As EU leaders debate using frozen Russian assets to fund Ukraine’s defense, the exact legal mechanism paralyzing that decision is being turned against Ukraine itself. A new report reveals 13 arbitration cases now challenging Kyiv’s sanctions and national security measures—most using European investment treaties.

An analysis by the German NGO PowerShift, published on 9 December, found that sanctioned Russian oligarchs and companies have filed 24 cases directly challenging the sanctions imposed after the 2022 invasion. More than half target Ukraine.

The total claimed exceeds $62 billion—approaching the €70 billion ($82.3 billion) in military assistance the EU has provided since the war began.

Belgium has resisted using €210 billion ($247 billion) in frozen Russian assets partly due to fears of investor-state arbitration under its treaty with Russia. Yet, Ukraine faces even greater exposure: seven cases against Kyiv are based on investment treaties with EU member states, and two more on the UK-Ukraine treaty.

The mechanism—investor-state dispute settlement, or ISDS—lets foreign investors sue governments before private arbitration tribunals rather than national courts. Awards can be enforced against a country’s assets worldwide.

Fridman leads the charge

Russian oligarch Mikhail Fridman, who faces EU and UK sanctions over alleged ties to the Kremlin, has filed five ISDS cases and threatened a sixth. Three target Ukraine directly.

After Kyiv nationalized Sense Bank in July 2023—because its owners were under sanctions — Fridman’s Luxembourg-based ABH Holdings filed a $1 billion claim.

The legal basis: the 1996 investment treaty between Ukraine and the Belgium-Luxembourg Economic Union.

A second Fridman-linked company, CTF Holdings, is suing Ukraine under the same treaty after Kyiv sanctioned it for ties to the oligarch. A third case, filed by EMIS Finance under the Netherlands-Ukraine treaty, demands $400 million in compensation for loans connected to the nationalization of Sense Bank.

Ukraine’s Security Service has accused Fridman of funneling 2 billion rubles (roughly $21 million at 2023 exchange rates) into Russian military factories since the full-scale invasion began. He denies the allegations.

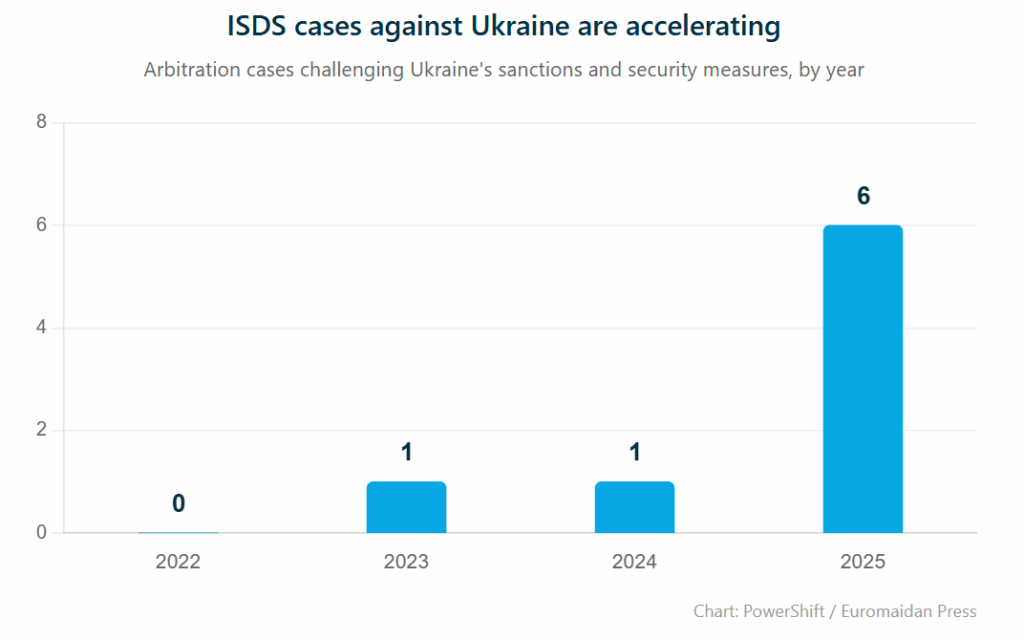

Six cases filed in 2025 alone

The pace is accelerating. Of 13 ISDS cases against Ukraine’s sanctions and security measures since 2022, six were filed this year.

Russian oil giant Tatneft submitted a notice of dispute against Ukraine after Kyiv sanctioned and froze its assets.

Trending Now

The claim—filed under the Russia-Ukraine investment treaty that Kyiv terminated in 2023—can still proceed due to a 10-year sunset clause protecting existing investments.

Other cases target Ukraine’s sanctions on companies linked to Russian businessmen Vadym Novynskyi and Andrey Molchanov. British-registered Enwell Energy is suing under the UK-Ukraine treaty; German-registered AEROC Investment Deutschland under the Germany-Ukraine treaty.

EU protects itself, not Ukraine

The EU’s 18th sanctions package, adopted in July, explicitly bars sanctioned Russians from using ISDS to challenge European sanctions and blocks enforcement of any awards. Switzerland adopted similar measures in October.

However, these protections do not extend to Ukraine.

This is a critical gap. European investment treaties are being used to challenge Kyiv’s national security decisions, yet Brussels has offered no equivalent shield. The cases “could have significant impacts on Ukraine’s public budget,” the PowerShift report notes.

The authors recommend that the EU and Ukraine negotiate a termination treaty for all investment agreements between them, following the model EU states used to cancel treaties among themselves. Such termination would also be required if Ukraine joins the EU.

There is no public indication that Brussels or Kyiv is pursuing this. So far, the Ukrainian government has not publicly addressed the growing pattern of ISDS cases targeting its sanctions policy.