Rating agency Fitch placed Euroclear Bank on negative watch on Monday, warning that the EU’s plan to use €210 billion in frozen Russian assets for a Ukraine reparations loan could expose the Belgian clearinghouse to legal challenges and liquidity problems.

A downgrade of Euroclear—one of the world’s largest securities settlement systems—by Fitch would raise its borrowing costs and could spook the global banks and funds that route trillions of euros through Brussels daily. The warning adds financial-market pressure to an already fraught political standoff one day before EU leaders vote on the loan.

Ukraine’s money will run out soon

Without the reparations loan, Ukraine faces a €71.7 billion ($84 billion) budget shortfall next year. Reserves run dry by April. The loan—which Kyiv would repay only if Russia compensates war damages—remains the only viable option after Hungary vetoed a €90 billion eurobond alternative on 5 December.

German Chancellor Friedrich Merz put the odds of agreement at “fifty-fifty” in a ZDF interview Monday evening.

“If we don’t jump now... when?” he said, calling this a “Schicksalswoche” — a week of destiny — for Europe. Failure would leave the EU “severely damaged for years,” he warned. “And we will show the world that, at such a crucial moment in our history, we are incapable of standing together.”

Fitch flags risks

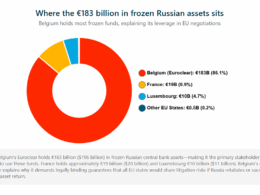

Most of the €210 billion in frozen Russian central bank assets sits at Euroclear in Brussels. The EU permanently froze them last week, blocking Hungary from forcing their release through a veto.

Converting the assets into a reparations loan is the harder step.

Fitch said it saw “increased likelihood that insufficient legal and liquidity protections could create a maturity mismatch”—meaning Euroclear could face obligations it cannot meet if Russia’s central bank ever gains standing to reclaim the funds.

The agency will resolve the watch once EU leaders clarify the loan’s structure and legal safeguards. If the summit produces no agreement or weak protections, a downgrade becomes more likely.

Trending Now

Some float bypassing objectors

Belgium, whose government has demanded that all 27 EU members share the legal risk, has been joined by Italy, Bulgaria, Malta, and the Czech Republic in resisting the plan. The resistance has hardened despite weeks of European Commission efforts to offer guarantees.

Some leaders now float ramming the loan through with qualified majority voting—bypassing objectors entirely.

“If this will be the only option, why not?” Latvian Prime Minister Evika Siliņa told Politico. “For Belgium, I don’t wish them to become second Hungary.”

EU leaders meet Thursday and Friday to decide.