.

Trending Now

The Bell, an independent Russian economics outlet now designated a “foreign agent” by the Kremlin, reported this week that parts of Russia’s economy not connected to the military are stagnating, with major state companies having problems servicing loans. The central bank is cutting despite inflation risks because the civilian economy can’t handle the squeeze.

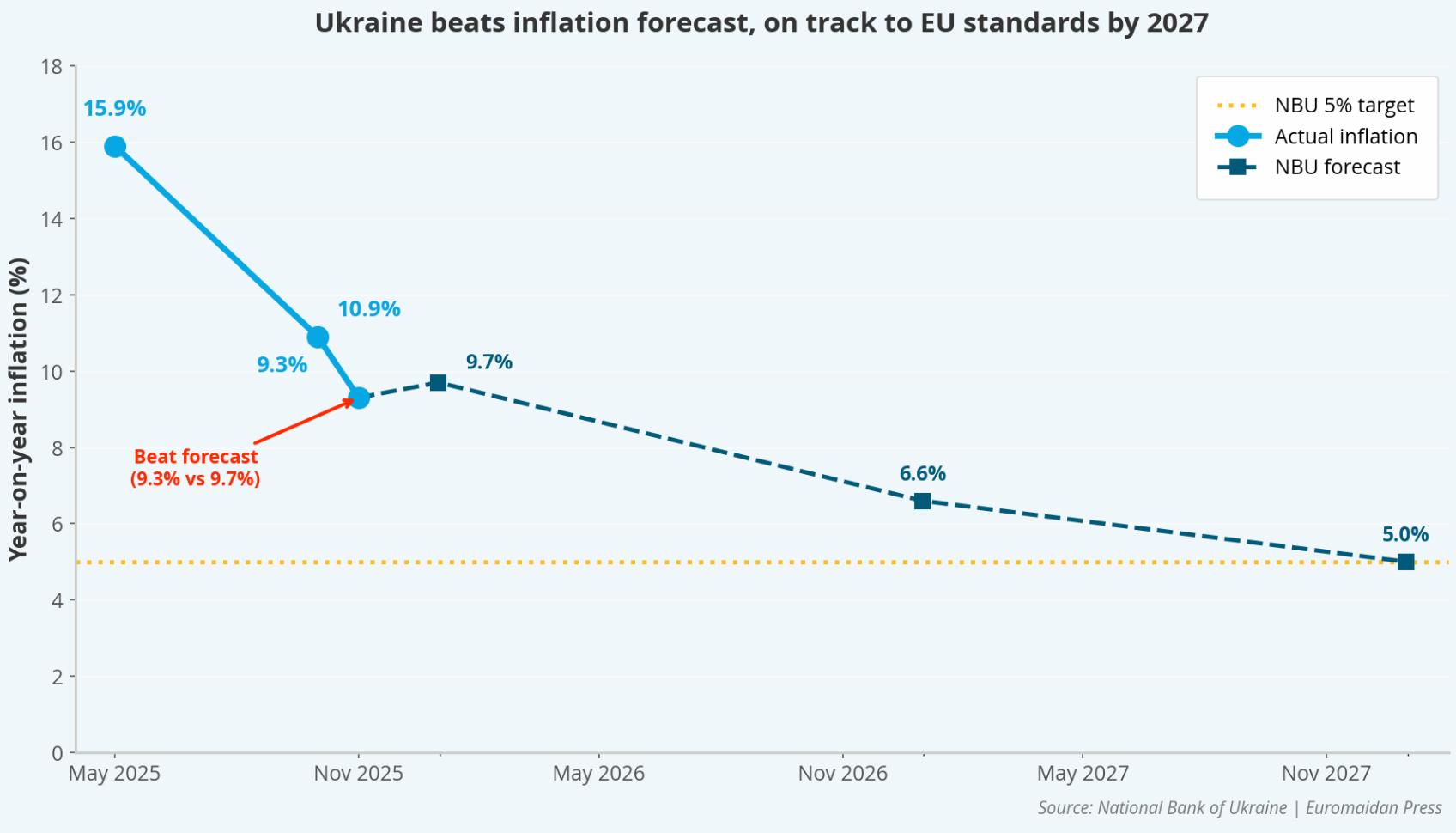

Ukraine’s NBU is holding firm. It kept rates unchanged at its December meeting despite inflation falling faster than forecast. The reason, according to The Kyiv Independent, is uncertainty over whether the EU will approve a new reparations loan at this week’s summit. Without continued financing, Ukraine faces a cash crunch by mid-2026. High rates keep money in hryvnias and foreign reserves stable—a cushion the central bank won’t surrender lightly.

What the deposits reveal

Record savings in wartime seem counterintuitive. But the numbers tell a story of institutional credibility. Ukrainians aren’t hoarding cash at home or fleeing to crypto. They’re parking money in regulated banks, earning interest, and trusting the system enough to do so while missiles fly.

That’s the kind of behavior that signals to Western partners—and future investors—that Ukrainian institutions do function under pressure.

The NBU aims to reduce inflation to 5% by 2027, aligning with European Central Bank standards. November’s deposit surge suggests Ukrainians believe it might actually get there.